How the Largest Cannabis Websites Approach E-Commerce

The legal cannabis market is expected to grow at a CAGR of 26.7% between 2021 and 2028, achieving a market size of $70.6 billion. This growth is driven by changing perceptions of cannabis use for both medicinal and recreational purposes, with adult-use (recreational) comprising 54.6% of the cannabis market.

Global cannabis sales grew by 38% in 2020, representing an increase from $14.8 billion in 2019 to $19.7 billion in 2020. And with the increased adoption of e-commerce by dispensaries and cannabis retailers, cannabis sales are expected to rise.

Many cannabis brands adopted emerging e-commerce technology and processes to contend with the COVID-19 pandemic, such as buy online pickup in-store (BOPIS), curbside pickup, and more. However, the largest cannabis e-commerce websites still have room for improvement if they hope to optimize their approach to e-commerce.

[toc-embed headline=”What Challenges Do the Largest Cannabis E-commerce Sites Face?”]

What Challenges Do the Largest Cannabis E-commerce Sites Face?

Canada legalized cannabis in October 2018. With 91% of Americans supporting the legalization of both medical and recreational marijuana, multiple states in the U.S. have followed Canada’s example, though there are still significant hurdles to overcome as cannabis remains illegal on a federal level.

Still, the rigidity of cannabis laws requires cannabis e-commerce websites to adopt a different online sales approach than other e-commerce giants. For example, cannabis-friendly e-commerce sites in Canada often use mix-and-match technology to power their online storefront, blending architecture that facilitates in-store or BOPIS purchases with orders made via provincially-authorized stores, such as the Ontario Cannabis Store.

This shifts away some of a brand’s control over the customer experience, mimicking the challenges of a marketplace model.

As laws shift to decriminalize, legalize, or otherwise overlook cannabis sales, the looming threat from e-commerce giants like Amazon increases. Cannabis e-commerce sites must leverage architecture and technology, including headless CMS solutions that give them an edge over larger mainstream retailers.

[toc-embed headline=”Features of the Best Cannabis E-Commerce Sites”]

Features of the Best Cannabis E-Commerce Sites

Provincial and federal regulations in Canada dictate how and on what website cannabis brands can sell their products. In U.S. states where cannabis is legal, cannabis e-commerce sites have more leeway in the choice of platforms and technologies used, though some functionalities and conveniences — such as delivery and payment at the time of purchase — remain limited.

Features of the best cannabis e-commerce sites include technologies and frameworks that facilitate convenient and smooth customer journeys despite legal and regulatory restrictions. Here are the common features that the largest e-commerce cannabis websites leverage:

- E-commerce enabled: This lets customers make purchases directly on the brand’s website through an online storefront.

- Fulfillment: This determines how customers receive products — delivery, BOPIS, curbside pickup, or in-store only.

- Multichannel support: This lets e-commerce brands sell products through a combination of multiple venues, such as online and in-store.

- User-friendliness: This allows for a convenient, fast, and simple customer experience from start to finish.

- Headless commerce: This separates the frontend from the backend to maintain data accuracy and consistency, enhance customization, and support multichannel strategies.

E-commerce enabled

E-commerce grew by 32.4% and achieved retail penetration of 19.6% in 2020, making it a tantalizing market for cannabis retailers to tap into. For some cannabis customers, buying cannabis online is more convenient than the traditional (and potentially unsafe or unreliable) means of buying it off the street.

Canadian cannabis websites may only sell products through government-controlled marketplaces. In contrast, American cannabis retailers have more freedom to embrace e-commerce functionality, though must abide by local and state laws that restrict how cannabis products are sold.

Some cannabis e-commerce websites maintain some form of e-commerce functionality to sell brand-related merchandise, such as clothing, stickers, and other non-cannabis products. In other cases, e-commerce retailers list or sell their products through a variety of branded websites. However, multiple storefronts can make it difficult to manage inventory and orders, though those challenges can be overcome by taking advantage of microservices.

Fulfillment

Laws and regulations dictate how cannabis e-commerce websites fulfill orders. In Canada, cannabis delivery was exclusively provided by the Canada Post. Curbside pickup options were temporarily available during COVID-19, though some provinces have opted to permanently expand pickup and delivery, including via private-sector solutions.

Because cannabis is illegal on the federal level in the U.S., delivery through the mail (including USPS and other delivery companies) is forbidden. This means cannabis can not cross state lines, necessitating on-demand and in-state delivery from services like Eaze. As such, many U.S.-based cannabis e-commerce sites opt for curbside pickup and BOPIS options, the latter of which grew by 106.9% in 2020.

A variety of fulfillment options is beneficial to both customers and cannabis companies, as Canada learned during its initial legalization rollout. Through a mix of delivery services, BOPIS, and curbside pickup, cannabis e-commerce websites can minimize customer wait times and improve overall fulfillment satisfaction.

Multichannel support

Multichannel and omnichannel support lets cannabis e-commerce websites maintain consistency no matter how a customer interacts with the brand. Creating a unified customer experience is especially important given the requirement for cannabis brands to operate across multiple channels, such as physical stores, different branded e-commerce websites, and government-regulated marketplaces.

Without sufficient multichannel support, cannabis e-commerce websites must develop a framework to accurately record transactions, track inventory, and, in essence, connect multiple separate systems. Though retailers can leverage enterprise resource planning (ERP), that often accrues significant technical debt. Such significant development time often steals focus from a cannabis brand’s core competencies, too.

Instead of relying on monolithic services like Shopify Plus and Magento, supplementing cannabis e-commerce software with microservices provides seamless control over products regardless of where they’re sold.

User-friendliness

Fifty percent of respondents surveyed by Statista cite convenience as a leading reason to shop online. Because cannabis e-commerce sites already face so many challenges in getting products into the hands of consumers — including the high cost of legal cannabis compared to black-market varieties — it’s important to prioritize a user-friendly experience.

Embracing user-friendliness is also an opportunity for cannabis e-commerce sites to differentiate themselves from competitors. This can be accomplished, in part, by supporting mobile ordering, which 75% of dispensary customers prefer compared to online ordering.

It’s also important for cannabis brands to own the experience, even if some channels are outside of their control. If customers are only able to make purchases in person, a website and in-store technology can be leveraged to provide education as part of the customer journey. In this way, brands can own the customer experience, build brand awareness, and enhance customer comfort and familiarity with available products.

Headless commerce

Workarounds for getting distinct systems to sync can be clunky and consume significant development time and resources — time which could be spent focusing on core competencies instead. Decoupling the frontend from the backend through headless commerce gives cannabis e-commerce websites better control over how their products are presented to customers and what the customer experience is like.

Though the frontend experience differs — as is the case with a customer purchasing from a government-run Shopify site or in-store via a POS system — the backend data remains the same. This allows cannabis brands to implement loyalty programs through microservices or run promotions or discounts through pricing and promo software, personalizing the experience no matter how a customer makes a purchase.

At the same time, brands can leverage inventory and order management through headless microservices. By doing so, orders made through a non-branded e-commerce website (for example) are seamlessly recorded by the same inventory software used by an in-store POS to ensure accurate inventory counts.

Replatforming from a monolithic solution to a headless e-commerce solution lets retailers scale with minimal challenge — something especially important to an industry-changing as often (and as quickly) as cannabis e-commerce. As a business evolves, grows, and changes, it can seamlessly integrate new microservices to meet its needs without compromising the frontend experience its customers are used to.

[toc-embed headline=”The Top Cannabis E-Commerce Websites by Market Cap”]

The Top Cannabis E-Commerce Websites by Market Cap

Canada’s full legalization of cannabis, as well as increasing legalization of recreational cannabis in the U.S., is helping drive the market. In addition, the COVID-19 pandemic and the age of social distancing demonstrated the importance and benefits of more fully embracing an e-commerce approach.

