The Last E-Commerce Duel Between Amazon and Google

This article was originally published on LinkedIn.

Success does not come easy in the fast-moving, highly-competitive world of e-commerce. Having spent over 20 years growing retail and logistics inside the world’s leading online businesses, including Google and Amazon, I’ve experienced dozens of failed projects as these companies tried to establish strongholds in this next frontier of trade.

But Google is a fascinating case. It is by far the most dominant search and advertising business in history, and it recently became one of only three US-based companies to reach a $2 trillion market capitalization. However, Google’s core business has been steadily losing market share to Amazon, and its failed attempts to capitalize on e-commerce opportunities are among the greatest mistakes I’ve witnessed.

For two decades, Google’s leadership recognized how critical e-commerce was to their advertising business, had the resources to create a superior shopping experience for their users, and had numerous chances to execute their plans. But they squandered their opportunities while Amazon zoomed ahead with game-changing offerings like Amazon Prime and ‘1-Click’ ordering.

Over the years, the opportunity costs of these e-commerce failures have been substantial. For example, if Google had managed to capture just 1% of Amazon’s sales in the last decade, it would have generated $15.9 billion in incremental revenue. Furthermore, the company’s mastery of network effects would have likely generated even more.

Now they’re at it again.

After two decades of flops and disappointments, the company is undergoing another e-commerce makeover. This time, they recruited new leadership, unveiled many updates and features, made it free for retailers to list products, revealed a partnership with Shopify, and just launched a new app with BigCommerce.

At first glance, it appears Google is making a valiant effort to reclaim lost opportunities in e-commerce. But is the company’s focus too scattered, and are its efforts too late to deliver a blow that’s capable of stopping Amazon as it infringes on its core business?

[toc-embed headline=”Google’s Core Business Faces Mounting Competition”]

Google’s Core Business Faces Mounting Competition

Back in 2014, Google executive Eric Schmidt surprised everyone when he named Amazon as Google’s biggest competitor in search:

“Many people think our main competition is Bing or Yahoo. But, really, our biggest search competitor is Amazon. People don’t think of Amazon as search, but if you are looking for something to buy, you are more often than not looking for it on Amazon. They are obviously more focused on the commerce side of the equation, but, at their roots, they are answering users’ questions and searches, just as we are.”

Years later, its e-commerce missteps have increased competition for its core search and advertising business. For example, Amazon passed Google for product searches back in 2018, which caused Google’s share of the product search market to decline from 54% to 46%.

Today, about 74% of US consumers begin their product searches on Amazon. This has caused Google to rapidly lose market share in digital advertising, their primary source of income. In 2020, Google generated $147 billion in ad revenue, but the company’s total share of the US digital advertising market declined sharply from 31.6% to 28.9%, while Amazon’s share soared from 7.8% to 10.3%.

Even smaller players like Walmart and Target are taking a bite out of Google’s product advertising business. Walmart recently reported a 95% increase in US advertising sales while its active advertisers rose more than 175%. Target doesn’t disclose its results but said that its digital advertising network has consistently outpaced its revenue goals since 2019 and remains a growing and profitable segment of the retailer’s business.

Slowly but surely, retailers are figuring out how to beat Google at its own game and have been ramping up their digital ad platforms to eat away at the search giant’s dominance.

According to a report by the Wall Street Journal, this has “raised alarms inside Google, prompting CEO Sundar Pichai to assure Alphabet’s board that rejuvenating its flagging e-commerce efforts is a priority. And now he must fix a mess of Google’s own making. The company has rebooted its digital shopping strategy at least four times over two decades and has had five leaders head e-commerce operations in 10 years.”

So, if e-commerce is a natural fit for Google’s mighty search capabilities, how is the company losing to Amazon and others?

[toc-embed headline=”Commercial Intent Keywords: How Amazon Wins”]

Commercial Intent Keywords: How Amazon Wins

Commercial intent (n.): the process of evaluating the likelihood that someone searching for a keyword becomes a lead or customer

Amazon’s domination in commercial intent keywords is critical to understanding why Google is failing in e-commerce. Because the economics of product searches have shifted in Amazon’s favor, this has created a mass exodus of advertisers away from Google’s once-invincible search platform.

The Google ad machine

To better explain, commercial intent keywords are how Google makes its money. The higher the commercial intent, the more valuable the search engine results page (SERP) becomes, and the higher the auction bids for those keywords.

