The World’s Largest E-Commerce Companies by GMV

Though the COVID-19 pandemic damaged the global economy throughout 2020, the top e-commerce companies experienced double-digit revenue growth. Gross merchandise sales grew by 29% last year, with 50 U.S.-based marketplaces growing sales by 40%.

Some of this growth was driven by e-commerce players adopting portions of a marketplace model. Marketplaces contributed to 57% of U.S. e-commerce sales in 2020, a figure likely to continue trending upward.

By forcing consumers indoors, COVID-19 accelerated retail’s transition to digital. Even though e-commerce brands contended with delayed delivery and customs clearance times, they also experienced four to six years of growth over a single year.

As a result, the total gross merchandise value (GMV) for the top 13 largest e-commerce companies rose by 20.5% in 2020. By perfecting sustainable e-commerce strategies, such as implementing headless platforms, the largest e-commerce companies were capable of not only weathering a tumultuous year but thriving throughout.

[toc-embed headline=”Features of the World’s Biggest E-Commerce Companies”]

Features of the World’s Biggest E-Commerce Companies

The most successful e-commerce companies understand the importance of responding to the changing needs of consumers and markets. Let’s look at common features that provide the best e-commerce companies with the flexibility and leverage necessary to increase GMV.

A summary of the common features contributing to the GMV of top e-commerce companies is illustrated in the table below.

| Feature | How it’s leveraged |

| Third-party marketplace functionality | This provides the largest e-commerce companies with value-added services and a wider range of product offerings. |

| Convenient ordering and shipping | This provides quick and simplified checkout and access to purchases. |

| Membership programs | This offers customers discounts, perks, and incentives for shopping with the brand. |

| Mobile functionality | This lets customers access the storefront on their terms from mobile devices. |

| Personalization | This presents to customers relevant recommendations, deals, and experiences based on data from their unique profiles. |

Third-party marketplace functionality

Since the mid-90s, top e-commerce companies have embraced one of three marketplace models: first-party (1P), third-party (3P), or a mix of both (hybrid). The benefit of operating an e-commerce website as a marketplace is two-fold: the company itself may take advantage of value-added services (such as Amazon Advertising) while expanding its product selection and assortment.

Fifty-nine percent of the top North American retailers sold their products on marketplaces as of 2021. Widening the assortment of products lets e-commerce players cross-sell, increasing sales and GMV.

Convenient ordering and shipping

By default, purchasing products from an e-commerce website is less convenient than shopping at a brick-and-mortar retailer. Shipping fees, delivery delays, and lengthy checkout may cancel out many of the advantages e-commerce brands have over traditional retailers.

In fact, 69.8% of carts are abandoned during checkout. Forty-nine percent of those carts are abandoned due to excessive shipping costs, taxes, and fees, and 19% are abandoned because of long delivery times. Thus, the world’s largest e-commerce companies understand the importance of convenience by offering free shipping, buy online pick up in-store (BOPIS) options, and fast, registration-free checkout.

Membership programs

Membership programs, such as Amazon Prime and Walmart+, offer incentives, discounts, and exclusive access in exchange for a nominal subscription fee. Launching a membership program lets e-commerce companies appeal to savvy consumers, some of whom spend 90% more than the average online shopper.

Loyalty and membership programs, powered by loyalty membership systems such as fabric Member, increase the revenue of e-commerce companies by almost 2.5 times that of competitors without a membership program. The incentives also help e-commerce brands retain customers. In fact, simply improving retention by five percent may increase profits—and, subsequently, GMV—by up to 95%.

Mobile functionality

Fifty-nine percent of online shoppers in the U.S. prefer shopping on their mobile phones. Even as the pandemic wanes, shoppers still expect to use mobile e-commerce websites for their purchases. By 2025, mobile e-commerce sales should comprise 10.4% of all retail sales in the U.S.

Top e-commerce companies understand the benefits of mobile functionality and its impact on GMV. Successful e-commerce giants must launch and market dedicated mobile apps, which convert at a rate 157% higher than mobile websites. (Mobile apps are easy to integrate with headless platforms commonly used by the top e-commerce companies.)

Personalization

Consumers expect more personalized experiences than just product recommendations. The world’s largest e-commerce companies use technology to understand their markets, identify the context behind purchases and searches, create different experiences for each user segment, and generate uniquely tailored profiles for each customer.