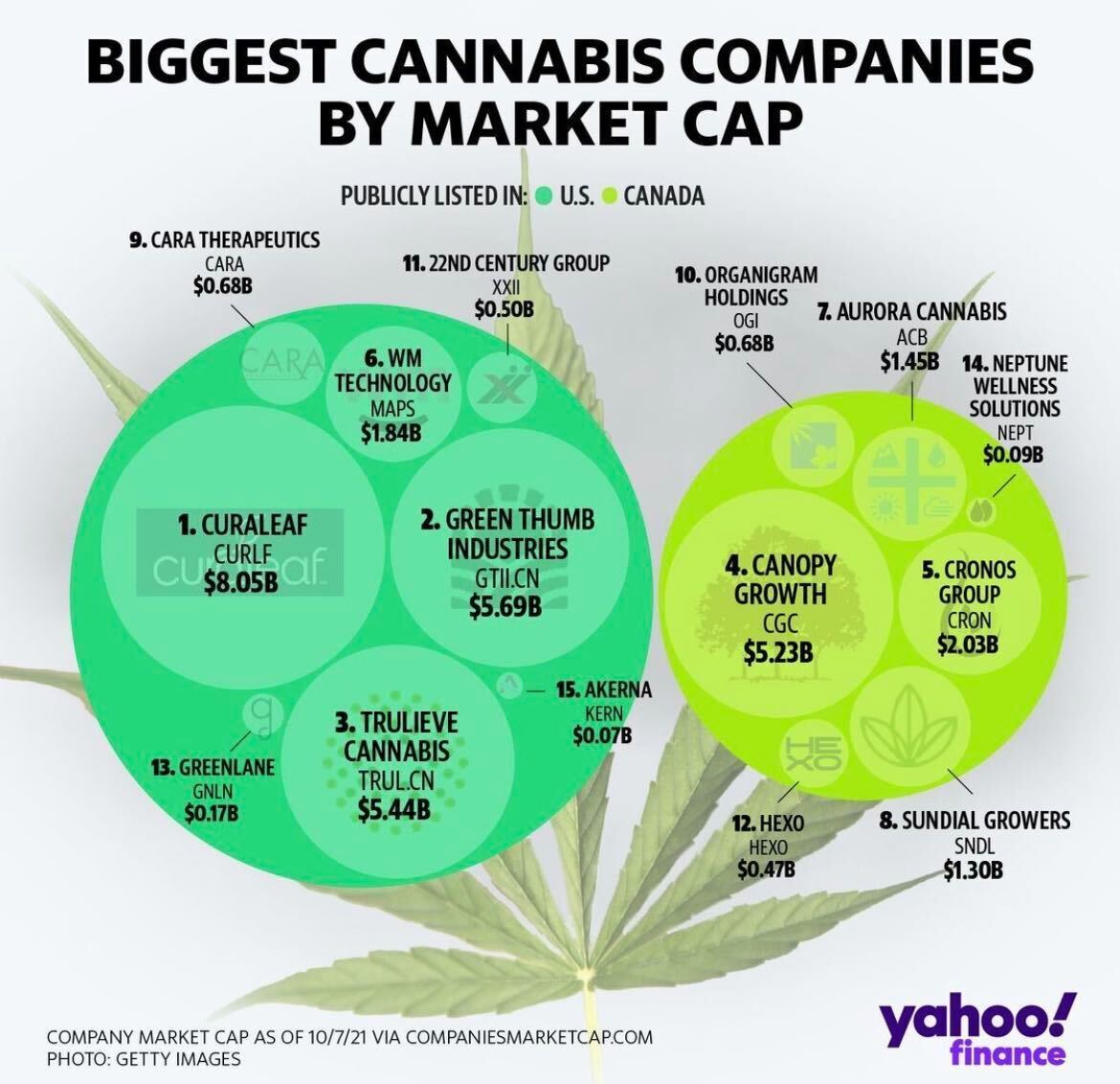

Note: The following statistics are based on information available at time of writing (11/5/2021) from CompaniesMarketCap.com. Cannabis companies not involved in retail sales of cannabis have been excluded from the above table.

Curaleaf

- Market cap: $6.41 billion

- E-commerce enabled: Limited; uses WooCommerce, Dutchie, and Jane

- Fulfillment: Delivery in a few locations; in-store and curbside pickup elsewhere

- Multichannel support: Limited

- User-friendliness: Prioritizes an informed customer journey, but provides a disjointed experience across locations and brands

- Headless commerce: No

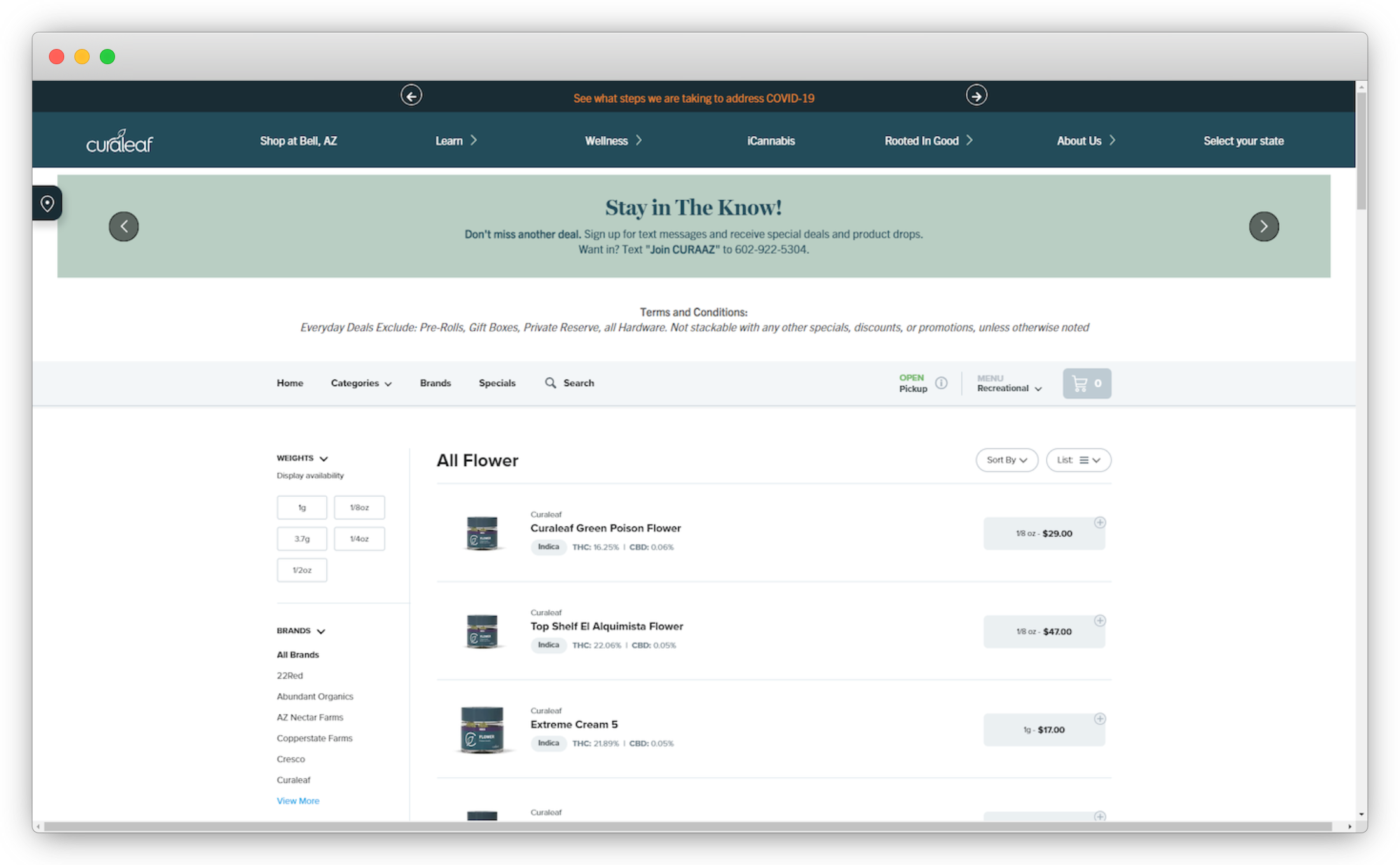

Curaleaf operates 101 dispensaries in 23 U.S. states. Curaleaf grows, processes, formulates, packages, and distributes its products in a seed-to-store approach. This vertical integration gives Curaleaf complete control over the type and quality of products it offers and plays into its philosophy of guiding and educating customers throughout their customer journey — which it accomplishes through its website.

Curaleaf is only available to customers in states where medical or recreational cannabis is legalized. As a result, available fulfillment options vary. For example, delivery to medical patients is permitted in Arizona, whereas medical customers in Pennsylvania are limited to reserving products for in-store or curbside payment and pickup.

Curaleaf uses WordPress as its CMS and WooCommerce for e-commerce functionality. APIs connect Curaleaf’s WooCommerce installation with services like Dutchie and Jane to facilitate product reservations and sales. Notably, product presentation and checkout differ depending on which service is used and the state the dispensary is located in.

