Warby Parker’s Retail Playbook to Reach 900+ Stores

Warby Parker’s D2C omnichannel empire is disrupting the traditional eyewear industry while simultaneously making a positive social impact.

Warby Parker leverages headless commerce and personalization to create a seamless omnichannel experience for customers.

The company’s data science team utilizes customer data to inform strategies including product innovation, supply chain optimization, and future retail expansion.

Before the rise of headless commerce platforms, Warby Parker’s choices were limited, which forced it to engineer its own commerce platform.

This article is part of Commerce 4.0, a series about the next frontier of e-commerce along with the strategies and tactics used by iconic brands to transform how we discover, select, and purchase products.

Warby Parker strives to represent the best of American business. Since its founding in 2010, the technology-first eyewear brand has made it its mission to demonstrate that companies can scale, become profitable, and make a positive impact in the world while putting people and the planet first. According to its co-founders, “we hope to serve as an example to businesses and entrepreneurs that you can do well while doing good.”

It’s hard to argue that this unique business model hasn’t worked. By foregoing short-term profitability in favor of long-term disciplined growth, the company built an empire that has completely disrupted the traditional eyewear industry.

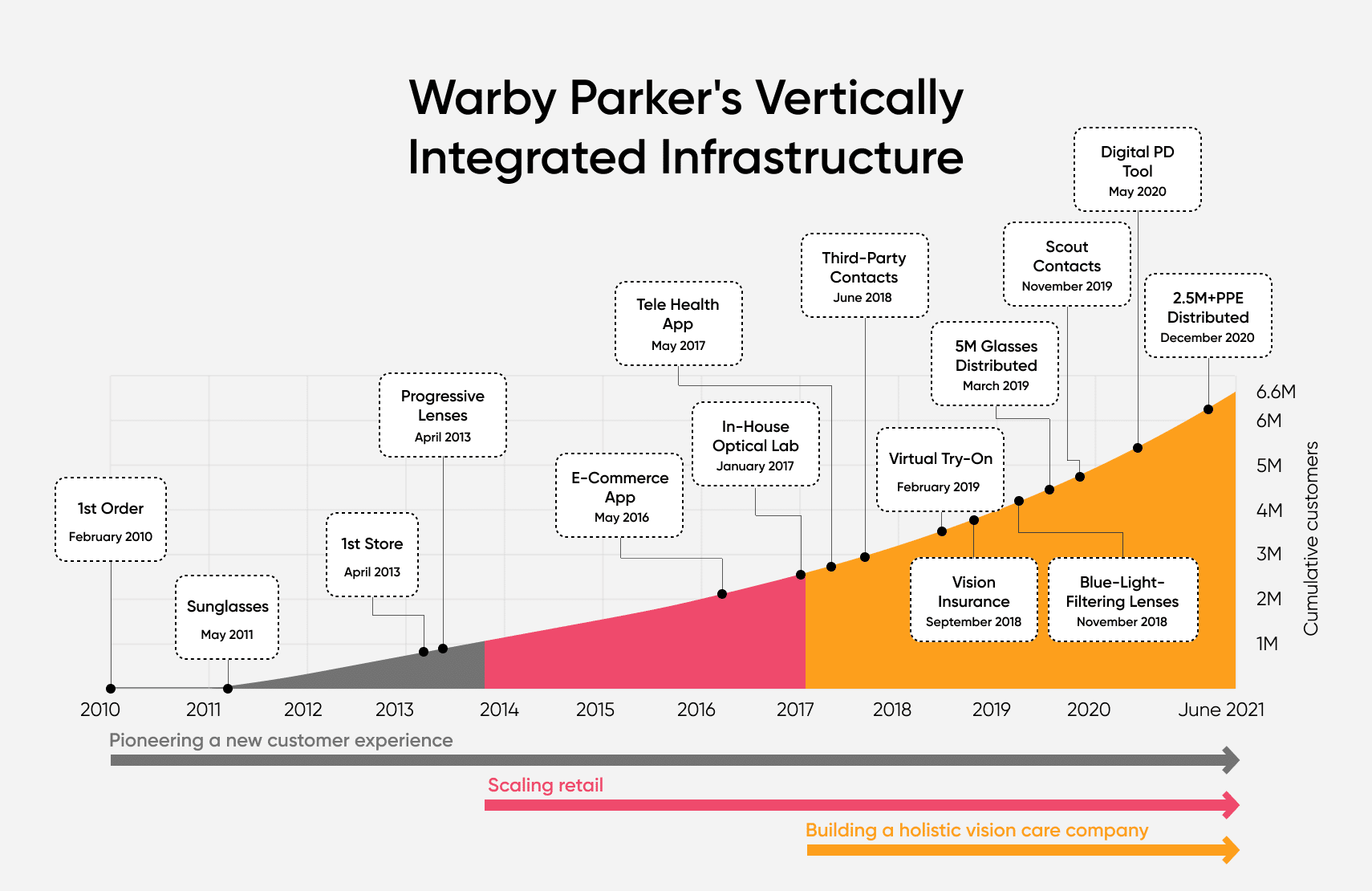

Its vertically-integrated infrastructure means the company controls nearly all aspects of the design, manufacturing, sales, fulfillment, and service of its products. In addition, its direct-to-consumer (D2C) strategy and omnichannel selling capabilities have inspired hundreds of startups to try to become the next Warby Parker of their respective markets.

Over the last 11 years, this vertically-integrated business model (p.81) has allowed the company to pioneer online sales, scale its physical retail business, and launch new products and services to become a holistic vision care company.

Today, the certified B corporation expects to generate revenues of around $540 million, representing a growth of around 38% versus 2020. It also expects revenues to rise at least 25% in fiscal 2022 and for margins to improve as well. If Warby Parker can sustain a compound annual growth rate (CAGR) of 25%, it will hit a billion dollars in sales by 2024.

A social mission to believe in

