Dropship: A Fast Response to Tariff Uncertainty for Mid-Market Retailers

The stop-and-start motion of tariffs is disrupting global trade and manifesting as broad uncertainty in the retail sector in 2025. With many companies facing exposure to tariffs on Chinese imports and being forced to make tough decisions in the back half of this year, the question on many retailers’ minds is what to do about it. While there are many options available to retailers, I’ll dive into how dropshipping represents a viable action to take to protect margin, provide customers more choice, and redirect attention back to core competencies.

“Dropshipping is a retail fulfillment method where a store doesn’t keep the products it sells in stock; instead, when a store sells a product, it purchases the item from a third party and has it shipped directly to the customer.”

Isn’t dropshipping dead?

Tariffs, global supply chain disruption, trade war, Trump – these newsroom terms are all very shock and awe, but the underlying theme speaks to the fact that there’s a lot of change happening all at once. And it’s the mid-market retailers that stand to be impacted the most. For retailers, there’s no silver bullet response that will protect them from the shifting global trade order. But, while Google searches for “Is dropshipping dead?” have skyrocketed recently, its relevance as a tool that’s helped establish and grow many small-mid market retailers makes me rethink its value as a viable option to respond to tariff uncertainty.

I believe that dropship, today more than ever, is positioned to aid all retailers seeking relief from the impacts of Trump’s tariffs. Dropship represents one lever that retailers can pull to navigate the uncertainty ahead. Let’s dive into it.

Impact of tariffs on mid-market retailers

Mid-market retailers, which I’m classifying as those doing $100M-$1B in GMV per year, face limited options to respond to tariffs as their supply chains have a smaller global footprint and their bargaining power is limited relative to Amazon, Walmart, and Target. Furthermore, a recent intelligence study from PYMNTS of 60 CFOs from mid-market retailers found that only 20% have contingency plans to respond to tariffs, and even fewer are deploying them at this stage. So, how do tariffs affect retailers?

Tariffs mean higher costs for landed goods, logistics network disruptions resulting in a general projected import decline of 15% in the US by year-end, and slower inventory turnover – products on hand aren’t necessarily what customers are buying. On top of this, the duty-free status for goods valued at $800 or less from China and Hong Kong will end on May 2nd, and a new tariff of either 30% or $25 per item will come into effect. Considering this, how are mid-market retailers responding?

According to the PYMYNTS survey, two-thirds of these retailers plan to negotiate with suppliers to control price increases, with one-third saying this will be their first step. 43% plan to increase prices, though only 5% say this will be their first action, and 15% plan to utilize just-in-time (JIT) inventory.

Just-in-Time (JIT) inventory means manufacturing products in small batches only when consumer demand is evident, minimizing waste from quickly changing tastes.

Consider dropship in your tariffs contingency plan

On the topic of deploying JIT inventory, the underlying strategy is similar to dropship. A key to both strategies emphasizes building flexibility into your product catalog. Where they differ is in the role of inventory. Dropship provides retailers the benefit of alleviating challenges tied to landing goods, warehousing them, and selling them. Here are four ways you can utilize dropship in your tariffs contingency plan.

1. Extend or secure product catalog

With the right dropship solution, retailers can extend their product catalog through suppliers and be strategic about their landed product mix to two-step around the goods most impacted by tariffs in the short term. It’s a win-win for customers too, as product mix gets extended, meaning more choice and enhanced convenience. It gives retailers the ability to increase revenue while balancing margin by outsourcing the risk of tariffs to their supplier network.

2. Easily onboard new or alternative suppliers

US-based retailers have been working to understand their exposure to the tariffs placed on China. Over $300 billion worth of goods have been targeted, and this number could grow. The right dropship solution provides retailers with an easy path to onboarding suppliers. The easy part is key. Easy supplier onboarding means retailers can react fast to newly tariffed goods and supply chain disruptions to bolster their agility in supplier sourcing, whether that be through onshoring, nearshoring, or “friendshoring” strategies. Said plainly, ease the burden of China tariffs by quickly onboarding suppliers from lesser-tariffed countries. With fabric’s Dropship product, onboarding new suppliers takes just 2-3 weeks for product data ingestion and enrichment.

3. Focus on core competencies

Dropship strategies also enable retailers to focus on their core competencies, such as marketing, merchandising, and customer service, to maintain positive relationships with customers. The relationship is what will be tested in retailers’ response to tariffs. Raising prices will only erode loyalty. It’s going to be key to prioritize brand building during the uncertainty in the coming months and years.