Curaleaf also operates two subsidiary brands: Grassroots Cannabis, a cannabis grower, processor, and dispenser, and Select, which Curaleaf claims is the top-selling cannabis oil brand in the U.S. Like the main Curaleaf website, Grassroots Cannabis runs on WordPress, though it lacks any sort of e-commerce functionality. In contrast, Select — and its merch site — use Shopify, though the main Select website lacks any storefront functionality.

With so many disparate brands and technologies, headless commerce could provide a more unified experience across Curaleaf’s brands. Additionally, WooCommerce is limited in its functionality and requires development resources to maintain and scale the business.

Pros of Curaleaf’s e-commerce website

- Leverages its website to provide education and information throughout the customer journey.

- Offers multiple fulfillment methods to prioritize customer convenience and preference (within the legal and regulatory framework).

Cons of Curaleaf’s e-commerce website

- Relies extensively on third-party solutions and functionality for sales and fulfillment.

- Limited multi-channel support leads to a disjointed experience across branded websites.

Canopy Growth

- Market cap: $6.41 billion

- E-commerce enabled: Flexible; lets customers make BOPIS reservations through Dutchie

- Fulfillment: Delivery, BOPIS, curbside pickup, and in-store

- Multichannel support: Supported

- User-friendliness: Convenient and accessible within local regulations

- Headless commerce: Limited; uses Adobe Experience Manager and Dutchie

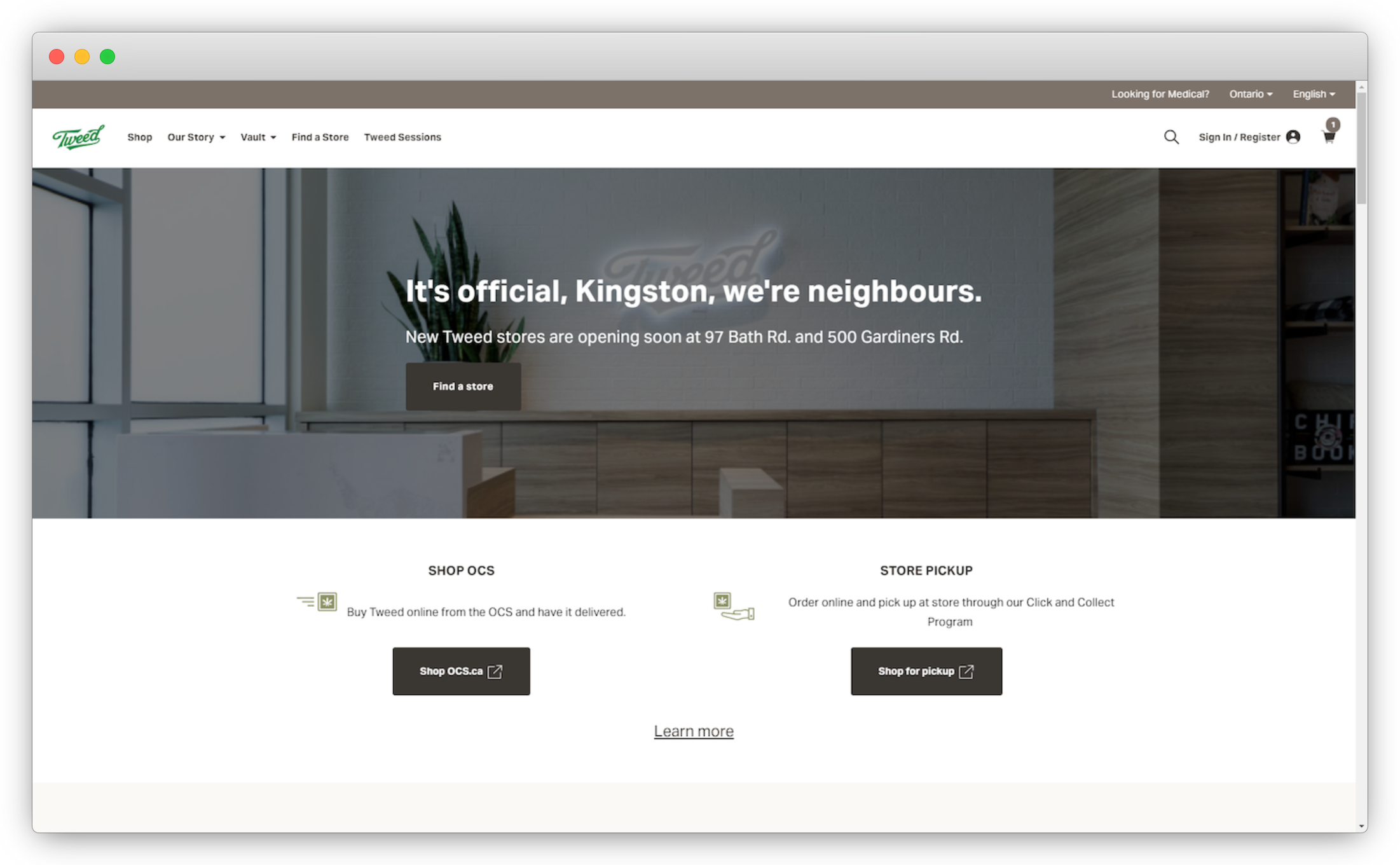

Canopy Growth, originally founded in 2013 as Tweed Marijuana Inc., was the first cannabis producer listed on the TSX Venture Exchange. Its early positioning let Canopy Growth (then Tweed) become one of the first licensed cannabis vendors in Canada.

Though Canopy began selling medical cannabis, the bulk of its revenue comes from its recreational products. This success has helped Canopy Growth open 305 new stores across Canada in Q3 of FY 2021 even as it continues to make headway into the U.S. market.

The main Canopy Growth site lacks e-commerce functionality. In contrast, Tweed, its cannabis e-commerce website, lets customers submit BOPIS orders through Dutchie, though payment is required at the time of pickup. Delivery is available through the provincially-regulated online marketplace. Non-cannabis products are available for sale directly on the Tweed website, which uses Shopify as its e-commerce solution.

Though WordPress powers the main Canopy site, the company uses Adobe Experience Manager as a headless CMS solution on its branded websites, including Tweed and Spectrum Therapeutics. This lets Canopy make changes to its backend content and assets without requiring downtime or interrupting the customer experience.

Pros of Canopy Growth’s e-commerce website

- Offers a fairly straightforward shopping experience within the limits of local regulations.

- Online product reservations enable a convenient BOPIS and pickup experience.

Cons of Canopy Growth’s e-commerce website

- Could make better use of headless technology to incorporate loyalty and promotional elements.

- The link to Tweed’s cannabis products is relatively obscure and could be better differentiated from its online merch store to improve the customer experience.