The company’s distribution of glasses to underserved people has made an even bigger impact. Warby Parker’s “buy a pair, give a pair” program works with nonprofit partners to distribute glasses in more than 50 countries around the world. Today, over eight million people now have the glasses they need to “learn, work, and achieve better economic outcomes.”

Investors clearly believe in the social mission and the strength of the underlying business. E-commerce sales soared during the COVID-19 pandemic and, in August 2020, the company raised $245 million from private investors to reach a valuation of $3 billion. Just over a year later, the company made its public debut in September 2021 through a direct listing, reaching an initial market capitalization of $6 billion.

Today, with the eyewear market forecasted to generate $154 billion in sales worldwide in 2022, Warby Parker is in prime position to scale far beyond its roughly 1% market share by revenue in the U.S.

In this Commerce 4.0 profile, we’ll examine how the company’s pioneering omnichannel retail strategy has shaken up the traditional eyewear industry. We’ll also explore Warby Parker’s plans to shape the future of vision by improving the customer experience with innovative technologies and expanding its retail footprint across the country and around the world.

[toc-embed headline=”Warby Parker’s Omnichannel Growth Strategy”]

Warby Parker’s Omnichannel Growth Strategy

If you’ve ever walked into an optical retailer to buy a pair of prescription glasses and wondered why they were so expensive, you’re not alone. The legacy optical industry is highly concentrated amongst a few industry players that have created an illusion of choice for consumers. When four Wharton Business School students decided it was time to do something about it, Warby Parker was born.

An industry ripe for disruption

Few people know it, but the global eyewear industry’s biggest and most powerful player is EssilorLuxottica, whose influence spans the full eyewear value chain from design to manufacturing, distribution, retailing, and even insurance. Created through a 2018 merger between lens-making company Essilor International SA and eyewear company Luxottica Group SpA, the combined entity is a vertically integrated giant that controls a significant portion of the global eyewear market.

EssilorLuxottica owns the popular retail outlets LensCrafters, Pearle Vision, and Sunglass Hut. It also owns proprietary eyewear brands such as Ray-Ban, Oakley, and Vogue Eyewear. Licensed brands include Burberry, Ferrari, Prada, Ralph Lauren, Versace, and many more. EssilorLuxottica even owns the vision insurance plan EyeMed Vision Care and the online eyeglass store EyeBuyDirect (p.8).

