5 Retail Management Software Options for Multi-Channel Success

Consumers are treating the traditional shopping experience as increasingly transactional. By conducting research and comparisons online before visiting a brick-and-mortar retailer, customers limit their browsing time. Shifting consumer trends are evident in the increase of options such as curbside pickup—which grew from 10.8% to 15.5% between March and July 2020—and buy online pick up in-store (BOPIS).

Retailers who already take advantage of omnichannel commerce made up 64% of click-and-collect sales in the U.S. last year. However, not all retailers with the most click-and-collect sales, such as Lowe’s, Macy’s, and Nordstrom, are considered top e-commerce players.

What does this mean for traditional retailers? Shoppers expect retailers to mix the e-commerce experience with the physical shopping process. As a result, retailers must adopt some form of retail management software that allows for unified commerce across channels, complementing traditional retail sales software with flexible and versatile headless retail software.

[toc-embed headline=”Traditional Retail Software Setup”]

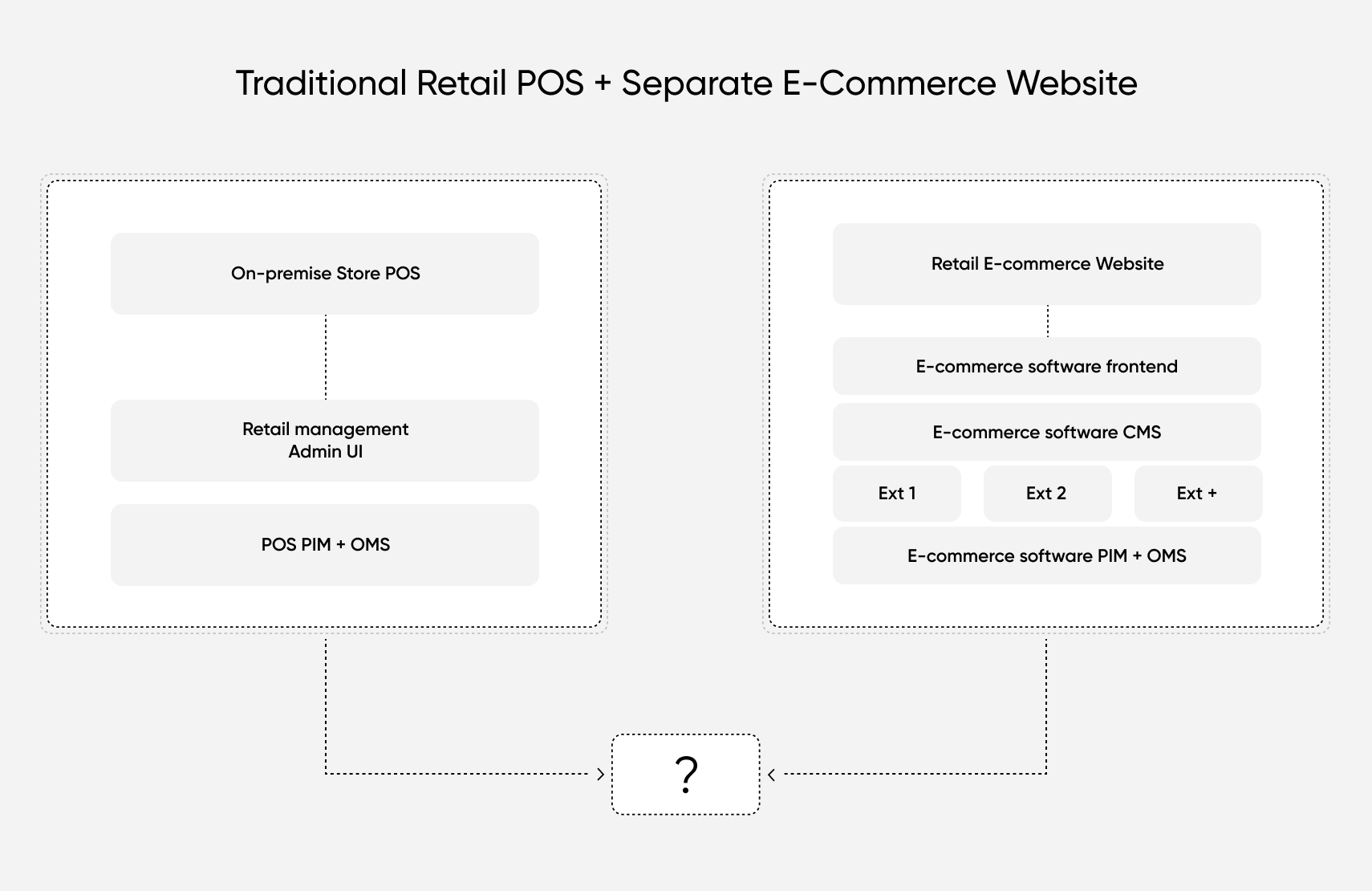

Traditional Retail Software Setup

An example of a traditional retail software setup. Proprietary in-store retail management systems may not communicate well with other deployed retail software, necessitating clunky workarounds or the development of a custom—and potentially inefficient or costly—solution.