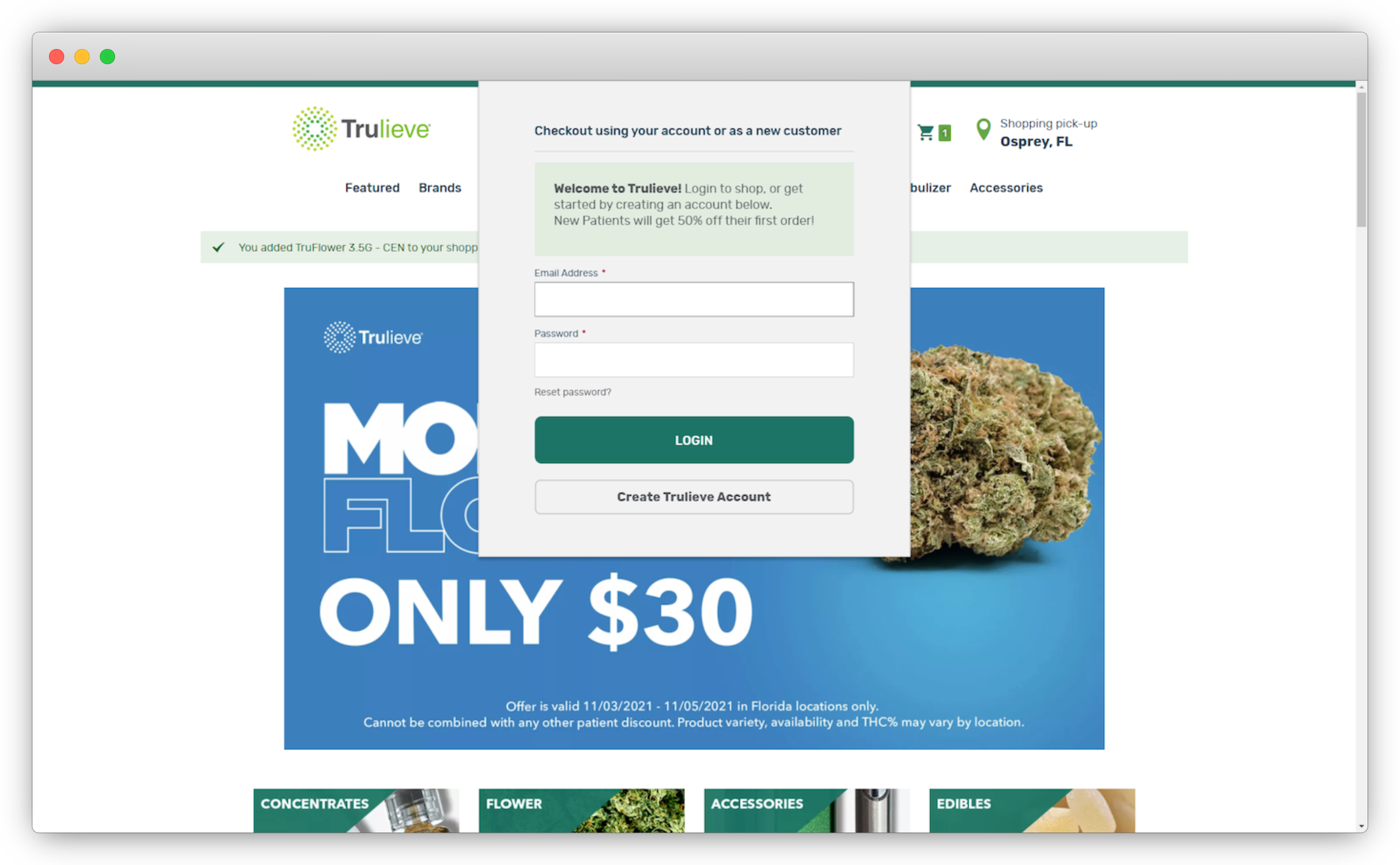

Trulieve Cannabis

- Market cap: $4.61 billion

- E-commerce enabled: Yes; uses Magento

- Fulfillment: Delivery in FL; pickup in FL and MA; in-store elsewhere

- Multichannel support: Very limited

- User-friendliness: Viewing a cart and checking out requires registration; online purchase is unavailable in most states

- Headless commerce: Limited; uses elements of Magento 2

Trulieve Cannabis is a medical cannabis company headquartered in Florida that prides itself on its vertical integration and seed-to-sale operation. Since beginning its operations in Florida, Trulieve has grown to become the largest cannabis retailer in the U.S., having acquired multiple organizations.

Trulieve operates stores in Florida, California, Massachusetts, Pennsylvania, Connecticut, West Virginia, Arizona, and Maryland. Delivery is only available in Florida, with payment expected at the time of delivery or pickup.

The Trulieve website is powered by Magento, a monolithic architecture that can limit a company’s ability to scale its e-commerce channel as it grows — though many of those limitations can be overcome by upgrading to the headless Magento 2 architecture.

Purchasing products on the Trulieve site is restricted to residents of Florida and Massachusetts. Cart access, checkout, and other storefront functionality (such as favoriting an item) require account registration, even though 24% of shoppers abandon their cart when forced to register an account on an e-commerce website.

Pros of Trulieve Cannabis’s e-commerce website

- Continued acquisitions contribute to a nationwide reach.

- Vertical integration lets Trulieve control the customer experience from seed to sale.

Cons of Trulieve Cannabis’s e-commerce website

- Delivery is limited to Florida.

- Despite operating in eight states, online purchases may only be made in Florida and Massachusetts.

- Account registration is required for anything beyond adding a product to a cart.

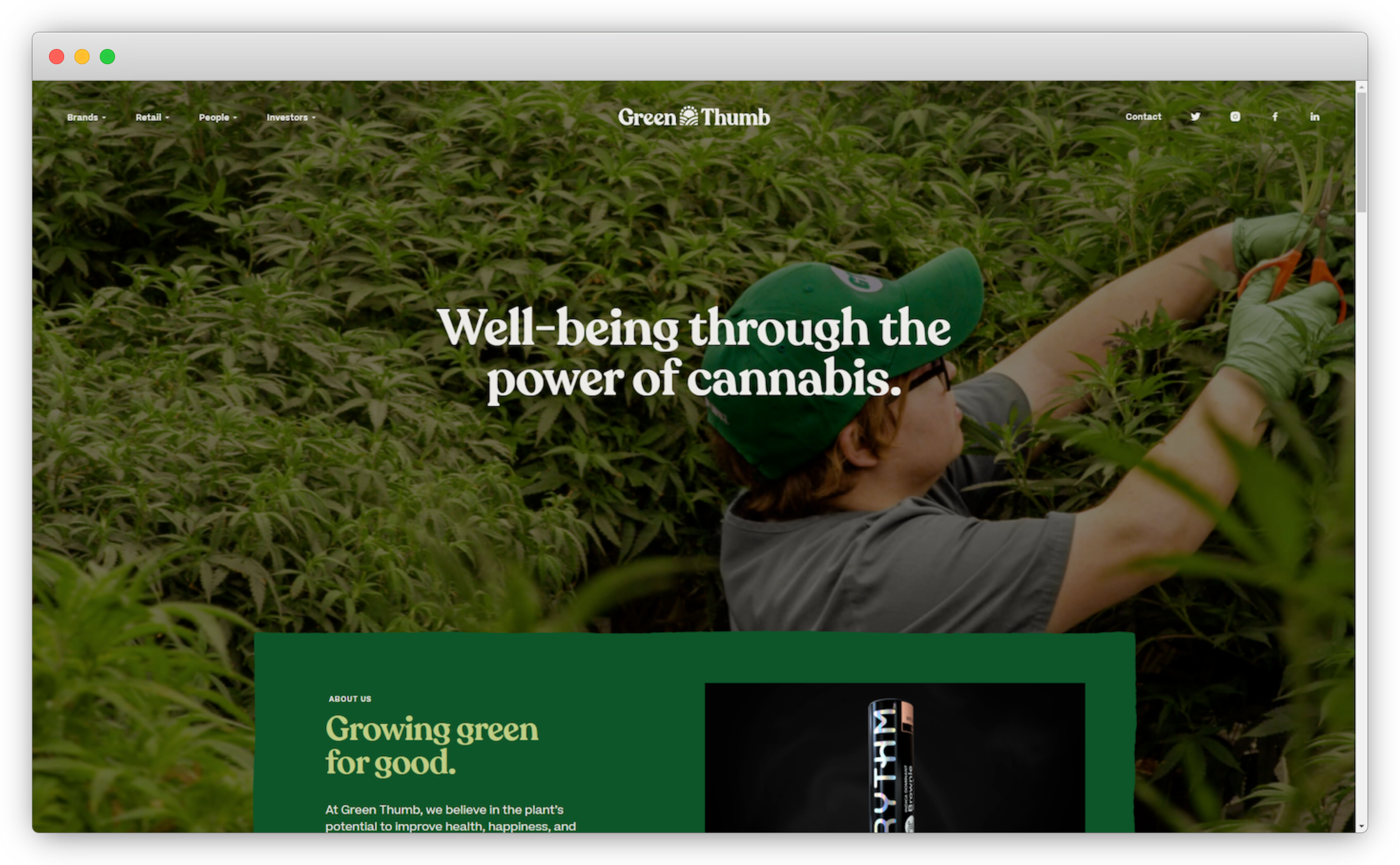

Green Thumb Industries

- Market cap: $4.24 billion

- E-commerce enabled: Yes; on branded retail websites using WooCommerce and Dutchie

- Fulfillment: Delivery and curbside pickup where allowed, in-store otherwise

- Multichannel support: Supported

- User-friendliness: Provides specific information and guidance for each location with a simple and usual checkout experience

- Headless commerce: No

Green Thumb Industries launched in Illinois in 2014 and has since grown to include several cannabis brands. In the first half of 2021, Green Thumb increased revenue by 87.3%, achieving its sixth consecutive quarter of positive cash flow in Q2 2021.

With its most recent acquisitions in August 2021, Green Thumb expanded its operations into a total of 14 U.S. states, including California, Colorado, Connecticut, Florida, Illinois, Maryland, Massachusetts, Nevada, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, and Virginia.

Both medical and recreational cannabis is sold through Rise, the company’s retail brand, which operates 31 stores in nine states, as well as a branded cannabis e-commerce website.

Though the main Green Thumb website lacks any sort of e-commerce functionality, the Rise website relies on WordPress for its CMS functionality. For its e-commerce framework, Rise seemingly runs on WooCommerce and Dutchie.

