Scaling a Massive Digital Marketplace Like Amazon, eBay, and Staples

The digital marketplace space in the United States grew 63.5% in 2020 with the Drizly marketplace growing the fastest at 350%.

Massive digital marketplaces include Amazon (a 1P and 3P marketplace), Staples (a 1P marketplace), and eBay (a 3P marketplace).

Creating a differentiation strategy, choosing the right model (1P, 3P, combo), and using flexible commerce SaaS is key to success.

You can design and scale a massive digital marketplace with fabric PIM, fabric OMS, and fabric Dropship.

Digital marketplaces have grown rapidly in recent years. In 2020, e-commerce received a major boost as movement restrictions became commonplace. In the United States alone, e-commerce revenue jumped to $432.6 billion in 2020 from $360 billion a year before. But even before 2020 there was a notable upward trajectory for online shopping, with marketplaces making up half of all global online sales.

Digital marketplaces come with an array of offerings and take numerous forms. Some of the most well-known include: Amazon (a first-party and third-party marketplace), Staples (a first-party marketplace), and eBay (a third-party marketplace).

When talking about online marketplaces, these brands often come to mind, yet there are many other companies taking advantage of the opportunities that building marketplaces offer. In fact, without including Amazon and eBay, the United States digital marketplace space grew 63.5% in 2020. Drizly, an alcohol delivery marketplace, grew the fastest in 2020; recording a growth of 350%.

Such brands have built marketplaces to tap into the fast-growing “marketplace movement” and you can too. In this article, we’ll talk about how you can make this shift by following core principles that Amazon, eBay, and Staples adopted to become massive online marketplaces.

[toc-embed headline=”Step 1: Create a Differentiation Strategy”]

