E-Commerce TCO: Why Your Business Pays A Hidden “E-Commerce Tax”

CEOs, CFOs, and CIOs are getting blindsided by the hidden costs of operating and maintaining their legacy e-commerce platforms. With inflation surging, here’s why companies need to complete a total cost of ownership (TCO) analysis to drastically lower costs before they lead to permanent loss of capital.

Drawing from years of operator experience at eBay, Staples, and Dell, and now as the co-founder of one of the fastest-growing companies in e-commerce, I often have the privilege of meeting with enterprise-level business executives to discuss a particularly urgent concern: the rising total cost of ownership (TCO) of e-commerce software.

More specifically, our talks tend to focus on surging inflation in the tech industry and how the hidden costs of running their rigid e-commerce platforms have quietly imposed a growing “e-commerce tax” of roughly 8% to 15% on their retail operations.

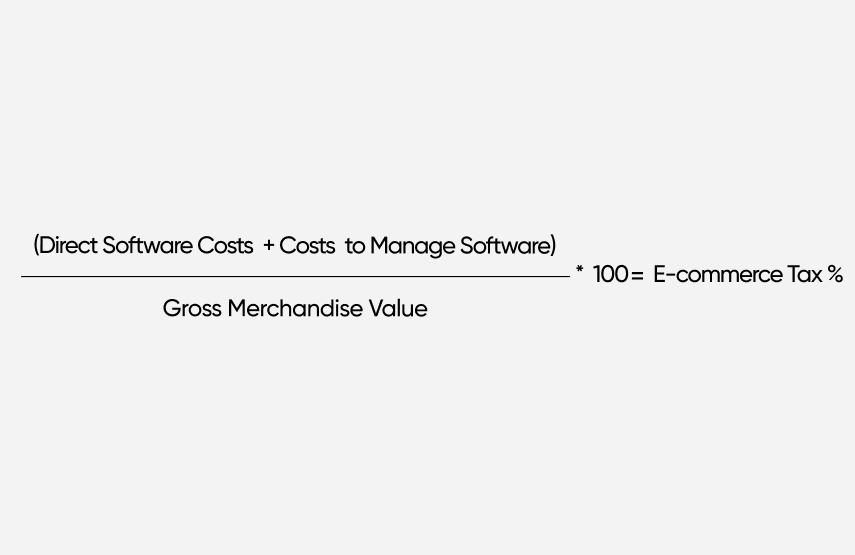

The “e-commerce tax” is defined as the TCO of software expressed as a percentage of gross merchandise volume (GMV). This includes all the expenses for software licensing, hosting and maintenance, payment processing, software development, site operations, and professional services, plus a slew of additional costs that you won’t find in standard income statements, balance sheets, or other financial statements. Businesses can calculate their e-commerce tax exposure by using the formula below:

Finding out the true TCO of running e-commerce software can be alarming for some companies. Over time, the direct and indirect costs of running legacy platforms like Salesforce Commerce Cloud, Oracle ATG, and Shopify Plus can dramatically exceed the cost of the actual software itself. Not only is this figure usually much higher than most people think, but the costs are now rising faster than ever before.

[toc-embed headline=”The Surging Cost of Doing Business Online”]

The Surging Cost of Doing Business Online

Launching and operating an online business is not cheap. Thanks to increasing competition, rising marketing costs, inventory forecasting and holding costs, high shipping fees, and the growing volume of returned items, many businesses have found it “really difficult” to make a profit by selling online.

In fact, some prominent retailers have shunned the e-commerce model altogether. For example, Trader Joe’s has outright refused to sell its products online and according to Matt Sloan, their VP of marketing, the reason is simple:

“Creating an online shopping system for curbside pickup or the infrastructure for delivery, it’s a massive undertaking. It’s something that takes months or years to plan, build, and implement, and it requires tremendous resources.”