Pros of Green Thumb Industries’s e-commerce website

- The Rise cannabis e-commerce website offers a typical online shopping experience (within local regulations).

- It has a streamlined checkout process.

Cons of Green Thumb Industries’s e-commerce website

- Customers must click off-site from the main Green Thumb website to shop for cannabis products.

- The retail storefront isn’t obviously identifiable from the main Green Thumb website.

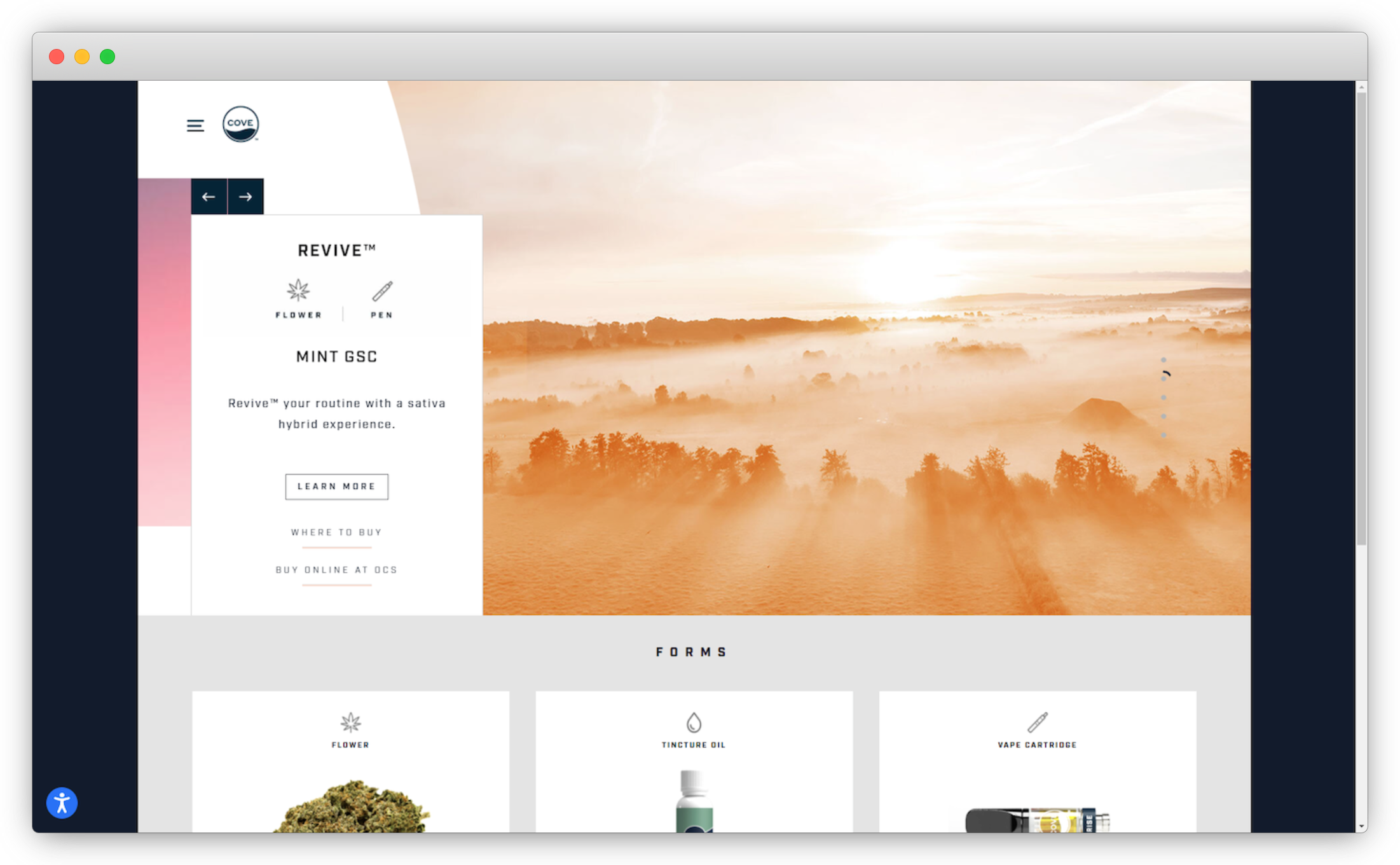

Cronos Group

- Market cap: $1.94 billion

- E-commerce enabled: No; entirely dependent on the government-controlled marketplace for cannabis products; uses Shopify for CBD product sales in the U.S.

- Fulfillment: Delivery, BOPIS, curbside pickup, and in-store

- Multichannel support: None

- User-friendliness: Provides information and directions for local retailers carrying its products, but relies entirely on the government-controlled marketplace for the online purchasing process

- Headless commerce: No

Cronos Group is a global cannabinoid company founded in 2013 and headquartered in Toronto, Ontario, Canada. Cronos Group was initially listed on NASDAQ on February 27, 2018, and up-listed from the TSX Venture Exchange to the Toronto Stock Exchange on May 23, 2018.

The company’s brand portfolio includes a wellness platform, two recreational cannabis brands, and three hemp-derived CBD brands. Both recreational brands — COVE and Spinach — are only permitted to sell in Canada, though the company’s hemp-derived CBD brands retail across the border in the U.S.

Surprisingly, neither the COVE nor Spinach websites include e-commerce functionality. Instead, the company guides customers to local stores through both the COVE and Spinach websites. On the COVE site, shoppers can click-through to the local government-controlled marketplace to order products via delivery or reserve a BOPIS/curbside pickup.

By taking this route, Cronos Group relinquishes some control over the customer experience. Because the only online avenue COVE products can be purchased through is a third-party marketplace, the brand must compete with other products from other vendors, both on pricing and for customer recognition.

Though its sales of recreational cannabis are subject to local regulations, Cronos Group could leverage a headless CMS to better control the customer experience and improve consistency across its brands.

Pros of Cronos Group’s e-commerce website

- Provides a streamlined experience to find local retail stores that carry its products, as well as easy access to the local government-regulated online marketplace.

- Uses its website to provide extensive information about its products — including flavor, THC content, and available forms — to assist with a customer’s decision-making process.

Cons of Cronos Group’s e-commerce website

- It lacks any e-commerce functionality.

- Potentially exposed to increased competition on government-run marketplaces.