Ninety-three percent of companies with a personalization strategy experienced revenue growth in 2018. Because personalization inspires loyalty, e-commerce companies may achieve incremental revenue growth of 10% or more.

[toc-embed headline=”The Largest E-Commerce Companies by GMV”]

The Largest E-Commerce Companies by GMV

E-commerce giants met the needs of many consumers unable to shop in person as a result of lockdowns and quarantines. Such a massive shift from traditional retail to e-commerce directly impacted the GMV of e-commerce leaders. A list of e-commerce companies by GMV is illustrated in the table below.

| GMV in 2020 (billions USD) | GMV change (2019-2020) | Market cap (billions USD)* | Market share† | |

| The Alibaba Group | $1,145 | 20.1% | $614.83 | 29%‡ |

| Amazon | $575 | 38.0% | $1,734.95 | 13% |

| JD.com | $379 | 25.4% | $123.46 | 9% |

| Pinduoduo | $242 | 65.9% | $159.19 | 4% |

* As of June 2021

† Based on GMV as of 2019.

‡ Includes Tmall and Taobao, which are both owned by the Alibaba Group.

The Alibaba Group

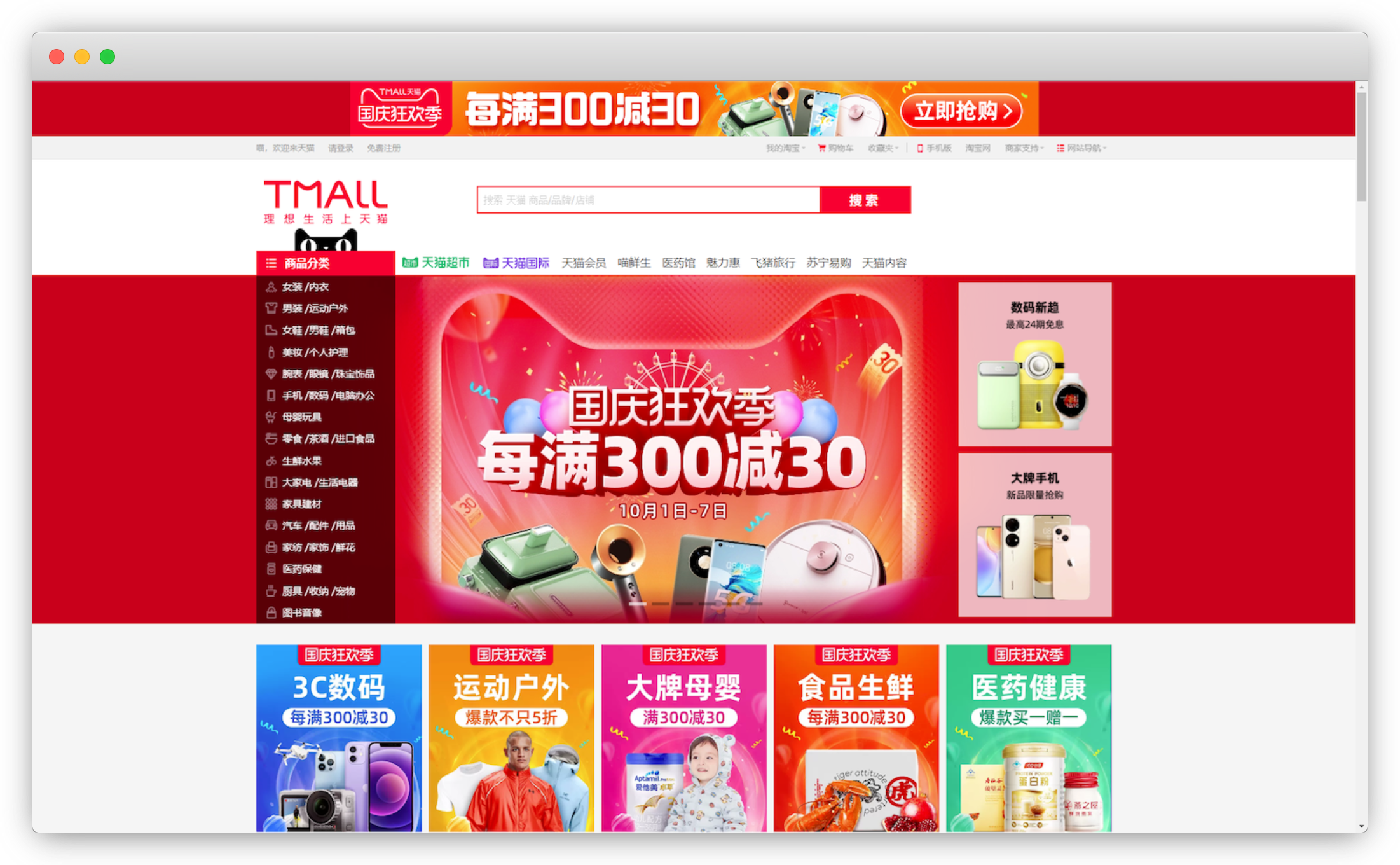

The Alibaba Group is China’s largest e-commerce company, controlling 55.9% of the Chinese market in 2019. In addition to operating the wholesale giant Alibaba, the Alibaba Group sells to the domestic Chinese market via Tmall, a B2C (business-to-consumer) marketplace, and Taobao, a C2C (customer-to-customer) marketplace. The Alibaba Group also caters to international customers, primarily through AliExpress and Lazada.

At the end of 2020, Alibaba recorded 779 million annual active consumers across its China retail marketplaces, rising to 828 million by June 30, 2021. Much of Alibaba’s GMV growth is attributed to its “community marketplaces business” and a focus on “[providing] quality product supply and on-time delivery.”

Daniel Zhang, CEO of the Alibaba Group, claims “online shopping has become a habit.” This habit and a growing familiarity with e-commerce contributed to Alibaba’s GMV growth, with an increase in sales of consumer goods (most notably electronics), necessities, and household goods. (Unsurprisingly, sales of apparel and accessories, furniture, and auto parts declined, though sales in those segments have since grown.)

On the tech side of things, Alibaba aims to drive innovation by building an ecosystem similar to Amazon’s. To illustrate that point, Alibaba Cloud partnered with Salesforce in September 2021 to launch a headless e-commerce product. Through the launch of Salesforce Social Commerce, Alibaba and Salesforce hope to capitalize on the growth of social commerce in China to continue to drive GMV across the Alibaba ecosystem via omnichannel commerce.

The main Tmall (top) and Taobao (bottom) pages, with organized category and product listings and accessible search functionality.