Step 1: Create a Differentiation Strategy

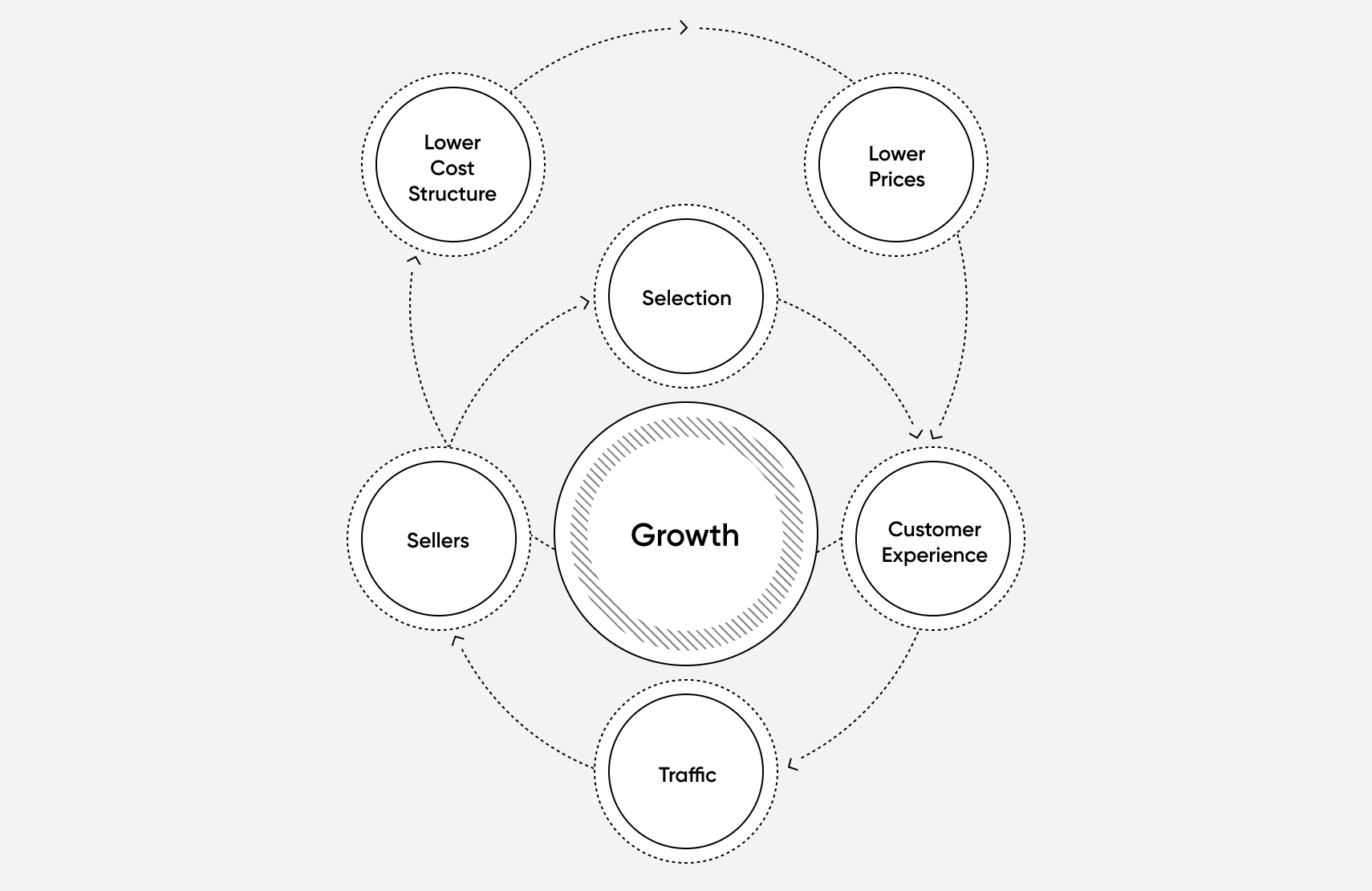

Today, there are hundreds of online marketplaces, with many of them receiving over a million visits every month. Having a differentiation strategy gives your marketplace a competitive advantage and helps it acquire more market share. Amazon identified its differentiation strategy early on as customer experience, which Jeff Bezos’ illustrated in his Virtuous Cycle.

Back in 2001, Jeff sketched a diagram to illustrate the idea that business success begins with excellent customer experience. He said that by focusing on customer experience, it is possible to drive more inbound traffic and juice the funnel. This would, in turn, attract sellers and drive selection, which would result in a better customer experience.

What’s more, the competition amongst the sellers would create a lower cost structure resulting in lower prices for customers. Jeff’s Virtuous Cycle was built into the culture at Amazon and became the organization’s differentiation strategy. And it worked out pretty well for them.

Staples, inspired by Amazon, adopted this idea of customer experience but took it a step further to differentiate its B2B marketplace, Staples Advantage. They established account reps who would help sellers with their orders. The seller would know their rep personally and would be available to help them with any problem that would arise. That customer-centric account management approach was a big differentiation point at Staples.

However, taking the customer experience cue from Amazon was not enough for Staples’ differentiation strategy. To further create its competitive advantage, the company chose selection and specialization. Staples focused on creating what it calls “solutions for work-life,” including printers, computers, ink, promotional products, printing services, office furniture, and other business essentials.

These differentiation points allowed Staples’ B2B marketplace to retain its customer base and continue to grow even after Amazon launched its B2B marketplace, Amazon Business, in 2015.

[toc-embed headline=”Step 2: Choose First or Third Party Marketplace”]

Step 2: Choose First or Third Party Marketplace

Some digital marketplaces are first-party (1P) marketplaces, others are third-party (3P), and others are both first-party and third-party marketplaces. Amazon and eBay are third-party marketplaces, but Amazon is also a first-party marketplace. Staples is a first-party only marketplace.

The difference is determined by which party is the seller of record (SOR). A 1P seller refers to a manufacturing company that sells its inventory directly to a marketplace company, which sells it to customers. In such scenarios, the marketplace is the SOR. On the other hand, a 3P seller uses the marketplace platform to sell their inventory directly to consumers, making the manufacturer the SOR.

Staples and eBay marketplace model

For instance, at Staples, the marketplace is more or less a dropshipping program, with Staples being the SOR. That means if you purchase on Staples.com or Staples Advantage you’re engaging in a transaction with Staples. After you place your order, Staples requests the vendor to dropship the item directly to you on their behalf.