The first point-of-sale (POS) system was introduced in 1879 to combat employee theft. It wasn’t until the early 70s that the more familiar POS system came into use, marrying a terminal screen and checkout scanner with a mainframe that recorded and stored transactions and data.

Over the next few decades, POS systems and technology evolved to start making use of retail management software. This resulted in the common retail software setup so ubiquitous and familiar today, in which frontend transactions from multiple POS systems are recorded in backend servers to make the following convenient:

- Inventory management

- Product information (such as pricing)

- Staffing

- Accounting

- Customer data collection and marketing

However, traditional software for retail may be difficult to integrate with emerging or evolving technologies. Getting multiple different proprietary retail systems to interact requires clever thinking, costly workarounds, and ample development time—if not a complete replatforming.

In many cases, attempting to bridge the gap between traditional retail store software and new and improved retail management systems is like playing a game of whack-a-mole. At the same time, retailers experiencing this retail software gap incur heaps of technical debt—situations in which developers apply a temporary “band-aid” solution to a problem instead of fully correcting it, often because a full-scale solution would require comprehensive restructuring.

[toc-embed headline=”Modern Retail Software Setup”]

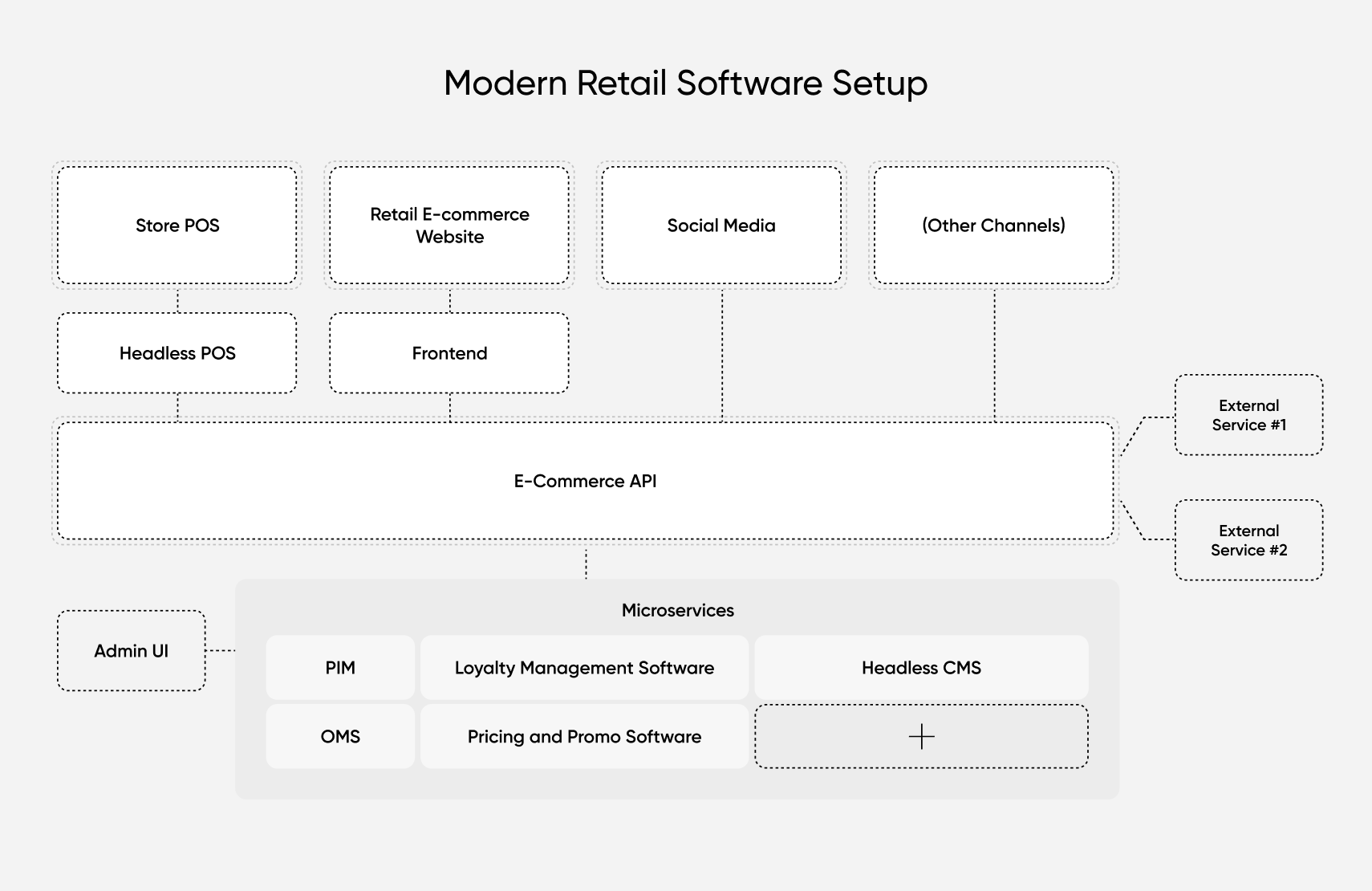

Modern Retail Software Setup

This illustrates a basic modern retail management system for a retailer operating an in-store POS and multi-channel e-commerce approach via a website, social media, and other channels (such as an app). Though frontend functionalities are separate, e-commerce APIs connect the frontend with backend architecture to seamlessly maintain and sync data between them. Additional backend functionality is implemented via microservices, which are controlled through an administrative interface.

Modern retail store software overcomes the technical debt trap through a modular, “headless” approach, which separates the frontend from the backend. At the same time, different modules—such as product information management and loyalty management—are accessible as microservices and APIs.