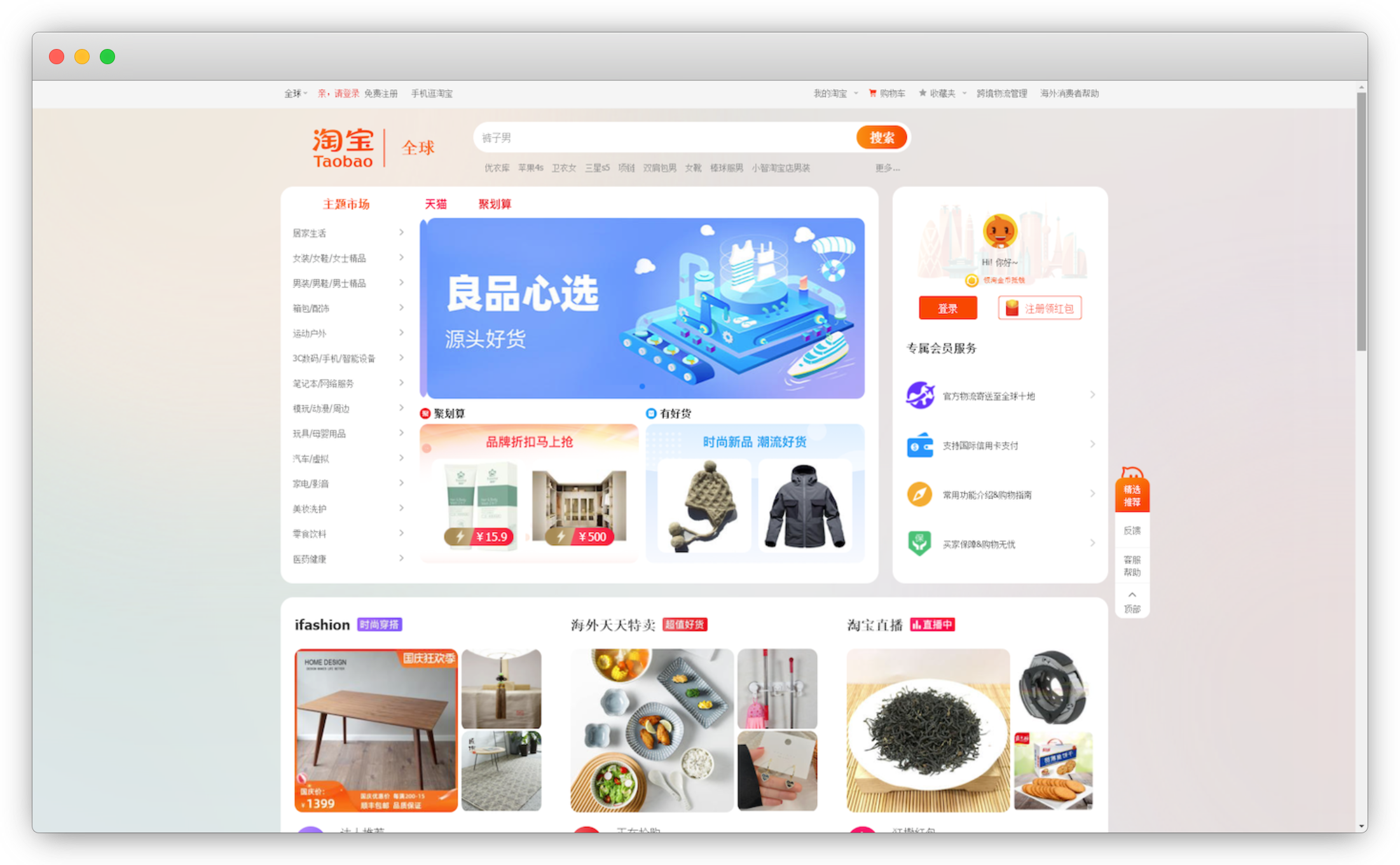

Amazon

Amazon is the world’s largest e-commerce company with consistent annual revenue growth year-over-year. Much of the e-commerce giant’s success may be attributed to its omnichannel initiatives and diverse product offerings, though the COVID-19 pandemic was also beneficial for Amazon’s GMV growth in 2020.

As consumers shifted more fully to online shopping, Amazon’s revenue soared, with the e-commerce company selling nearly $100 billion worth of products in the third quarter of 2020. In addition to record sales, Amazon’s profits rose by nearly 200%.

Much of Amazon’s growth may be spearheaded by its efforts to make shopping more convenient. As the pandemic set in, Amazon reduced its click-to-door time from 3.4 to 2.2 days, aiming to put orders in the hands of customers as fast as possible.

Amazon also grew its GMV by investing in its marketplace, adding more than 190,000 new third-party sellers. Prime Day—an exclusive sales event for Amazon Prime Members—led to record sales, with third-party sales surpassing $3.5 billion, or a 60% increase from Prime Day 2019.

The main Amazon page, with suggestions for seasonal purchase recommendations and deals. Note the prompt encouraging users to sign in for a better, personalized shopping experience.