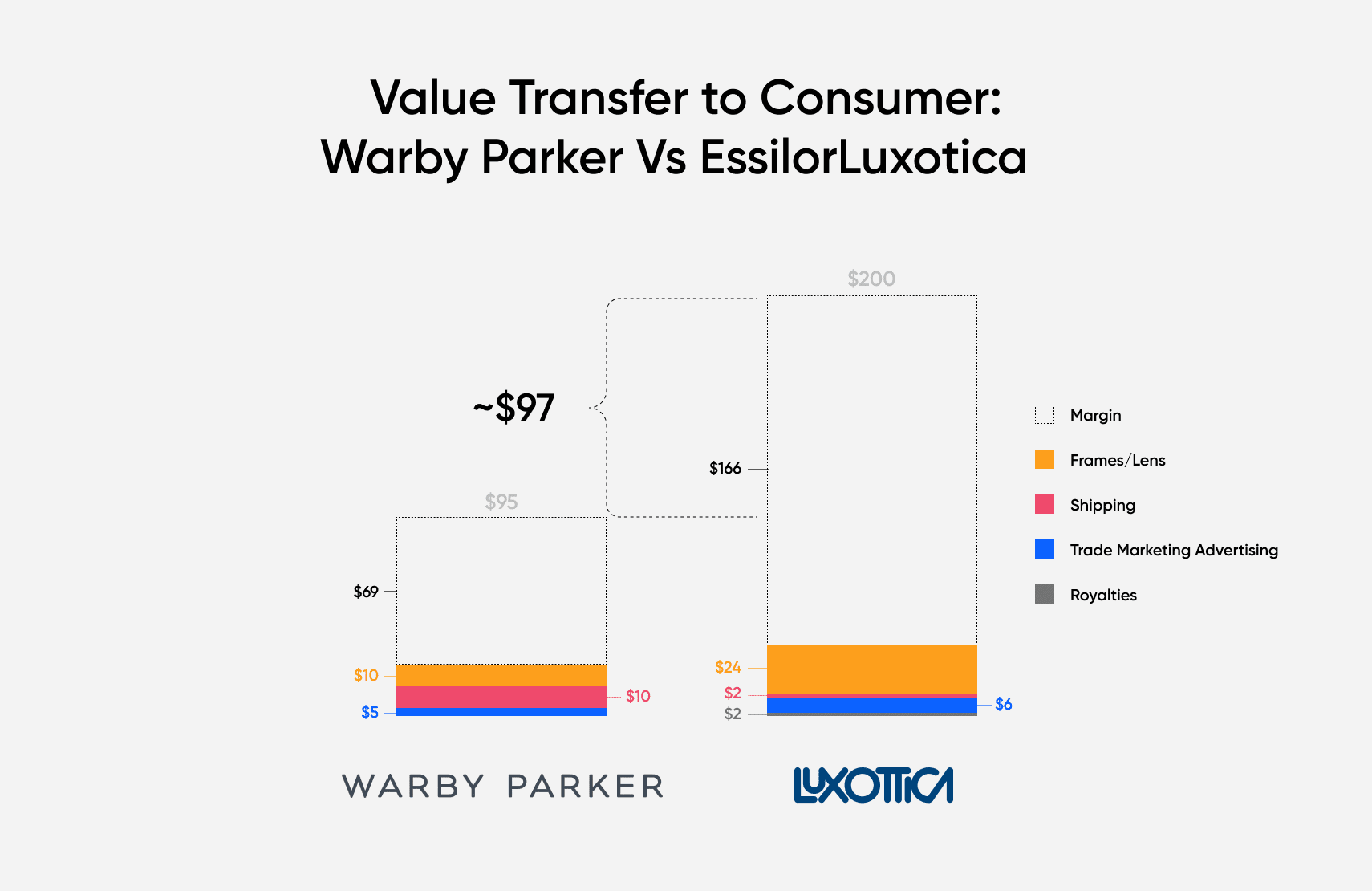

With no clear competitors, EssilorLuxottica maintains an illusion of choice while its monopolistic control of the market allows for a significant markup of eyewear at 10x to 20x from manufacture to sale. These products are often burdened by various licensing, wholesale, and retail fees that support the legacy supply chain (p.6). Unfortunately, customers often find their vision insurance (if they have it) only covers a portion of their purchase, and they are left with a significant out-of-pocket expense.

Shaking up the eyewear market

When Warby Parker launched its business in 2010, its strategy was simple: cut out the middleman and sell glasses directly to consumers online. This made it part of the early breed of digitally native vertical brands (DNVB).

In order to execute this plan, the company focused on the disintermediation of the traditional retail supply chain. They did this by circumventing traditional channels, designing frames in-house (avoiding licensing fees), working directly with suppliers, integrating in-house lens-finishing and assembling within their optical lab, and transferring that value to consumers by selling D2C online. This allowed Warby Parker to provide high-quality, well-designed prescription eyewear at a fraction of the price of traditional retailers.

When comparing $200 glasses from Luxottica with $95 glasses from Warby Parker, an analysis by UCLA found that Warby Parker drastically reduced costs by working directly with lens and frame suppliers and avoiding the licensing costs that come with the brand names offered by the competing eyewear giant.

In this scenario, Warby Parker charged $105 less for a pair of glasses and still maintained a healthy gross profit margin. More importantly, the company was able to transfer roughly $97 in value to the consumer.

Today, Warby Parker is expanding beyond prescription glasses and sunglasses to provide a holistic vision care offering that includes contact lenses (including its own private label brand called Scout), eye exams and vision care, and vision insurance.