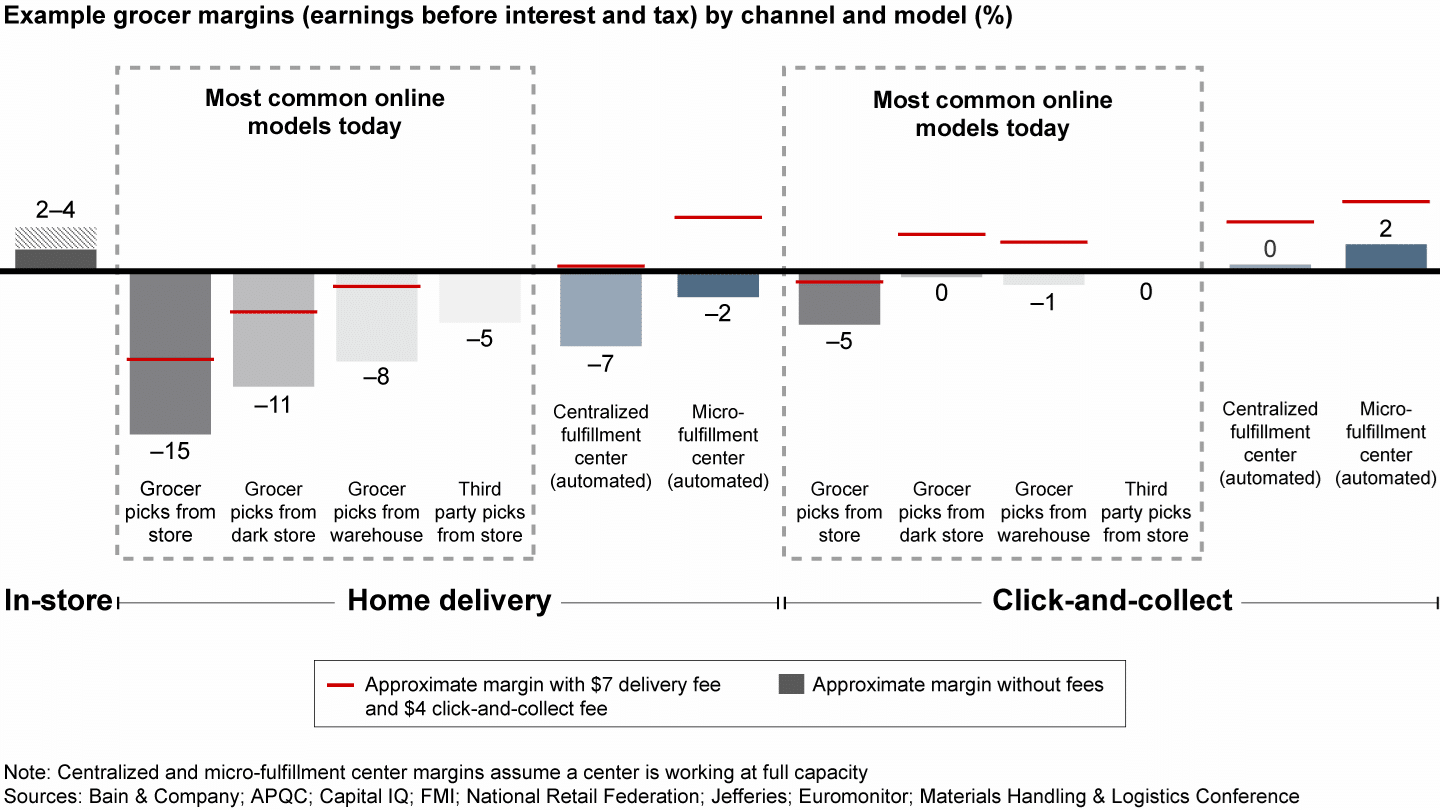

A quick look at the profit margins for grocery retailers shows just how difficult it is for companies to compete online today:

COVID-19 only exacerbated the problem. The global pandemic accelerated digital sales growth—forcing many businesses to invest heavily in e-commerce operations just to survive. Factor in rampant inflation triggered by a host of factors like supply chain disruptions, surging energy prices, and lax monetary policy, and it’s easy to see why technology budgets have ballooned, hidden costs have surged, and profit margins have deteriorated.