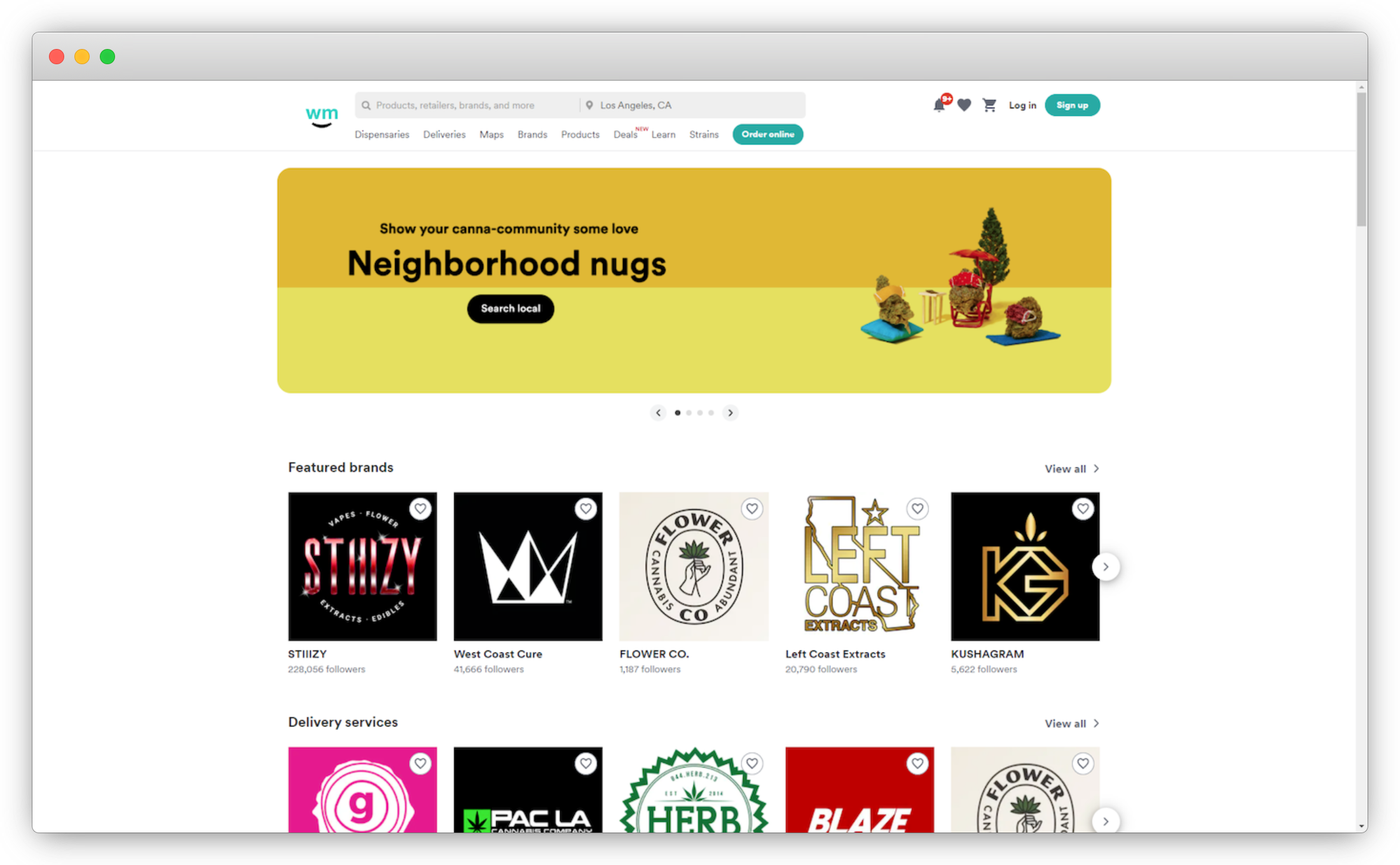

WM Technology

- Market cap: $1.49 billion

- E-commerce enabled: Yes

- Fulfillment: Delivery, BOPIS, curbside pickup, and in-store, depending on local laws and retailer preferences

- Multichannel support: Supported

- User-friendliness: Provides a variety of options for online purchasing and doesn’t require account registration

- Headless commerce: No

WM Technology is a California-based company and cannabis tech platform founded in 2008. The company offers cannabis retailers a cloud-based SaaS suite of products that includes POS, logistics, wholesale, and ordering functionality.

In addition to its SaaS product, WM Technology also operates the Amazon-like Weedmaps e-commerce cannabis website, a platform that lists local dispensaries in exchange for listing fees, through which the company earns revenue.

The consumer-facing Weedmaps functions “like a Yelp for pot.” Shoppers can browse through menus from available dispensaries and brands in their area. Fulfillment is handled by each retailer and its choice of delivery service, so pickup and delivery options vary. As with other cannabis e-commerce sites, payment is made upon pickup or delivery of the product.

Overall, Weedmaps delivers a cohesive and convenient customer experience for shoppers in cannabis-friendly states, with fulfillment options dictated by both local laws and dispensary preferences or requirements.

Pros of WM Technology’s e-commerce website

- Lists a wide variety of dispensaries, retailers, and products.

- Enables multiple fulfillment options, including delivery services.

- Doesn’t require account registration.

Cons of WM Technology’s e-commerce website

- Payment is only accepted at the time of delivery or pickup.

- “Featured Brand” recommendations aren’t always available in a customer’s area and should instead use personalization to recommend local featured brands.

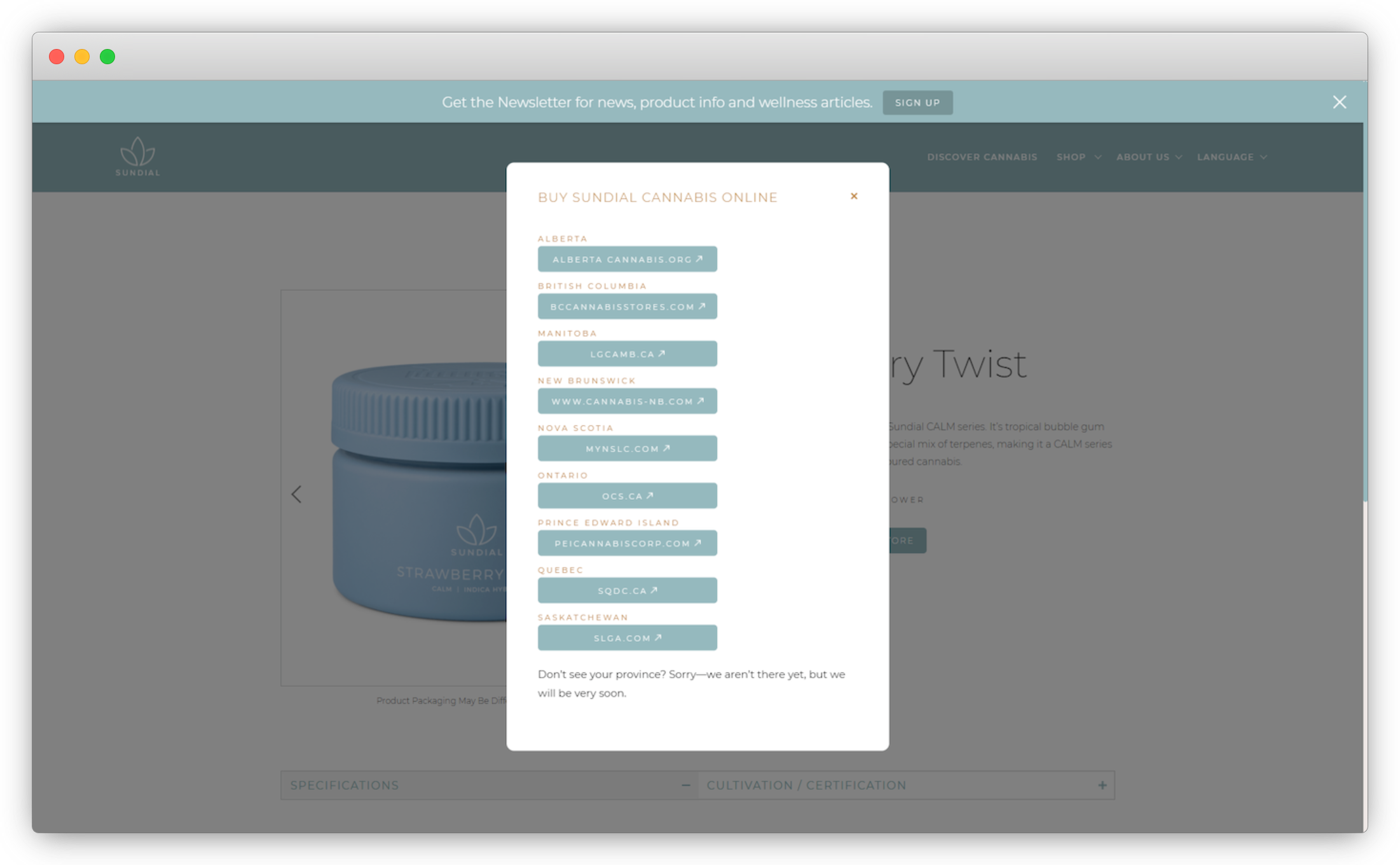

Sundial Growers

- Market cap: $1.35 billion

- E-commerce enabled: None; entirely dependent on the government-controlled marketplace for cannabis products

- Fulfillment: Delivery, BOPIS, curbside pickup, and in-store

- Multichannel support: None

- User-friendliness: Minimal; four distinct brands targeting different markets, but little cohesion among them and no control over customer experience

- Headless commerce: No

Sundial Growers is a Canadian cannabis company founded on January 1, 2006. After a tumultuous 2019 IPO and a subsequent 87% loss in market value, the company bounced back after rising as a popular meme stock.

In terms of cannabis growth and sales, Sundial owns four cannabis brands that retail in Canada. Each of the four sites uses Webflow for a CMS and lacks any other cannabis e-commerce software, relying entirely on the provincial government-controlled marketplace and a map of local retail stores that carry Sundial products.

Though Sundial — like its competitors — is limited by local laws in its ability to run an e-commerce cannabis website, it would likely benefit from increased multi-channel support to improve brand awareness and the customer journey.

Pros of Sundial Growers’s e-commerce website

- Four distinct cannabis brands provide a variety of products to a wide and diverse audience.

- Uses elements of personalization on its namesake brand website to match shoppers with products that fit their preferred cannabis experience.

Cons of Sundial Growers’s e-commerce website

- Lacks any e-commerce functionality and relies entirely on the government-run marketplace.

- Except for the Sundial Cannabis site, the remaining three branded sites feel barebones and fail to support the customer experience.