In 2020, the company generated 95% of net revenue from the sale of glasses, 2% of net revenue from the sale of contacts, 1% of net revenue from eye exams, and the remaining 2% of net revenue primarily from the sale of eyewear accessories (p.81).

[toc-embed headline=”Warby Parker Omnichannel Growth Tactics”]

Warby Parker Omnichannel Growth Tactics

“We’re in business of creating amazing customer experiences and that requires a best-in-class technology team to build the systems to support those experiences (desktop and mobile site experiences, office infrastructure including an increasingly busy call center, supply-chain and inventory management systems, housing and analysis of all different types of data to inform our product, marketing, and customer service strategies, etc).”

Neil Blumenthal, Co-Founder & Co-CEO, Warby Parker

Before Warby Parker, omnichannel D2C retail was still uncharted territory. As a pioneer, the company had to write the playbooks on how to scale a digitally native vertical brand and also how to disrupt a traditional legacy business as entrenched as eyewear.

Warby Parker owes its success to several important growth tactics employed throughout its journey, including:

- Pioneering a seamless buying experience

- Developing innovative products and services

- Reinventing the brick-and-mortar experience

- Leveraging headless commerce and personalization

Below, we will explore each of these tactics to see how they contributed to the company’s growth over the years.

Tactic #1: Pioneering a seamless buying experience

Underpinning the growth of Warby Parker is relentless and continuous innovation. The company prides itself for being a mission-driven lifestyle brand that operates at the intersection of design, technology, healthcare, and social enterprise. This has allowed the company to pioneer a true omnichannel retail experience for customers.