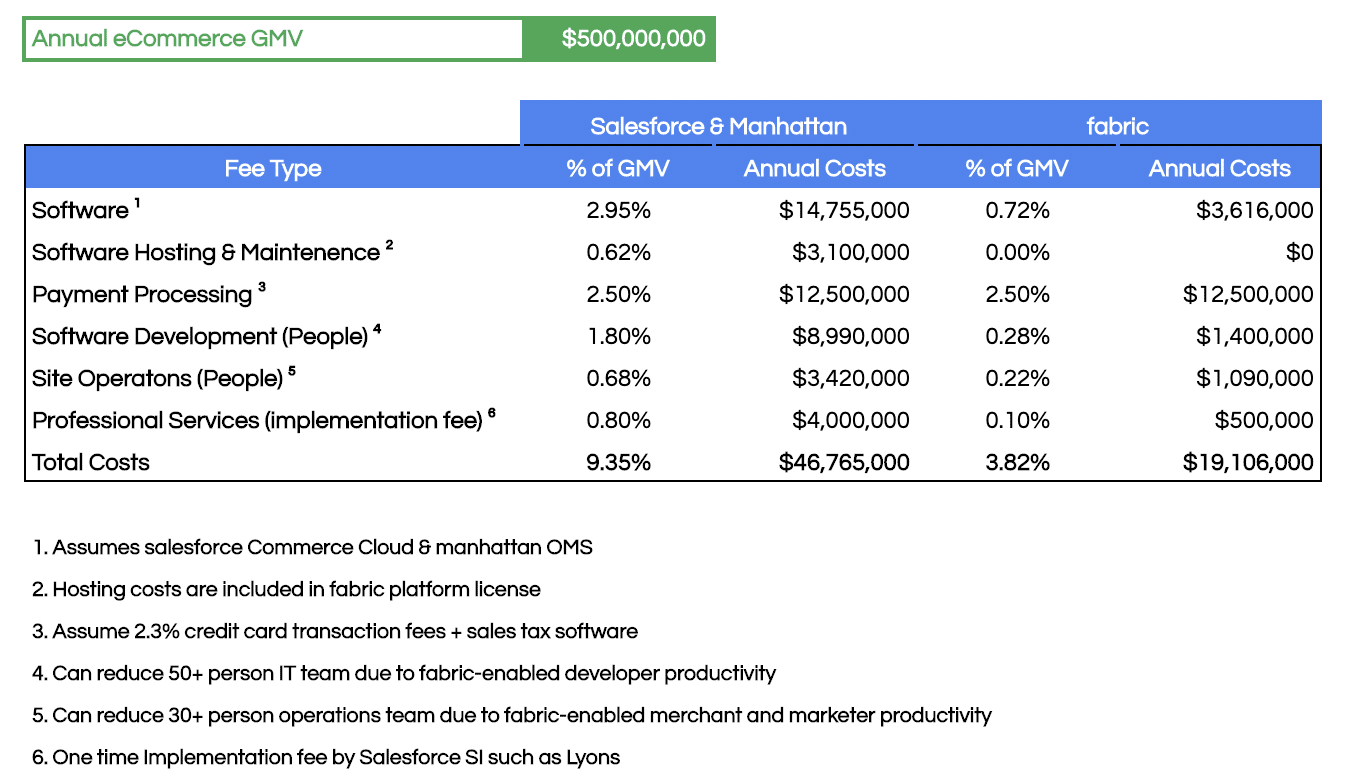

In the past, I sounded the alarm on the rise of the e-commerce tax and estimated that total costs could range from 8% to as high as 15% for online businesses. For a company that generates $500 million in GMV annually, an e-commerce TCO of 9.4% would equate to $47 million per year.

That’s a shocking figure for anyone to digest, let alone a global e-commerce business that generates billions in GMV. With worldwide retail e-commerce sales projected to exceed $5.54 trillion this year and reach $7.39 trillion by 2025, it is now imperative that enterprise businesses complete a TCO analysis to reduce their software-related operating costs before they spiral out of control and lead to permanent loss of capital.

[toc-embed headline=”Aggregation: Why Hidden Expenses Are Running Rampant”]

Aggregation: Why Hidden Expenses Are Running Rampant

Companies are now scrambling to find solutions as they face intense and mounting competition online. But, unless they change the accounting treatment of technology expenses and vastly improve the efficiency of their e-commerce operations, businesses can expect even more pressure on their profitability moving forward.

Therese Tucker, the Founder and CEO of BlackLine, hit the nail on the head when she wrote:

“Traditional accounting is no way to prepare for the digital transformation of business models. It falls short in confronting evolving financial and accounting regulations and stricter compliance regimes. And it fails miserably in addressing the escalating demands across the value chain for data analytics.”

In the past, companies ignored the costs of owning and running technologies because their financial impacts were negligible. Even though there were many parameters that affected the cost of ownership, items with similar characteristics were aggregated together and buried in “IT budgets” for the sake of simplifying the presentation and disclosure of these expenses.

Fast forward to today, and these rudimentary accounting systems have become painfully obsolete. Not only do they fail to capture the fully landed costs of running today’s e-commerce software, but they also aggregate expenditures neatly into “cost buckets” that don’t provide any details on the ancillary products, services, and people that are critical to an e-commerce operation.

There are opportunity costs to consider as well. Without apples-to-apples comparisons of different variables, it becomes very difficult to quantify the opportunity cost of using an antiquated monolithic architecture versus a modern microservices architecture. For example, what is the financial impact of the increased time it takes to implement new features? How much money can be saved by hiring fewer developers? How many customers do you lose by having a slow website, or poor design and functionality, or a poor UX?

Without this crucial financial data, it becomes abundantly clear why companies are now getting blindsided by the rising TCO of e-commerce. In fact, a 2019 survey by Blackline of over 1,100 C-suite executives and finance professionals in large and mid-size organizations found that:

- Only 38% of finance professionals claimed to completely trust the accuracy of their financial data;

- Over half (55%) of the respondents were not completely confident they could identify financial errors before reporting results;

- And nearly 70% of the respondents thought that either they themselves or their CEO made a significant business decision based on out-of-date or incorrect financial data.