4. Rapidly market test new products and suppliers

Finally, dropship allows retailers to market-test products in new categories. It gives retailers the ability to easily extend catalogs to include new SKUs and trial adjacent categories to evaluate demand at a lower risk threshold than acquiring inventory and managing logistics. Additionally, consider this point in relation to managing supplier sourcing. Tariffs may impact a certain category of goods more than others in your catalog. Market testing translates to testing new suppliers less affected by tariffs to identify new products that yield the highest demand.

Overall, leveraging dropship provides retailers with options. And identifying the best options to navigate the higher costs of importing goods from tariffed countries should be step one in outlining a contingency plan.

Market validation

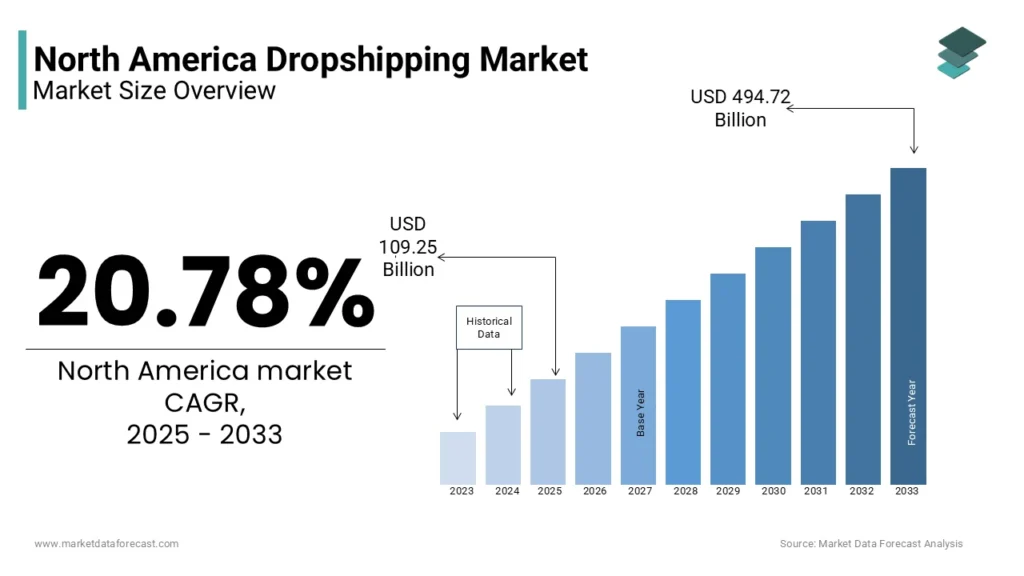

Deploying dropship as a response to tariff disruption isn’t a risky bet. Market adoption is growing exponentially. You might find it’s just good business sense. North America’s dropship market is projected to grow nearly five times from 2025 to 2033 (from roughly $109 billion to $495 billion), reflecting a 20.8% CAGR in this period.

Source: Market Data Forecast

With e-commerce set to top $1 trillion annually in the coming years, retailers need to find alternatives to expand catalogs and compete with the big three (Amazon, Walmart, and Target), eating up over half of the e-commerce market.

Nordstrom embraced dropship to enhance its online assortment. In 2021, Nordstrom announced a partnership with sports merchandiser Fanatics, using a dropship model to launch the entirely new category of sports team apparel and memorabilia on Nordstrom.com. This move gave Nordstrom access to thousands of SKUs (licensed jerseys, hats, etc.) that it never carried in-store. It was part of a broader strategy Nordstrom described as moving toward “non-wholesale models to offer customers more choices.”

Other retailers, including Stitch Fix, Walmart, Home Depot, and Wayfair, are investing in dropship rollouts. It’s becoming clear that dropship has evolved into a key strategic tool for mid-sized and enterprise North American retailers, not just a niche tactic for small online sellers.

Make dropship a strategic priority against tariff exposure

Given the vast uncertainty of global trade, supply chains, and cost impacts from tariffs, dropship should be considered as an option in your contingency playbook. The key for retailers is speed. Dropship enables retailers to take fast action and fabric’s Dropship product streamlines supplier onboarding and provides tooling for automated enrichment and syndication in a matter of weeks. When paired with fabric OMS, the two solutions layer real-time inventory and OFL rules configurability to maintain brand promises to customers of fast, dependable fulfillment. Generally speaking, adding dropship capabilities will strengthen critical muscles in your retail organization to build stamina for the obstacle course that is this tariff war and global supply chain disruption.

Don’t wait for tariffs and supply chain disruptions to catch you off guard. Get ahead with fabric dropship and OMS. Contact us today to start developing a more resilient retail operation.

Director, Product Marketing @ fabric