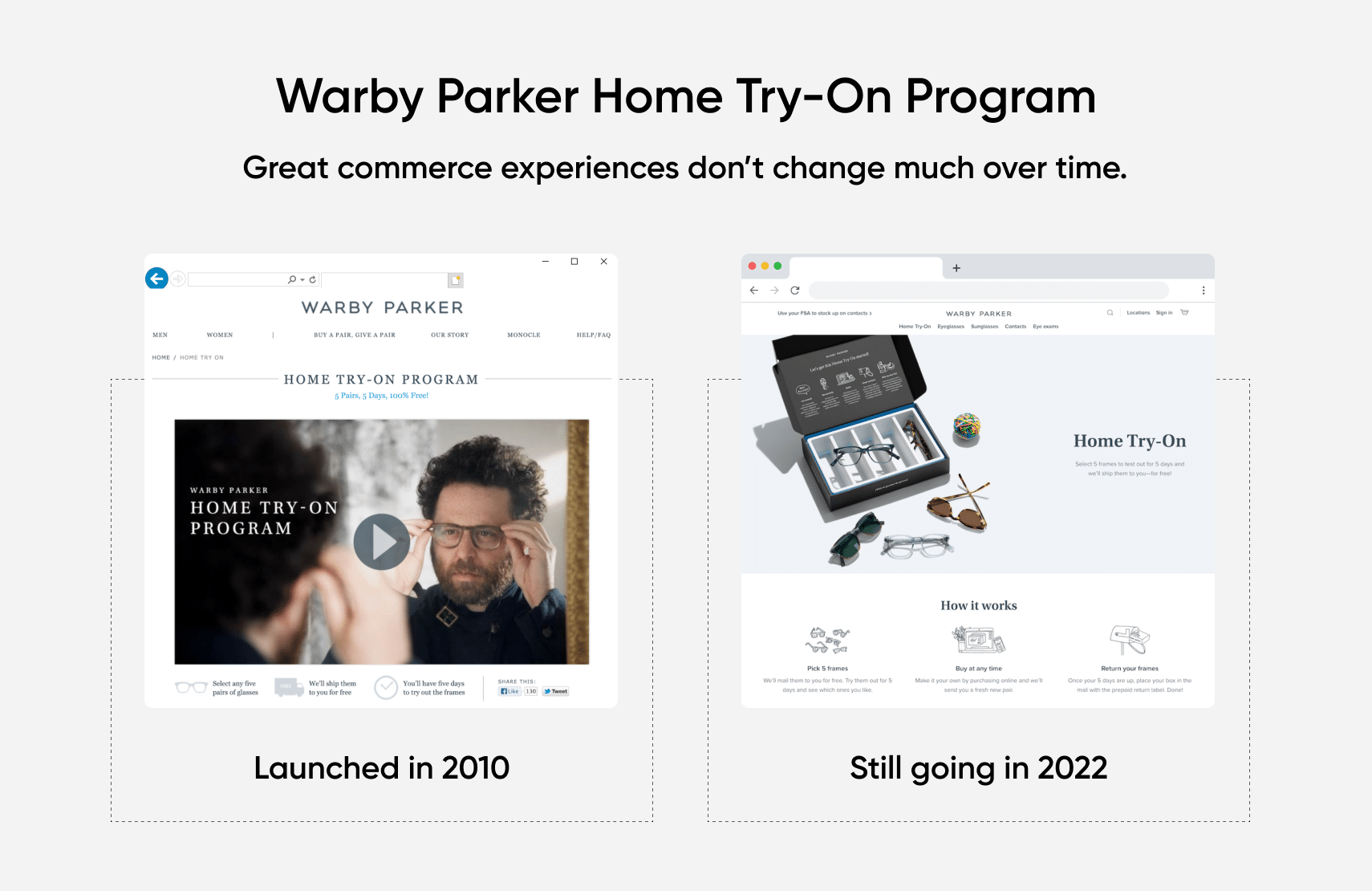

For example, back in 2010, less than 2.5% of glasses were sold online in the U.S. This meant that Warby Parker needed to overcome the reluctance consumers had for buying a very personal item like prescription glasses from an e-commerce website or mobile app. Their innovative solution was to create a store-like e-commerce experience.

The 2010 launch of Warby Parker’s Home Try-On (HTO) program allowed customers to pick five pairs of frames on their website and try them at home for five days for free. Consumers could purchase at any time online by entering a prescription, and the company would send a new pair of customized glasses within five business days. Customers then returned the HTO frames using a prepaid return label.

This simple, risk-free, and innovative approach to selling glasses was highly successful at motivating people to buy glasses online for the very first time.

After HTO was launched, Warby Parker reached its first-year sales targets in three weeks, sold out of its top 15 styles in four weeks, and went on to build a waitlist of thousands of customers (p.110). Combined with beautifully designed, high quality eyewear and drastically lower price points compared with competitors, Warby Parker secured a first-mover advantage and carved out a niche in the eyewear market that didn’t exist before.

Since launching HTO, the seamless buying experience has only improved and attracted more customers.

Today, people can shop from home by browsing the company’s website and mobile app, take an online quiz to find frames to fill their Home Try-On box, or visit a retail store for a more hands-on experience. They can also try on glasses virtually using their iPhones, and connect directly with customer service staff and Warby Parker’s social media team through phone, chat, or email. As of September 30, 2021, Warby Parker had 2.15 million active customers.

Tactic #2: Developing innovative products and services

Warby Parker’s team of strategists and technologists have developed several proprietary tools and launched many other innovative products and services over the years. Some of these include a customized point-of-sale system called Point of Everything (2013), an e-commerce app (2016), an in-house optical lab (2017), a telehealth app (2017), and blue-light-filtering lenses (2018). A few more recent innovations include:

- Virtual Try-On (2019): Using Apple’s ARKit and TrueDepth camera technology, along with their own proprietary frame placement and fit system, the company built an easy-to-use tool that uses augmented-reality capabilities and a selfie camera to display a digital pair of glasses on your face as you shop in the Warby Parker app.

- The Digital PD Tool (2020): Pupillary distance (or PD) is the distance between your pupils, which is essential for centering a prescription correctly in your frames. The company’s app features a Digital PD Tool that lets customers measure their PD when ordering new frames.

- Virtual Vision Test (2021): A recent update to the company’s telehealth prescription renewal app, Virtual Vision Test is a 10-minute eye test that can be conducted at home, costs just $15, and is available in 29 states. The company developed a proprietary distance estimation algorithm that works alongside Apple’s Vision Framework to measure how far a user is from their iPhone in real-time, guaranteeing the accuracy of their test results. The app also updates prescriptions for contact lenses.

Over the years, Warby Parker has consistently been recognized as one of the most innovative companies for retail, social good, and design. In fact, Fast Company named Warby Parker as the most innovative company in the world in 2015, beating out tech heavyweights like Apple, Alibaba, Google, and Instagram. According to the publication, the company was recognized for “building the first great made-on-the-internet brand.”

Tactic #3: Reinventing the brick-and-mortar experience

As mentioned, less than 2.5% of glasses were sold online in the U.S. back in 2010. Even though e-commerce penetration in the eyewear industry has steadily grown over the years and recently accelerated due to the impact of the COVID-19 pandemic, it still only accounted for 8% of sales in 2020 (p.5).

Because of the slow adoption of e-commerce in the eyewear industry, Warby Parker knew early on that having physical retail locations would be critical to scaling operations. What they didn’t know was that its retail locations would become wildly popular and generate some of the highest sales per square foot in all of retail.