[toc-embed headline=”Businesses Need to Disaggregate Expenses For Greater Transparency”]

Businesses Need to Disaggregate Expenses For Greater Transparency

Accounting professionals and executives agree: the aggregating of expenses into “cost buckets” won’t fly anymore. It obscures relevant information and reduces the understandability of the information disclosed. This is why the disaggregation and presentation of different types of expense items has become a hot topic in accounting circles.

In response, new changes have been proposed. Under new rules by the International Accounting Standards Board (IASB), a single dissimilar characteristic will be enough to disaggregate expenses if that information is considered material (i.e. a product information manager (PIM) will not be grouped together with an order management system (OMS) as one expense under the software category).

But there’s a problem. As of this writing, none of these changes have been approved, and even when they get finalized, entities would be given at least 18-24 months to prepare for the transition.

E-commerce companies that are drowning in expenses today are essentially on their own for at least the next two years—which is why businesses are seizing this opportunity to lower costs and take control of their finances before it becomes too late. That’s where fabric can help.

[toc-embed headline=”How To Slash Your E-Commerce TCO With Modern Modular Software Architecture”]

How To Slash Your E-Commerce TCO With Modern Modular Software Architecture

fabric is a market leader in headless commerce. We specialize in helping mid-market and enterprise brands make the transition from custom solutions and outdated monolithic platforms, like Salesforce Commerce Cloud (SFCC), Oracle ATG, and Shopify Plus, to a modern modular solution.

Modern headless software architecture refers to the separation of the frontend (the presentation layer that customers interact with such as a website) from the backend (the data functions such as orders, product information, and pricing). This enables independent management, greater flexibility, and speed in making changes to either side.

However, the benefits of going headless extend well beyond better frontend and backend functionality, scalability, and flexibility.

It’s also a lot cheaper.

In fact, a modular platform is the only solution that helps businesses lower TCO by introducing cost savings across the entire e-commerce tech stack.

A simple exercise leads to generous cost savings, improved margins

Traditional monolithic e-commerce platforms like Salesforce Commerce Cloud (SFCC) and Shopify Plus are built as single, indivisible units, which aggregate features and their associated costs.

Monolithic e-commerce solutions also require many extra services and people, some of which include web servers, payment processors, system integrators, consultants, and software developers. Fees and expenses are often difficult to estimate, and there are additional costs you won’t find on standard income statements or balance sheets.

On the other hand, modular e-commerce platforms like fabric divide backend components into individual e-commerce modules that let companies disaggregate expenses effortlessly. Costs are transparent, which means there are generally no hidden expenses or surprises when running the system.

To illustrate this point, below is a hypothetical TCO comparison between two businesses that generate $500 million of GMV. On the left, you have a typical enterprise company that uses Salesforce Commerce Cloud with Manhattan OMS. And on the right, you have an enterprise company that uses fabric:

fabric helps one business achieve TCO savings of $27.7 million over one year – which is 59% lower than the other business. That equates to an e-commerce tax of just 3.82% versus a whopping 9.35%.

As you can see, running legacy monolithic platforms carries high costs, which limits e-commerce profit margins. Comparatively, a modern e-commerce platform reduces expenses across the board, from the software itself to the reduction of headcount due to platform productivity.

These cost savings can also scale down to mid-market companies that generate $50 to $100 million in GMV as well. By completing a TCO analysis and directing inefficiencies with modern software architecture, mid-market and enterprise brands can begin lowering costs and saving money in this rocky inflationary environment.

[toc-embed headline=”The Time to Cut Costs Is Now”]

The Time to Cut Costs Is Now

Because much of the e-commerce tax remains hidden from the view of even the most seasoned finance professionals and executives, we expect the rapidly rising TCO of software to continue to wreak havoc on the profitability of many online merchants. And with much-needed IFRS accounting changes still years away from being adopted, this trend will likely continue for the foreseeable future.

But the buzzword of digital transformation shouldn’t paralyze CFOs and CIOs with inaction. Huge cost savings achieved by slashing the e-commerce tax can easily be used to pay for any transformation efforts. Furthermore, choosing the right modular e-commerce platform can create a super short and efficient payback period, which helps to boost margins and improve profitability faster than most companies expect.

With trillions of dollars in commerce shifting online, fabric is helping mid-size and enterprise B2B, B2C, and D2C brands deliver exceptional e-commerce experiences at scale with the first comprehensive collection of cloud-native commerce modules and APIs for reducing TCO.

If you want to learn more about how fabric can help your business lower its e-commerce tax and increase its profitability, all while giving you the tools you need to scale your business, we’d love to speak with you.

Co-founder @ fabric. Previously general manager @ Staples, eBay, and Dell Inc.