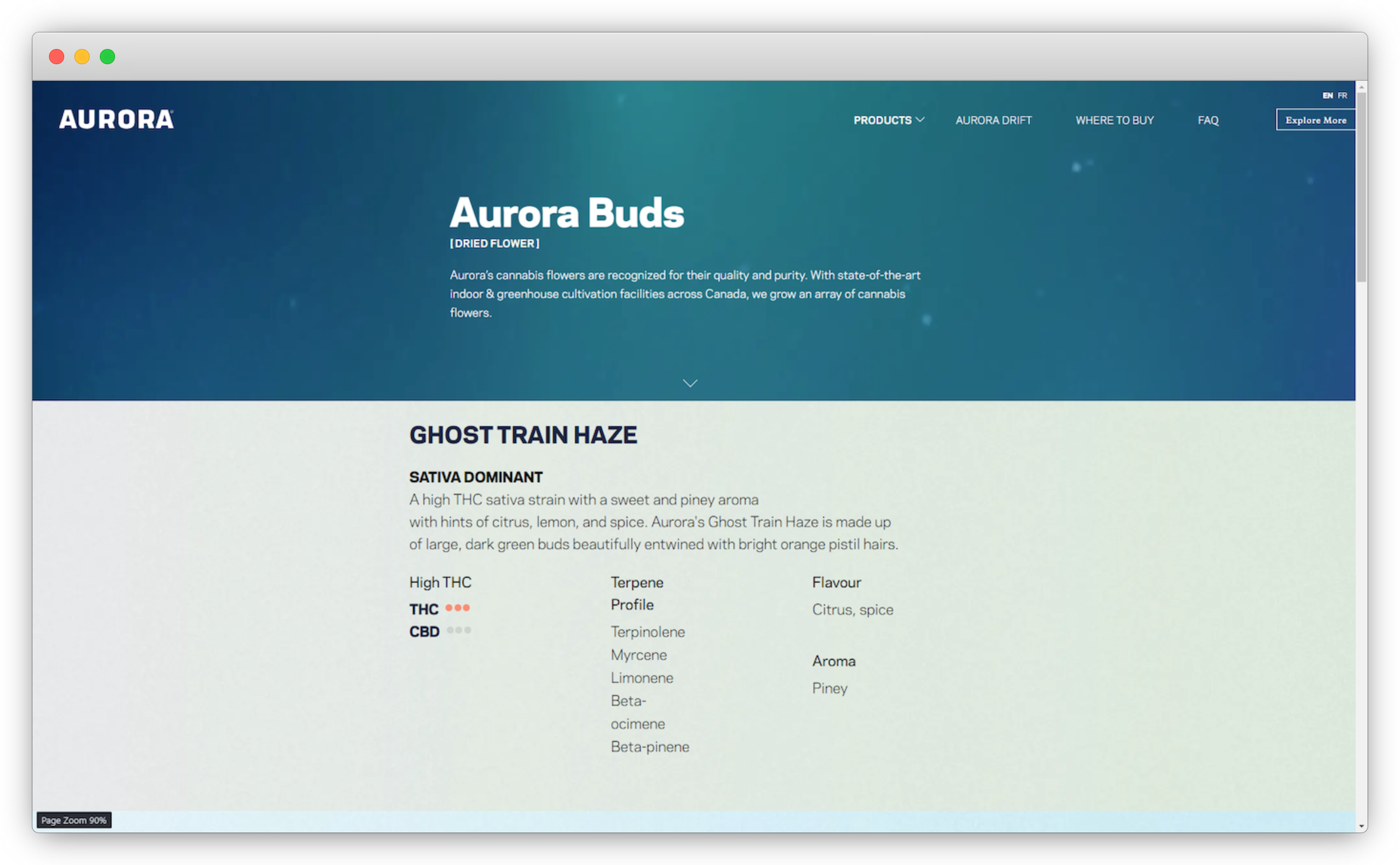

Aurora Cannabis

- Market cap: $1.35 billion

- E-commerce enabled: Limited; Shopify for medical brands; no e-commerce functionality for recreation

- Fulfillment: Delivery, BOPIS, curbside pickup, and in-store

- Multichannel support: Limited/dependent on retailers

- User-friendliness: Minimal; medical brand websites require registration and extensive personal information

- Headless commerce: No

Aurora Cannabis is a global cannabis company first established in Alberta, Canada on December 21, 2006. Aurora Cannabis markets medical products in Canada and the European Union, recreational cannabis in Canada, and hemp-derived CBD products in the U.S. Altogether, Aurora operates four medical brands and six consumer brands.

None of Aurora’s consumer cannabis sites — such as its namesake consumer offering (which uses Prismic, a headless CMS) — support e-commerce functionality. Like many other Canadian cannabis companies, a brief overview of each of the company’s products is provided. However, product pages lack any links to Aurora’s product listing on local online marketplaces, requiring shoppers to instead click the “where to buy” link in the navigation menu.

In contrast, the company’s medical e-commerce cannabis websites, such as Aurora Medical, run on the Shopify platform. However, registration — including insurance and medical information — is required before customers can purchase any products.

Pros of Aurora Cannabis’s e-commerce website

- Wide variety of medical and recreational cannabis brands and products.

- Its medical brands are centralized onto one cannabis e-commerce website to streamline the purchasing process and customer journey.

Cons of Aurora Cannabis’s e-commerce website

- No recreational cannabis storefront.

- Medical cannabis storefront requires registration to view the cart or proceed through the purchasing process.

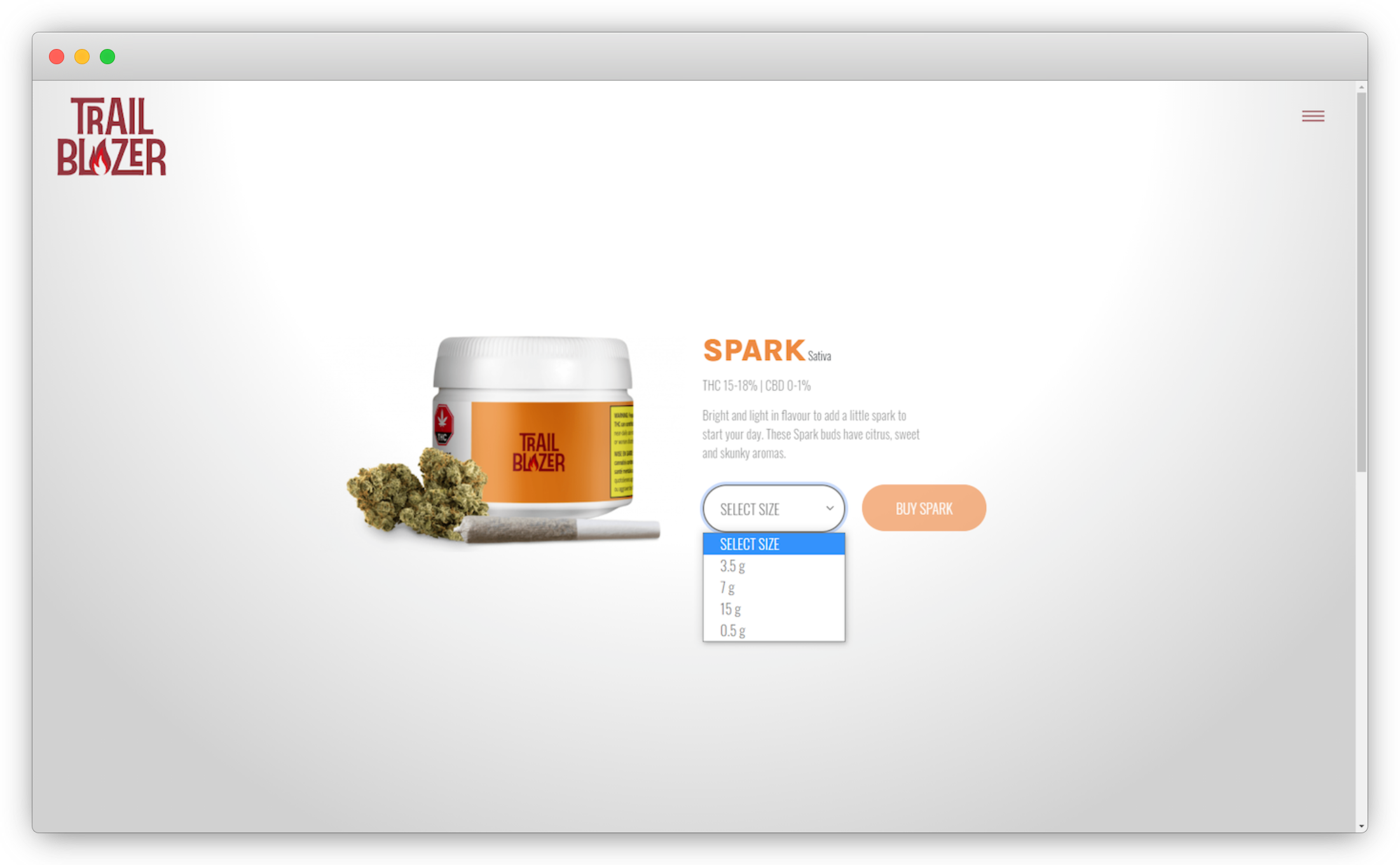

Organigram

- Market cap: $0.68 billion

- E-commerce enabled: None; entirely dependent on the government-controlled marketplace for cannabis products