Their stores target four-wall margins of 35% and average sales per square foot of $2,900 (p.125) which places them amongst top retailers such as Apple ($5,546 per sq. ft.), Murphy USA ($3,721 per sq. ft.), Tiffany & Co. ($2,951 per sq.ft), and Lululemon ($1,560 per sq. ft.). On average, Warby Parker’s retail stores achieve profitability shortly after they open and seek payback of invested capital in under 20 months.

More importantly, store openings don’t cannibalize e-commerce sales. On average, the company observes that total market sales increase over 250% in the first year after opening the first retail store in that market. During the first year of opening, e-commerce sales growth slows as the market rebalances between online and store sales. After this initial period, the company sees e-commerce growth rates normalize to the same level as their purely e-commerce markets that have no store presence (p.124).

Warby Parker opened its first retail location in 2013 and originally planned to open just 5 retail locations in total. Because of the strong economics of these stores, the company now owns 145 brick-and-mortar stores, including 142 locations in the U.S. and three locations in Canada with plans to open more. Its retail footprint covers 35 states/provinces and 99 cities, and its stores are in 45 of the 50 most populous markets in the U.S.

In 2020, Warby Parker generated 60% of net revenue from e-commerce and the remaining 40% of net revenue from its retail stores. Prior to the COVID-19 pandemic, the channel mix in 2019 from retail stores and e-commerce was 65% and 35%, respectively.

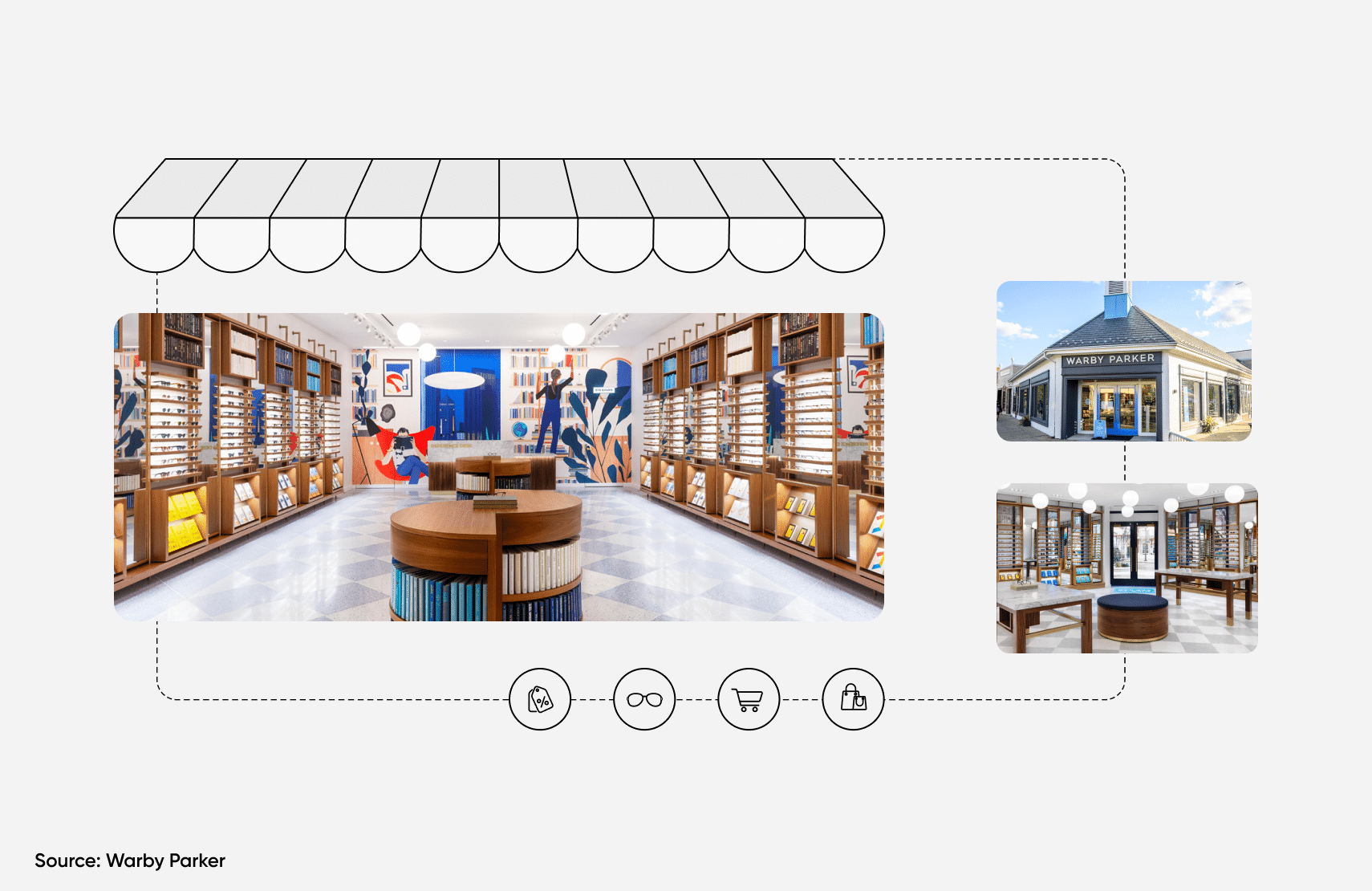

Source: Warby Parker’s Galleria Edina store located in Edina, MN.