As a result, the best retail software lets businesses implement new microservices as they grow to improve scalability. Developers aren’t faced with the herculean task of getting disparate services to talk. Instead, they simply choose and introduce the chosen microservice(s) into their existing headless retail software setup.

Headless retail management software lets retailers shift away from monolithic platforms to flexible solutions that scale with a business’s needs. It’s why brands can shift from rigid retail software to a modern approach, which maintains and improves brand experience through microservices such as OMS and PIM. Simultaneously, headless retail store software sustains backend operations with versatile APIs to allow for scalability without complex or demanding development time.

[toc-embed headline=”“Headless” Retail Software Options”]

“Headless” Retail Software Options

Customers’ changing needs and expectations serve to highlight the benefits of adopting headless retail management software. Retailers who take advantage of the best retail software can rapidly institute changes without costly or lengthy development time as their business scales. See how retailers are implementing these changes in Retail Consulting Partners’ 2021 POS & Customer Engagement Report:

- 67% of retailers prioritize adding or enhancing OMS integration

- 52% of retailers prioritize omnichannel capabilities and integration

- 52% of retailers prioritize upgrading or replacing their POS systems

The table below illustrates five retail management software options that enable multi-channel success.

|

Software option |

Description | Examples of headless products |

| Product information manager (PIM) | It maintains a central source of product data and information, such as items, attributes, and hierarchies. |

|

| Order management system (OMS) | It provides centralized ordering, inventory, and warehousing information and lets customers track orders. |

|

| Pricing and promo software | It manages pricing, promotions, discounts, and coupons for products and product categories. |

|

| Loyalty management software (LMS) | It creates loyalty programs, including data management, analytics, and customer relationship management. |

|

| Headless content management system (CMS) | It separates backend content and assets from frontend presentation, using APIs to connect backend data with customer-facing channels. |