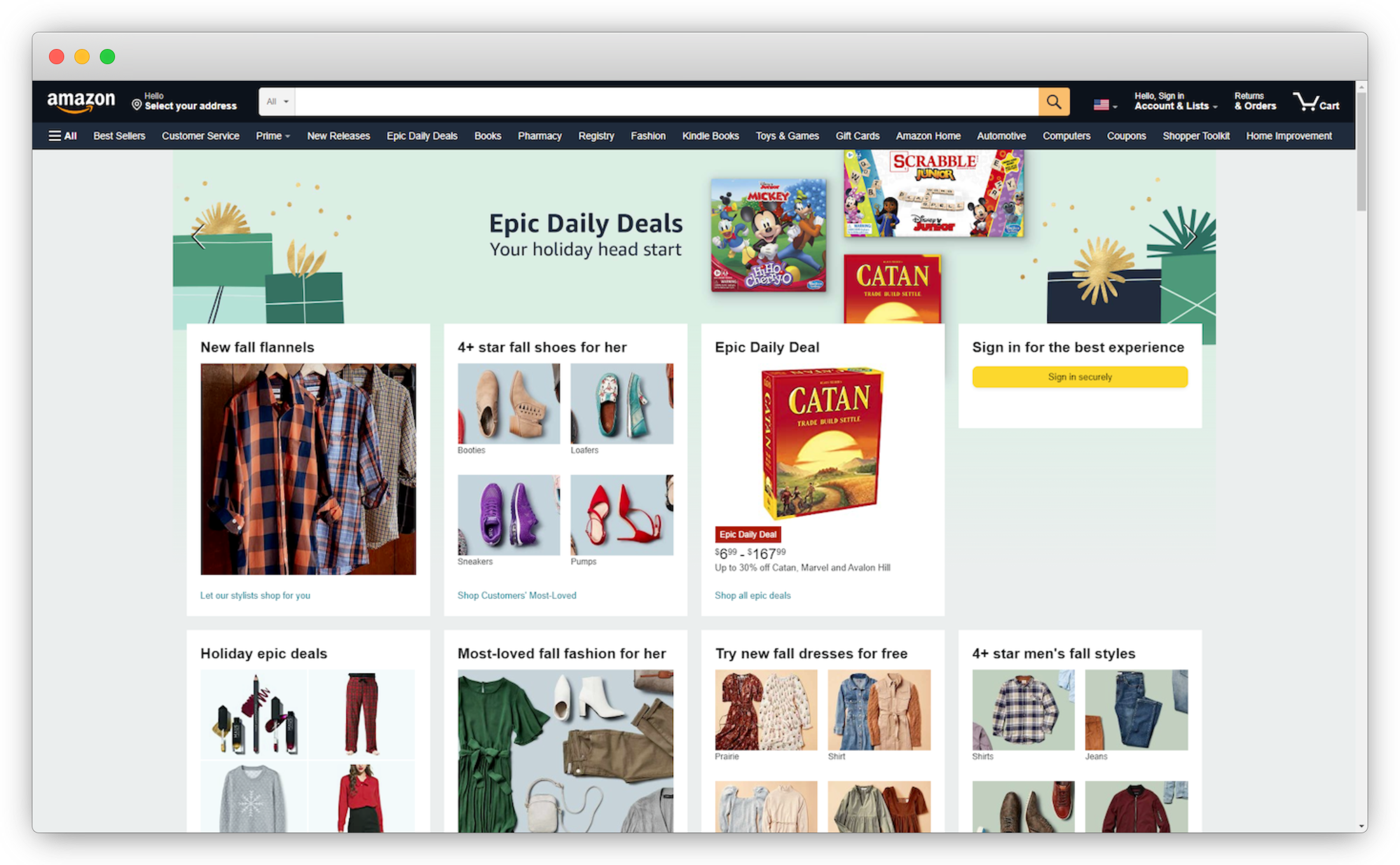

JD.com

JD.com is one of Alibaba’s chief competitors in the Chinese market. Its business model is more reminiscent of Amazon than Alibaba, leveraging a national shipment and delivery network to standardize same- and next-day delivery.

After recording net revenue of $82.9 billion in 2019, JD.com reported net revenue of $114.3 billion in 2020, an increase of 29.3% over the previous year. Though its growth waxed and waned throughout the year, JD.com’s strength was in its expanding margins. Part of this growth is due to JD.com’s increasingly efficient fulfillment network.

JD.com is also focusing on exclusivity with its JD Plus membership program. The program claimed more than 20 million customers in October 2020, all of whom were given access to rebates, free shipping coupons, and perks from over 600 brands across industries. As a result, JD.com reported improved engagement and retention, contributing to increased GMV in 2020.

By partnering with luxury brands to expand its marketplace offerings, JD.com aims to solidify its GMV growth into the future, which, according to analysts, seems realistic.

The main JD.com page, highlighting product recommendations and organized category listings.