Another notable difference between a first-party marketplace like Staples and a third-party marketplace like eBay is the offer structure or who sets the pricing. In a 1P marketplace, Staples is setting the pricing, whereas, in the 3P marketplace, eBay makes money through the fees it charges third-party sellers.

For 1P marketplaces, differentiation is often achieved through well-curated experiences. For 3P marketplaces, differentiation is often achieved through surfacing an extensive volume of products. Additionally, you can use marketplace pricing to drive the growth of assortment in specific categories in 3P marketplaces. This is not the case in 1P marketplaces. Instead, your team must manually drive this effort.

Amazon marketplace model

Amazon has been incredibly successful as a 3P marketplace. A marketplace that started only as an online bookstore is one of the world’s most competitive marketplaces with enviable delivery services.

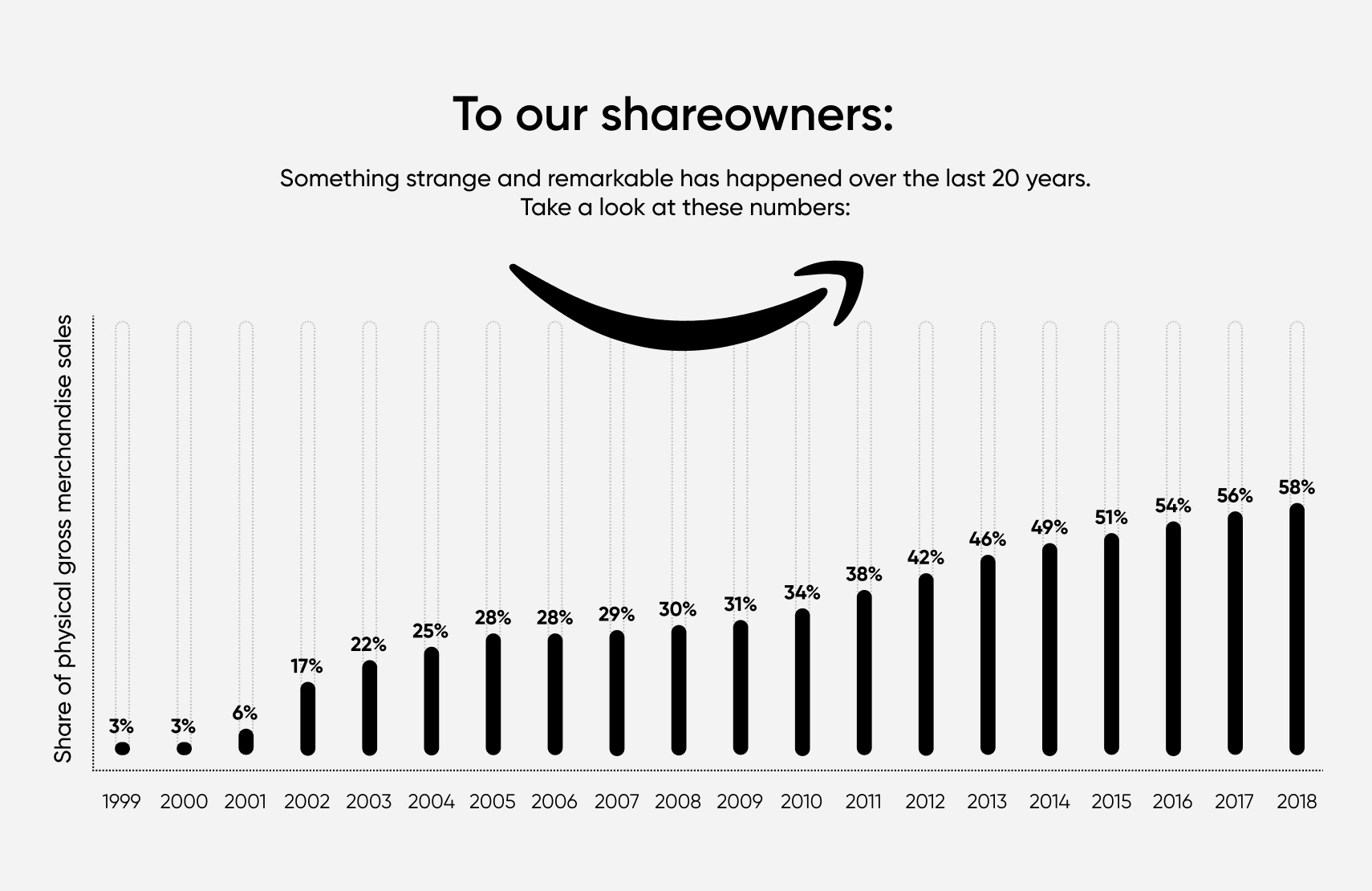

Back in 2000, Bezos introduced the idea of inviting 3P sellers on the platform to compete with Amazon’s products (from 1P sellers). While the concept provoked consternation when Bezos first introduced it, fast forward to over two decades later and 3P sales have surpassed Amazon’s.

In a 2018 shareholder letter, Bezos intimated that third-party sales have been growing at a compound annual growth rate of 52% compared to its first-party business’ 25%.

In 1999, 3P sales were a mere $0.1 billion. In 2018, 3P sales were 58% of the company’s sales at $160 billion. Bezos attributes this exponential 3P growth to, among other things, the company’s Prime membership program and Fulfillment by Amazon (FBA).

Unlike in first-party marketplaces where the marketplace handles all the customer-facing aspects of the business, you outsource these activities in a third-party marketplace. The 3P seller is responsible for taking the initial customer contacts, offering customer support, and all product returns. Of course, the Amazon story is slightly different because of FBA and its flywheel customer experience differentiation.

[toc-embed headline=”Step 3: Choose Software and Services”]

Step 3: Choose Software and Services

Marketplace SaaS

In its early years, Staples used CommerceHub, a ready-to-go dropshipping and marketplace platform. The platform handled order fulfillment and vendors used it to add SKUs to Staples’ marketplace. However, because of the exponential growth the company underwent and the cost structure it needed to implement, it soon became apparent that CommerceHub wouldn’t scale. And with thousands of vendors and close to a billion dollars worth of GMV running through the platform, a custom solution was necessary at the time.