Tactic #4: Leveraging headless commerce and personalization

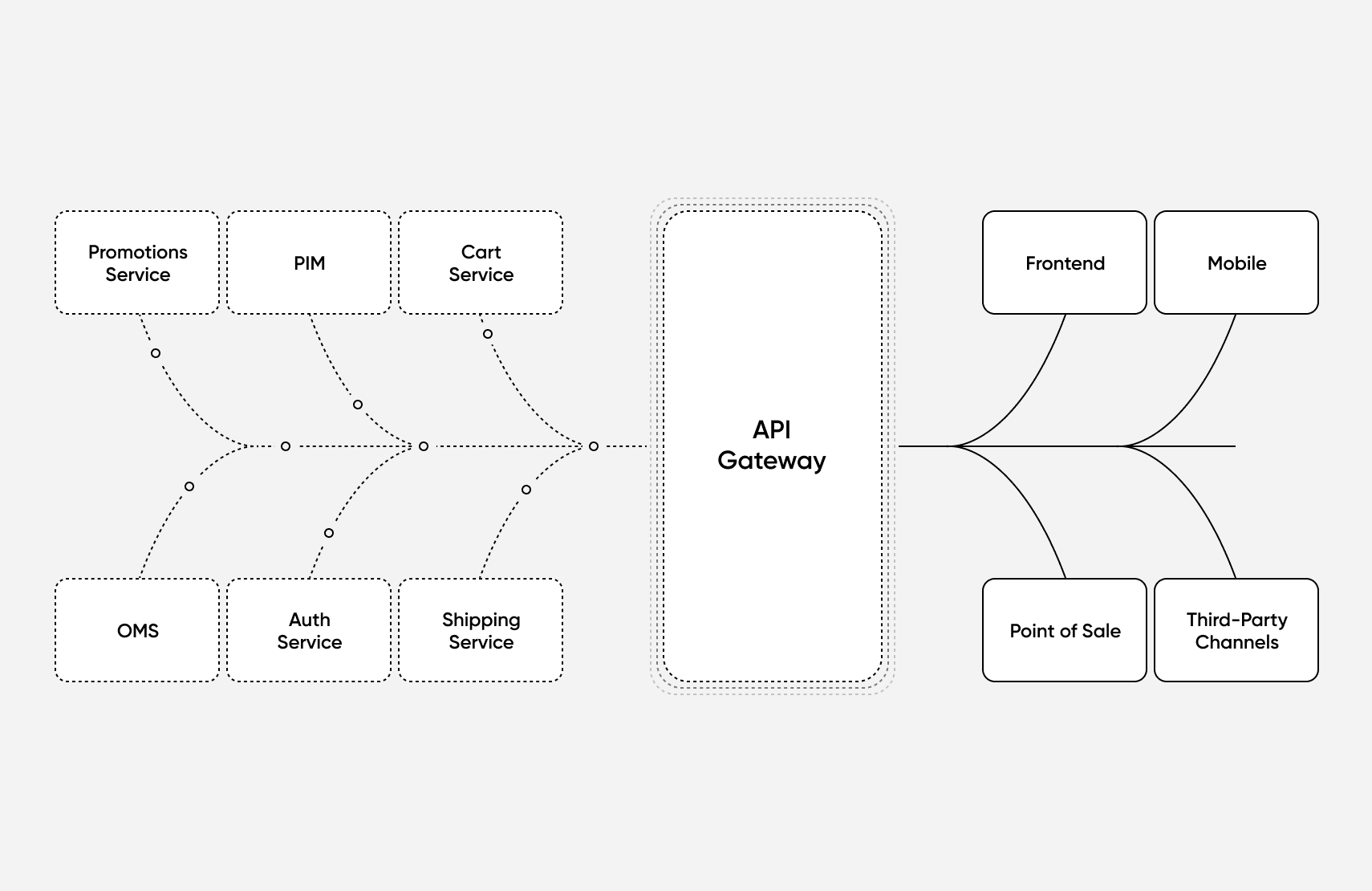

Warby Parker may have started as a digitally native brand, but it is now channel-agnostic to where a purchase transaction takes place. Because a customer journey can start in-store and end with a purchase online and vice versa, the company built an integrated omnichannel presence to meet the customer wherever and whenever they want to shop. Essentially, this is headless commerce realized.