|

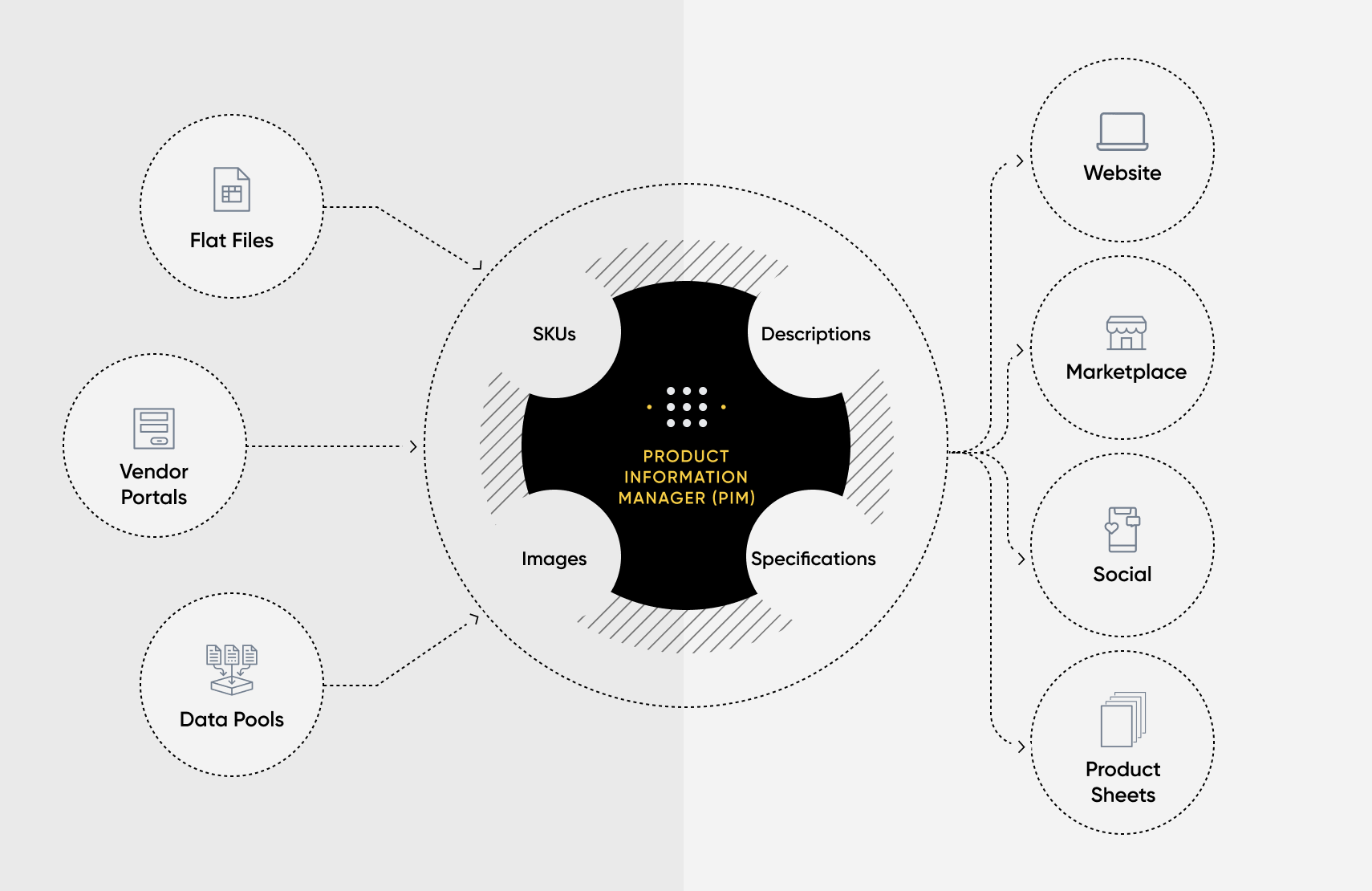

Product information manager

Headless product information managers let retailers and vendors input product information data. This data is then validated and shared across multiple distribution channels.

Every product a retailer lists for sale comes with an assortment of relevant data and information, including the product’s name, title, description, SKU, UPC, and EAN. Other data may also be useful, such as a product’s size, materials, ingredients, and warranty.

How the product is organized and its relation to other products is also important. What category and subcategories does the listing belong to? How many variations of the product are for sale (such as colors or collections)? Naturally, product images are necessary for improving conversion rates, as are details specific to the channels a retailer is selling on.

A product information manager (PIM) is retail management software that stores and manages the information for all of a retailer’s products. In doing so, the PIM system validates the inputted information for accuracy and lets retailers distribute that information across multiple distribution channels.

Headless PIM systems are especially beneficial to retailers because they’re designed to seamlessly integrate with other retail management systems, such as an OMS. This results in accurate and more consistent data, quick and efficient multichannel selling, and the ability to easily scale as a business and its tech stack grow.

PIM software options include:

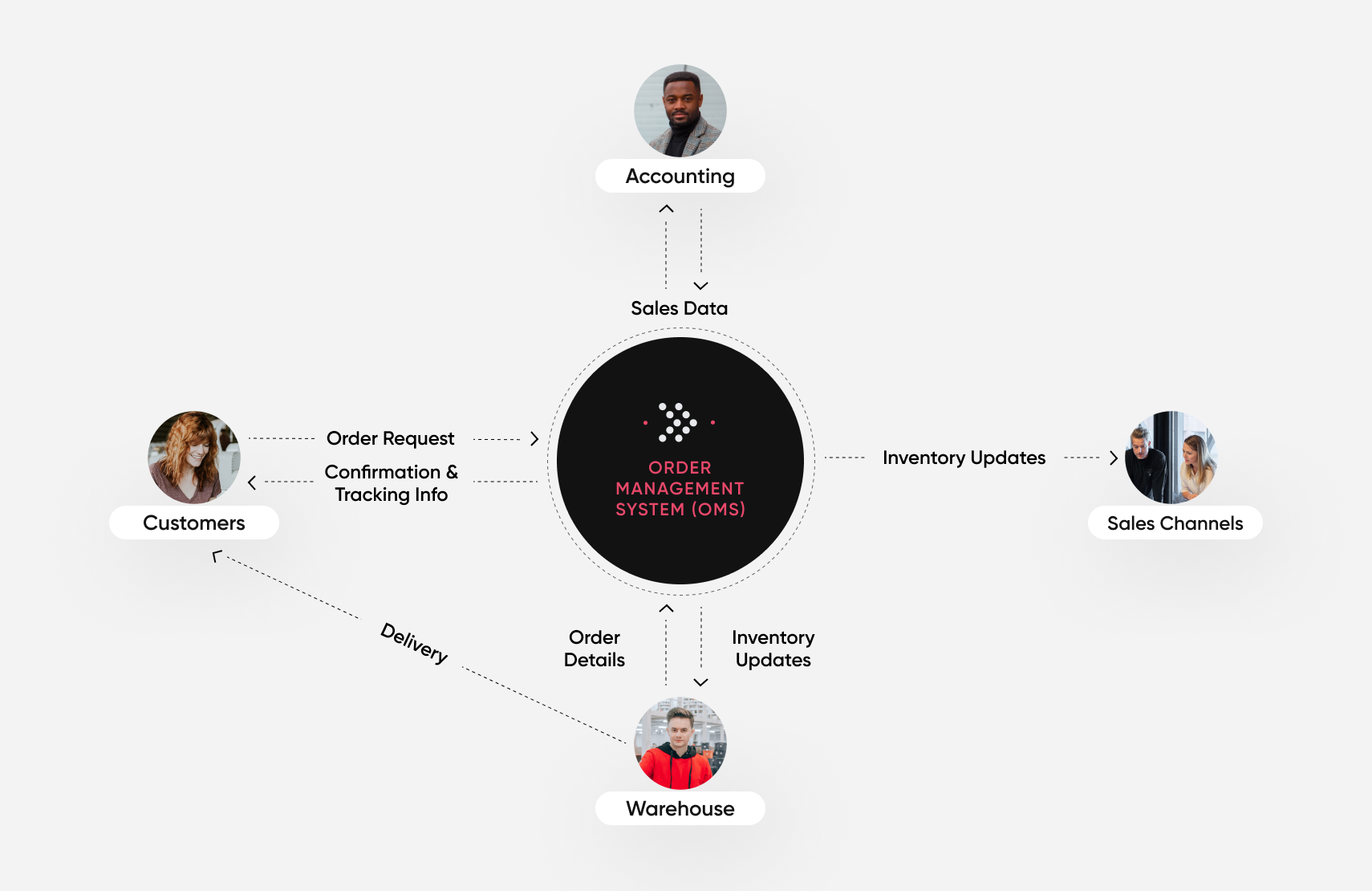

Order management system

Headless order management systems manage data to ensure accuracy between accounting, inventory, and fulfillment systems. This data is used to control inventory levels across multiple sales channels and improve purchasing, shipping, and delivery to customers.

Even established companies have difficulties with fulfillment. And although 71% of companies surveyed by Saddle Creek considered their fulfillment operations to be “very good” or “excellent,” 36% were concerned about scalability, 32% were concerned about order processing speed and accuracy, and 25% were challenged by inventory management across multiple facilities.

An order management system (OMS) helps to overcome many of these challenges. OMS software for retail stores keeps, maintains, and syncs an accurate inventory across a retailer’s supply chain. It also processes and tracks orders and shipments, manages inventory across distribution channels, and supports warehouse operations.

Some OMS software can handle the checkout functionality of a retail management system without requiring another solution or product. Additional functionality can be introduced through APIs to connect an OMS with external services.

Many headless OMS solutions interact seamlessly with an existing retail management software system to automate different stages of order processing and fulfillment. As a result, retailers benefit from accurate and improved inventory management. Furthermore, customers enjoy a more streamlined experience with fewer errors, improved tracking, and timely delivery.

OMS software options include:

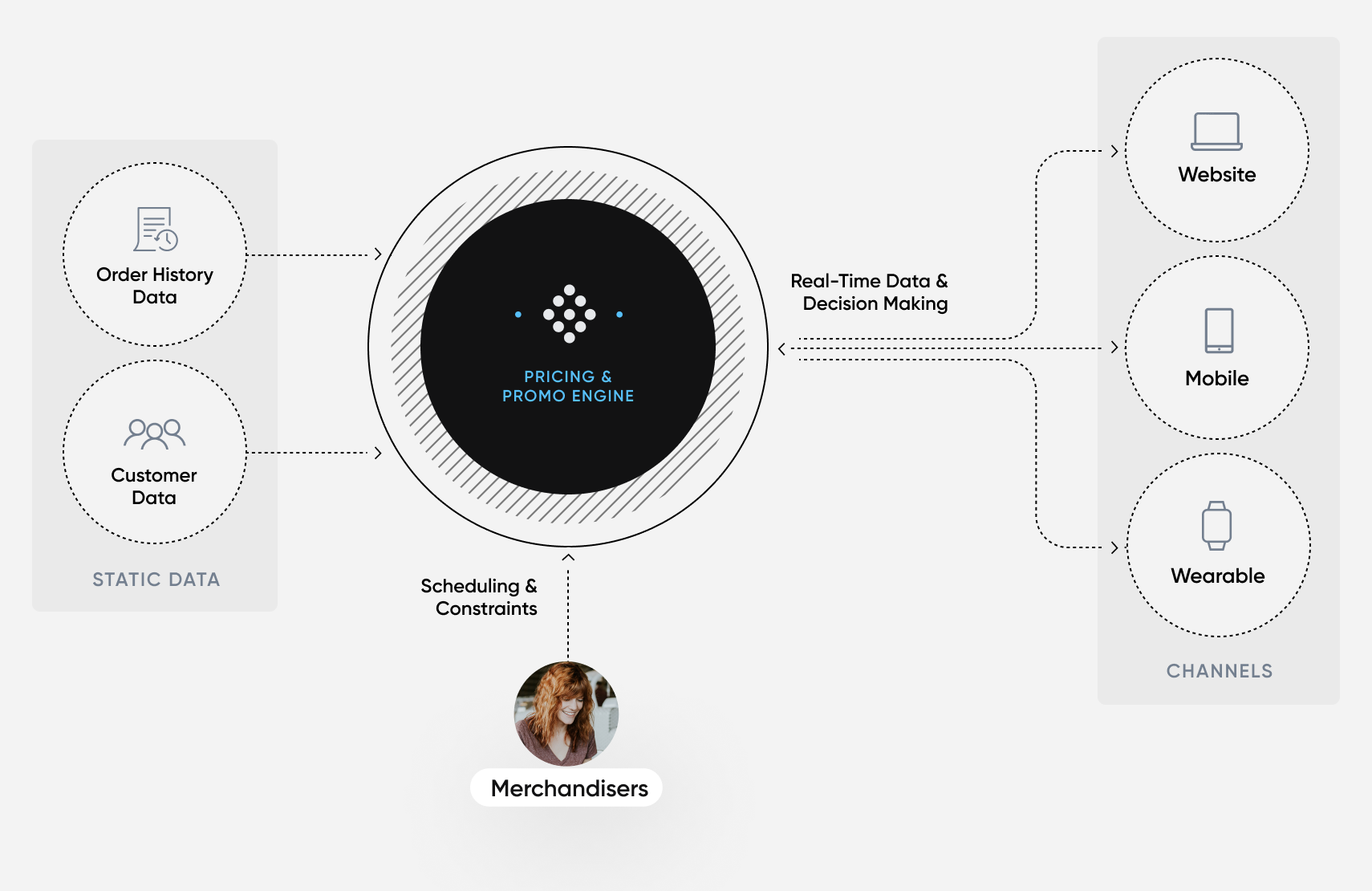

Pricing and promo software

Promotions engines function by using customer data and order history to personalize pricing and special offers based on set parameters. Retailers also leverage promotional engines to maintain consistent pricing and promotions across multiple channels.

Eighty percent of shoppers are more likely to purchase from a retailer that offers a personalized experience. To create personalized experiences, retailers must gather and analyze customer data, pull and share data across different retail sales software, and deploy retail management software options that enable scalability.

Headless pricing and promo retail software, or promotions engines, integrate with existing retail management system software to control product pricing. A promotions engine can also pull data from a retailer’s CRM or another backend service to present customers with personalized offers and deals.

Promotions engines can target certain user segments—such as new customers—with special offers or coupons. In other cases, retailers can apply less personalized overall promotions to defined products or groups of products.

Seventy-six percent of shoppers are likely to consider shopping with a retailer that offers consistent pricing and promotions across channels. Pricing and promo retail software helps retailers achieve this while allowing for continued scalability as the retailer grows.

Pricing and promo software options include:

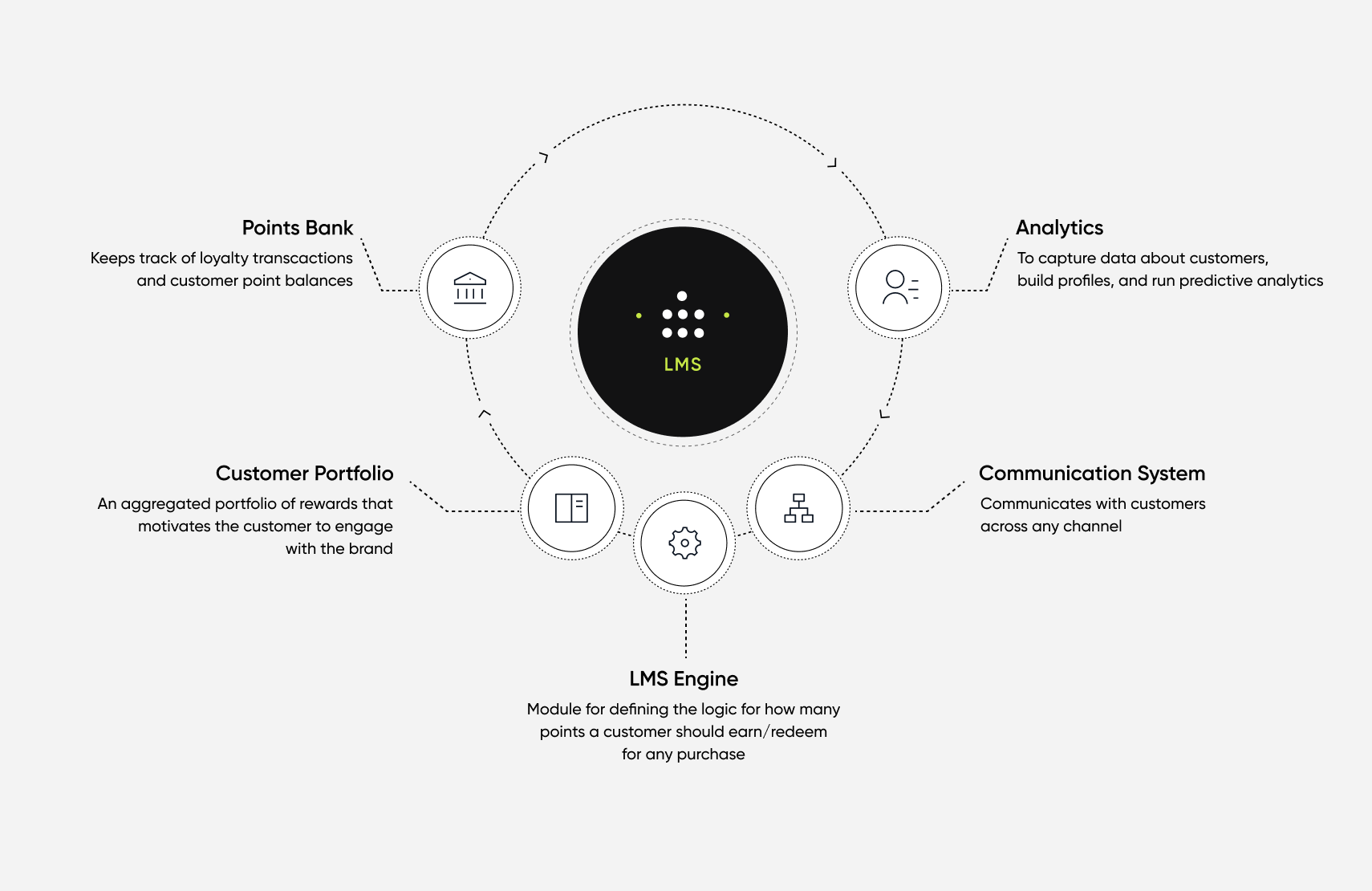

Loyalty management software

Loyalty management systems create customer profiles when the customer signs up through one of the retailer’s sales channels. This data is shared across the retailer’s ecosystem to support a unified customer experience, reward loyalty, and encourage retention.

Customers are more likely to spend on brands with loyalty programs, though retention most often requires value-added services, exclusive access to benefits, and personalized experiences.

Retailers can leverage headless loyalty management software (LMS) to launch and manage loyalty or membership programs. By setting rules and parameters for participation in its loyalty management system, retailers can define the benefits, rewards, or bonuses customers receive.

LMS facilitates sign-up across multiple channels, too. Depending on a retailer’s specific setup, customers can subscribe to a loyalty program on in-store POS systems, on the brand’s website, or through an app. The LMS then syncs the data across channels to ensure a consistent user experience and convenient access to bonuses no matter how or where the shopper makes future purchases. Because customer data is centralized, customers can track their status and review their earned rewards or applicable promotions.

Retailers can integrate headless loyalty management software with other microservices and external services via API. As a result, headless LMS scales with a growing business’s needs—for example, by integrating with email marketing software.

LMS options include:

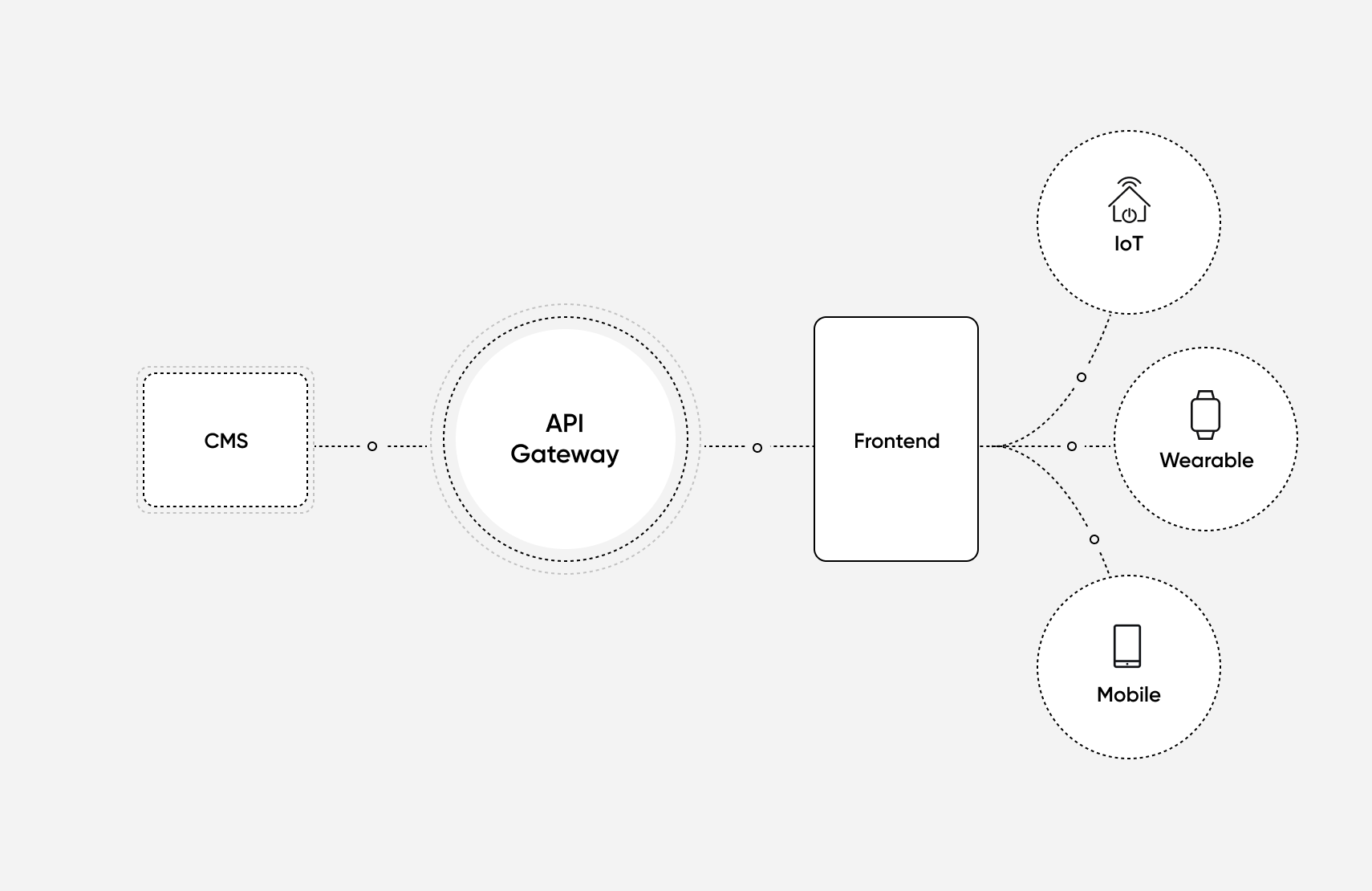

Headless CMS

Headless CMS separates the frontend and backend components of retail management software. In doing so, data and content are stored on the backend and accessible by each frontend component, creating a unified and consistent experience while allowing for continued scalability.

Multichannel e-commerce sales are expected to grow by 18.8% in 2021 and eventually comprise 46% of all e-commerce sales by 2023. Retailers who intend to capitalize on this growth must deploy retail management software that supports a multichannel approach.

Headless CMS software provides the flexibility necessary for brands to scale without compromising any of their sales channels. This is because, by its nature, headless CMS separates the frontend (what customers interact with) from the backend (where content and data are stored).

Even though customers interact with a brand through different channels—such as in-store at a POS, on its website, or via an app—a headless CMS provides the framework for a consistent, unified experience. In other words, the frontend may change to provide an optimized experience depending on how the customer accesses it (e.g., through the brand’s website on a desktop vs. a dedicated mobile app), but the data and content remain the same.

Headless CMS retail software syncs well with microservices and APIs to continually evolve a retailer’s offerings. As a result, brands can spend less development time overhauling their entire architecture and instead integrate relevant components as needed. Additionally, the backend can be changed and updated independently of the frontend, eliminating downtime while future-proofing the retailer’s tech stack.

Headless CMS software options include:

[toc-embed headline=”Key Takeaways”]

Key Takeaways

- Creating a unified customer experience across multiple channels is difficult and challenging for brands built upon traditional retail software setups.

- Modern headless retail management software systems let brands move away from monolithic platforms by providing flexible integrations with microservices and external APIs as needed.

- Choosing the best retail software helps retailers scale and improve their omnichannel approach without compromising the customer experience by ensuring accuracy and consistency between the frontend and backend.

- Headless retail management software from providers like fabric lets retailers manage product information, orders and fulfillment, product pricing and promotions, loyalty programs, and a consistent customer experience.

Tech advocate and writer @ fabric.