- Fulfillment: Delivery, BOPIS, curbside pickup, and in-store

- Multichannel support: Limited

- User-friendliness: Enables shoppers to choose the desired product and size on its branded site, then links directly to the product listing on the government marketplace

- Headless commerce: No

Organigram is a Canadian company founded in 2013 as a medical cannabis provider. Since then, Organigram expanded to include the production of both medical and recreational cannabis, the latter of which is sold under one of five retail brands. In 2020, Organigram reached an agreement with Canndoc, an Israeli medical cannabis producer, to provide the company with dried flowers for distribution into the Israeli medical market.

Two of Organigram’s retail brands (Indi and Big Bag O’ Buds) lack internet presence, with the remaining lacking e-commerce functionality. However, on both the Edison Cannabis and Trailblazer Cannabis websites, Organigram has taken steps to influence the customer experience.

Beneath each product listing is a small shopping cart icon that links directly to the product on the relevant government-run storefront. This helps limit the likelihood customers become confused or exposed to competitors’ products. In some cases, shoppers can even choose their preferred product size and are then directed to the corresponding selection on the government site.

With this strategy, Organigram practices some control over the customer experience within the confines of regulatory restrictions.

Pros of Organigram’s e-commerce website

- Smooth and convenient shopping experience despite governmental limitations.

- Product listings hint at a traditional e-commerce experience even without e-commerce functionality.

Cons of Organigram’s e-commerce website

- The website for the Shred brand lacks similar functionality as the Edison and Trailblazer sites and relies entirely on an amateurish Linktree list for information about where to buy.

- Two of Organigram’s retail brands lack any online presence.

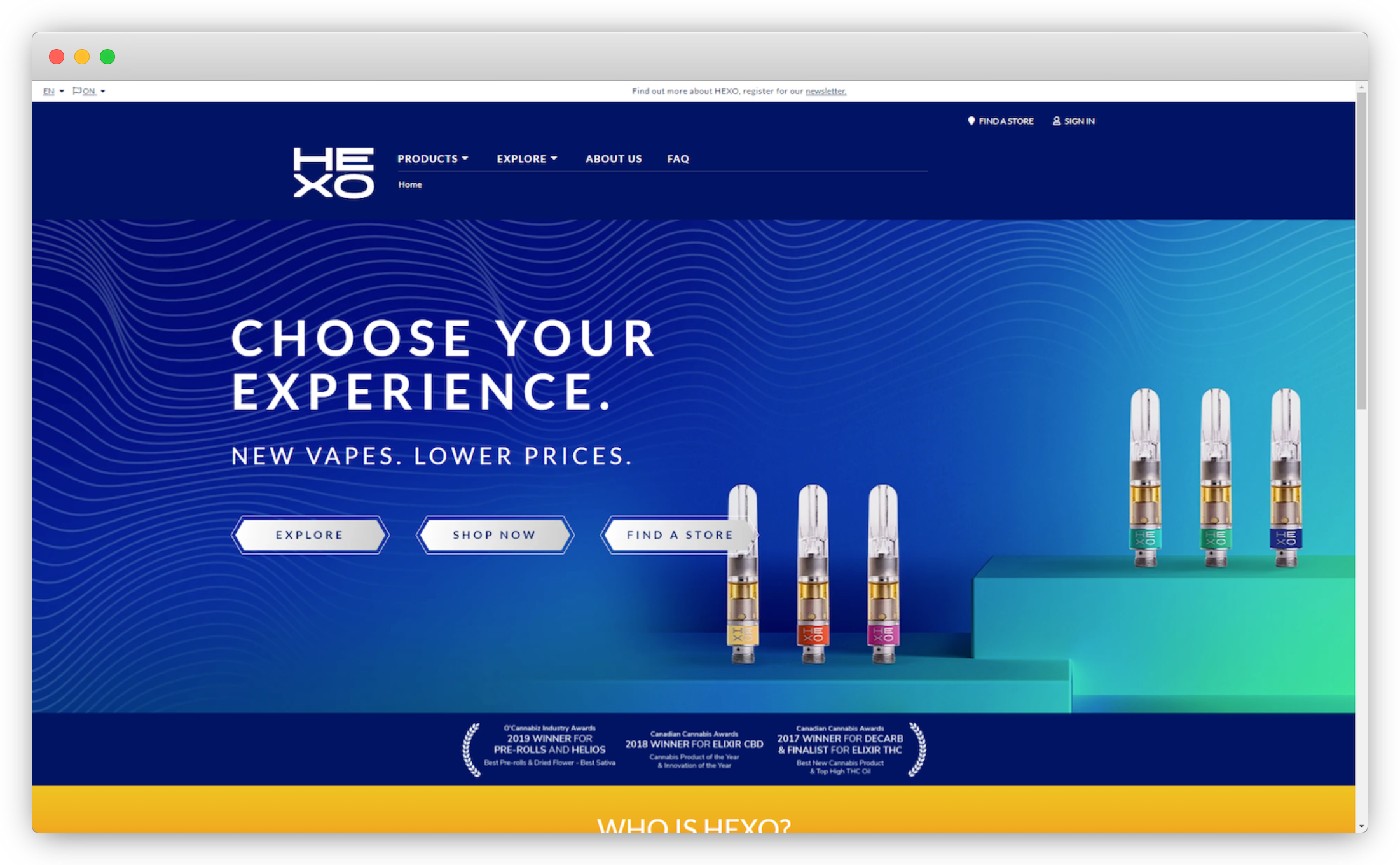

HEXO

- Market cap: $0.42 billion

- E-commerce enabled: Limited; retail brand websites use Shopify but lack e-commerce functionality; its medical brand allows online purchasing

- Fulfillment: Delivery, BOPIS, curbside pickup, and in-store

- Multichannel support: Limited

- User-friendliness: Minimal: retail customers are linked to the company’s general product offerings on the local marketplace

- Headless commerce: No

HEXO was originally incorporated as the Hydropothecary Corporation in 2013 with a sole focus on the Canadian medical cannabis market. After rebranding to HEXO in 2018 in response to Canada’s cannabis legalization, the company entered the recreational market. Today, HEXO operates one medical brand and five retail brands that serve the Canadian market.

Each of HEXO’s retail websites runs on Shopify, though none support product purchases or checkout. Instead — and like its other Canadian competitors — customers must order or reserve HEXO products on their local government-run cannabis e-commerce website. However, unlike competitors, HEXO doesn’t link to its specific products on the marketplace and instead links to its general product listings.

Purchasing medical cannabis is more streamlined on the Hydropothecary website. Customers may choose, purchase, and pay for products directly on-site, though registration (including medical information) is required. Until 2016, the Hydropothecary website ran on Spree, a headless open-source e-commerce platform, though it’s no longer clear what solution the website currently uses.

Pros of HEXO’s e-commerce website

- Product listings are informative and educational.

- Leverages its cannabis technology to partner with other companies through joint ventures, expanding its offering of cannabis-based products.

Cons of HEXO’s e-commerce website

- “Buy now” buttons for specific product listings don’t link to the exact product page on the local marketplace website.

- Products aren’t available on each province’s e-commerce store — in some cases, the “shop now” link leads nowhere.

[toc-embed headline=”Key Takeaways”]

Key Takeaways

- Cannabis e-commerce software is emerging to give brands more multichannel support and control over fulfillment, but local laws and regulations still restrict the endpoint of a customer’s journey.

- E-commerce cannabis websites must focus on owning and improving the customer experience, especially if the final checkout step takes place off-site.

- Companies competing on marketplaces must optimize their e-commerce cannabis sites to link directly to their branded products and limit exposure to the “Amazon problem.”

- Leveraging headless e-commerce technology like fabric XM, fabric PIM, and fabric OMS helps brands maintain consistent backend data across multiple channels, even if the frontend varies (such as from location-to-location or online-to-store).

Tech advocate and writer @ fabric.