Headless commerce

Headless commerce refers to e-commerce architecture where the frontend or presentation layer (such as a website, mobile app, in-store device, or other “head”) is decoupled from the backend commerce functionality (such as cart, checkout, content management system, or other system). Communication between the frontend “head” and the backend “body” is done via application programming interfaces (or APIs).

For online retailers, separating the two sides can offer many benefits. For example, because they work independently of each other, going “headless” makes it easier to develop and deploy new customer experiences without affecting the entire technology stack. This kind of flexibility doesn’t exist with dated monolithic e-commerce solutions where all the components are built in a single unit.

Another key benefit is the ability to connect multiple heads to the same backend, which helps to create a faster, more agile, adaptable, and scalable shopping experience for customers. This is what Warby Parker does and it’s a key reason for their success.

Going “headless” also enables Warby Parker to use different best-of-breed backend commerce solutions to build a modular commerce platform. With this architecture, each module (pricing, promos, cart, point-of-sale, etc.) is a service that operates separately from all other services, giving businesses the flexibility to fully customize their platforms with the best available tools. These can include third-party services and integrations or internally-developed applications.

In Warby Parker’s case, its internally-developed point-of-sale system is a great example of headless and modular commerce in action.

Back in 2013, the company couldn’t find point-of-sale software that met their threshold for the experience that they wanted to offer consumers. So they engineered their own system, Point of Everything (POE): a cloud-focused and software-defined system that contains nine applications covering every part of the customer journey.

How Point of Everything works

In a Warby Parker store, there are no checkout lines since salespeople carry iPad Minis that are used as checkout points. However, the iPads are also used to quickly access crucial data, including a customer’s history, their favorite frames they found on the website, past correspondence, shipping information, payment information, prescription information, and more.

This data is pulled from their headless, omnichannel commerce platform and salespeople use it to direct the customer to the frames the customer “favorited” online. They are also able to recommend other product offerings based on past purchases.

On the other hand, if a new customer walks into a store for the first time and likes a pair of frames, a picture can be taken on the iPad and the system will send it to the shopper in a custom email so they can buy that pair online later. According to Co-CEO Dave Gilboa, more than 70% of the people who get that email open it, and more than 30% end up purchasing the glasses.

By leveraging data across the entire end-to-end customer journey and using an internally-developed headless commerce platform, Warby Parker can offer customers a seamless, highly personalized, and brand-enhancing customer experience whether shopping in-person or online.

[toc-embed headline=”The Future of Warby Parker Retail”]

The Future of Warby Parker Retail

900+ store count

Warby Parker’s omnichannel data is also used to inform strategic decisions, including the company’s retail store rollout strategy. Because its e-commerce business has been shipping glasses around the country for years, Warby Parker knows exactly where its customers are located. Furthermore, the company also created a data science team that built a model that analyzes 129 different variables to determine the best locations to target for future stores.

Their U.S. retail footprint has a long runway for expansion. Based on analysis the company conducted with a third-party research firm, their retail footprint has room to expand in the U.S. to 900+ retail stores, which is still a fraction of the over 41,000 optical retail stores in the U.S. as of 2020 (p.118).

There’s also the potential for expansion into new international markets. Only 2% of Warby Parker’s business is currently located outside the U.S. and expanding internationally would add over $100 billion to Warby Parker’s total addressable market (TAM) (p.119)

New optical lab and potential software licensing

In addition to store locations, the data team also leverages machine learning to look for new lab locations based on optimal size, shipping costs, labor costs, and other variables. Company-owned optical labs help control more of the manufacturing process since it typically partners with third-party labs. Key benefits include controlling production and distribution, which leads to better quality inspections and fewer shipping delays.

The company recently opened a second optical lab in Las Vegas, Nevada, which will increase the company’s “bandwidth, production, and shipping, enabling the brand to continue to scale its in-house manufacturing process.” The lab will also fulfill online and in-store orders of its frames for customers west of Texas.

But beyond their retail operations, the company is also looking into expanding into software sales. For example, Warby Parker could productize the data strategy software they use and sell it to other businesses, which would likely generate higher margins than their current retail operations. It is also considering licensing its vision tests and its Point-of-Everything system to other retailers as well.

According to Co-CEO Neil Blumenthal, “It’s a very real possibility that vision tests could be our first category expansion. And POE could one day be sold to other customers. We have an unfair advantage in those areas.”

Digital content editorial team @ fabric