Note: We launched fabric Dropship in November 2021 as a flexible marketplace SaaS solution to direct scaling issues with traditional marketplace SaaS.

Custom software

To handle scaling issues and relieve the company from CommerceHub’s exorbitant fees, Staples created its own software to replace CommerceHub. This approach is not for everyone, but, when you reached the size of Staples, it used to be a viable option to consider. Flexible dropshipping, order management, and SKU management software that was offered as a service (SaaS) simply did not exist in the mid-2010s when Staples was overhauling its marketplace.

Years later, the headless and modular commerce paradigm changed this. Mid-market and enterprise-level companies can now use commerce SaaS and APIs to build a custom solution without building custom software.

Commerce SaaS and APIs

With a headless and modular commerce platform that offers distinct commerce software and APIs for creating any commerce experience—including a massive digital marketplace—you can achieve much of the flexibility offered by custom software, as well as the scalability inherent in SaaS, without getting locked into a specific vendor and unscalable fee structure.

Here are some tools you can use to build a digital marketplace without building the software:

- Vendor Onboarding: You must have a process and associated system for obtaining vendor information, production information, and other data from marketplace vendors. This system is separate from PIM but works with it. All vendor data must flow into your PIM when it’s finalized.

- PIM: A product information manager lets you import, enhance, and organize your product information efficiently, helping customers make fast and informed decisions. This software also enforces product data requirements for vendors to keep product detail pages (PDPs) within the marketplace consistent with experiences on other PDPs generated by other vendors.

- OMS: An order management system streamlines transaction management and lets you effectively distribute orders, collect fulfillment information, and update product inventory. Your OMS should have a dropshipping component to increase the value and lower the risk of vendors participating in your marketplace.

These products can be paired with other commerce modules and APIs to create a more robust marketplace experience. They can also be integrated with existing commerce systems and software to increase the time to market.

Product @ fabric. Previously e-commerce and marketplaces @ Staples and eBay.