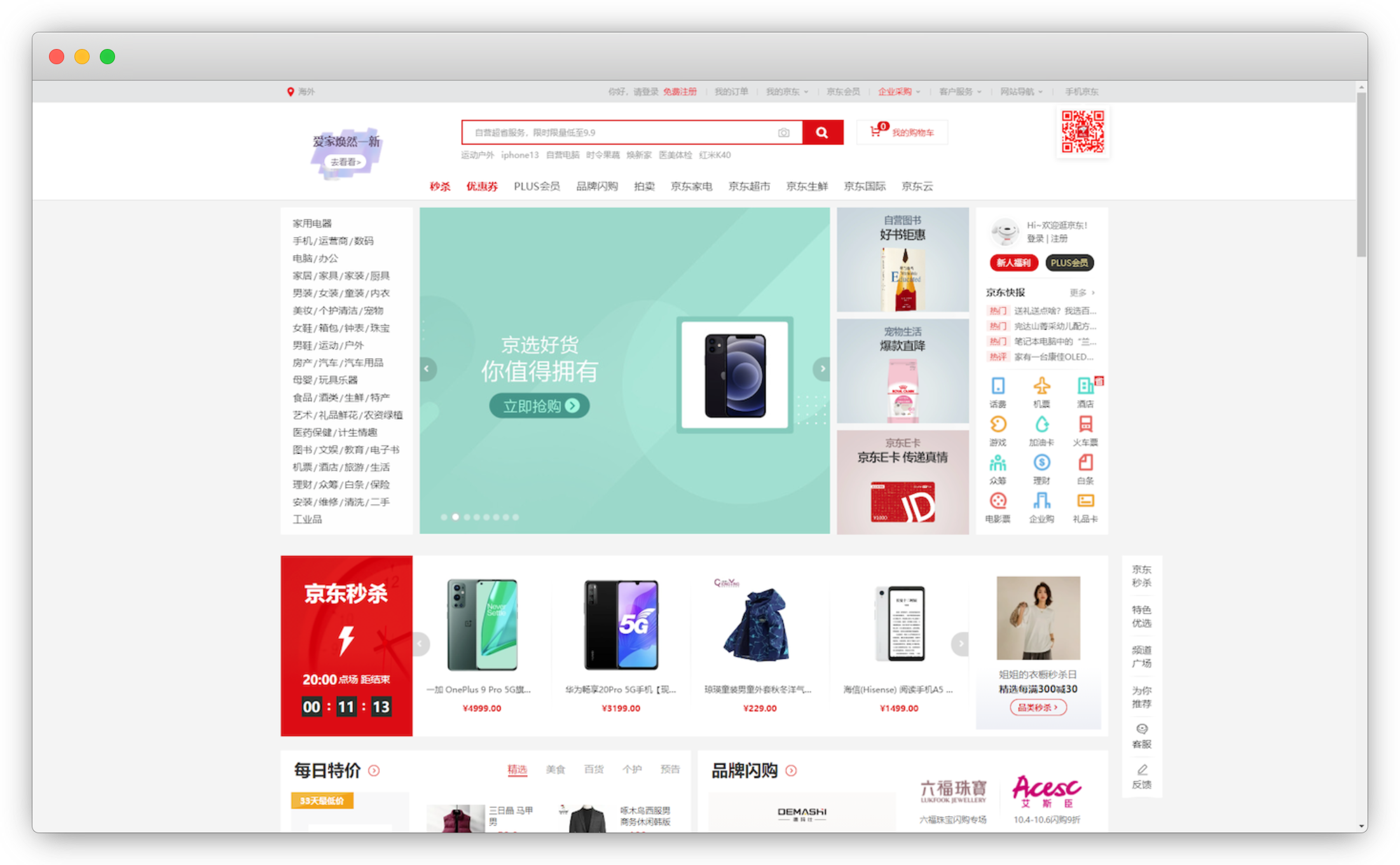

Pinduoduo

Pinduoduo launched in 2015 and found quick success, touting more active buyers than e-commerce giant Alibaba after its successful 2020. Pinduoduo’s business model is based on its marketplace services — a combination of sales commissions and advertising revenue.

In contrast with its rivals, Pinduoduo is accessible as a mobile-only platform. This is, however, by design. Pinduoduo’s focus is on interactive social commerce, leveraging personalized experiences with games, rewards, and a community aspect.

This social-based approach is most obvious through Pinduoduo’s team purchase feature that incentivizes shoppers to form teams in exchange for discounted products. Team purchases benefit both shoppers and sellers: consumers save money and merchants move a higher volume of products.

Pinduoduo’s unique approach to social e-commerce brought in net revenue of $9.1175 billion in 2020, an increase of 97% from 2019. As Pinduoduo continues to innovate — particularly by expanding into fresh food — it seeks to remain an e-commerce leader and continue to grow its GMV.

Promotional screenshot of the Pinduoduo app, highlighting the interface and some available options.

[

toc-embed headline=”Key Takeaways”]

Key Takeaways

- The COVID-19 pandemic contributed to significant GMV growth among the world’s top e-commerce companies.

- The largest e-commerce companies by GMV include Alibaba, Amazon, JD.com, and Pinduoduo, all of which use first- or third-party marketplace models.

- Improving customer convenience, operating exclusive membership programs, supporting mobile functionality, and personalizing the shopping experience are key to growing GMV for e-commerce companies.

- Licensing innovative headless e-commerce solutions from providers like fabric support continued GMV growth without introducing burdensome overhead or requiring significant development time.

Tech advocate and writer @ fabric.