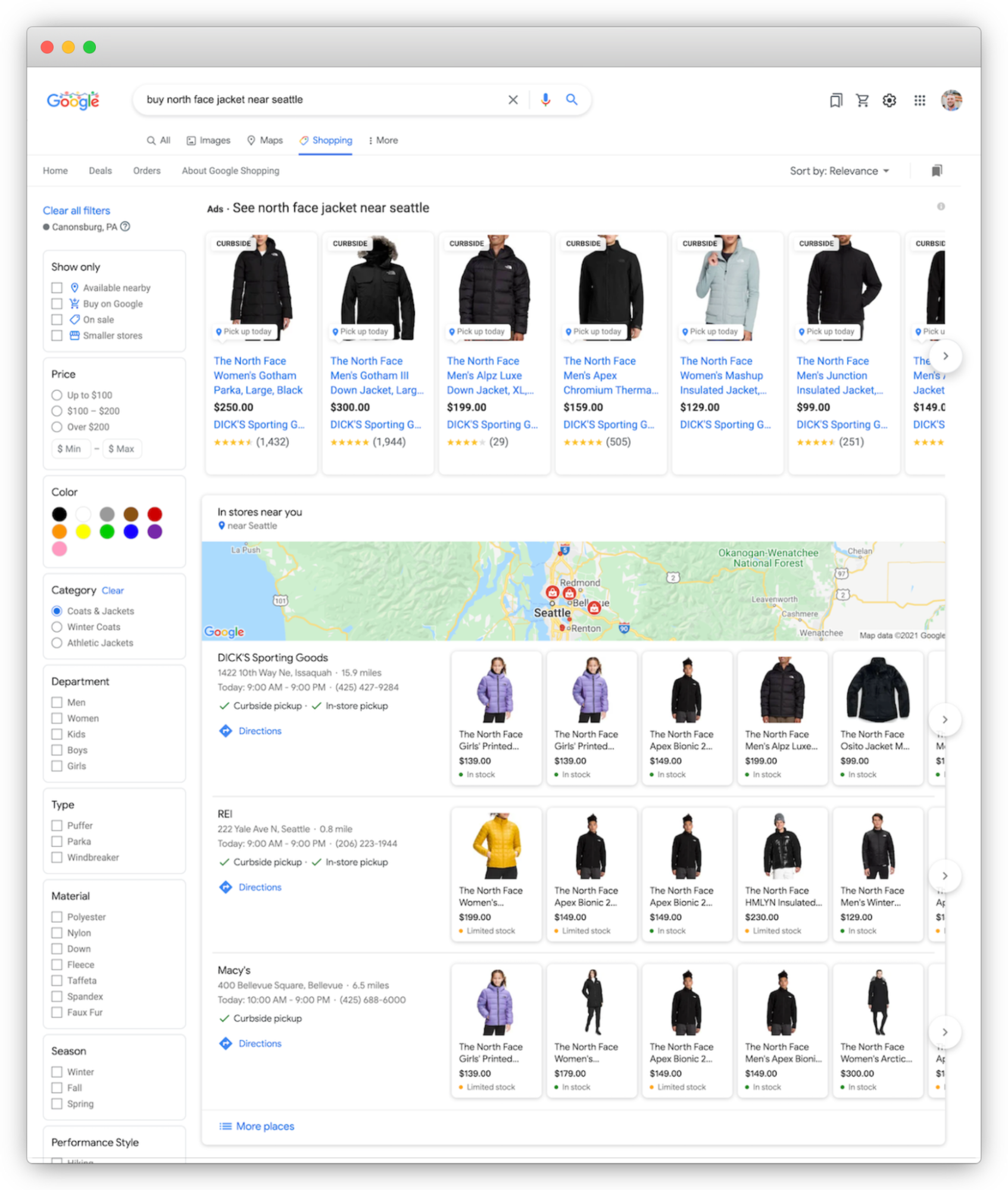

For example, a long-tail keyword like “buy North Face jacket near Seattle” is a search phrase with very high commercial intent and produces a high conversion rate for an advertisement placed on Google’s SERP.

Because Google always gave users the most relevant search results and ads, they had a stranglehold on this lucrative advertising market for years. But, over time, Google’s business became more focused on short-term revenues, which steadily translated into more ads dominating search results than ever before.

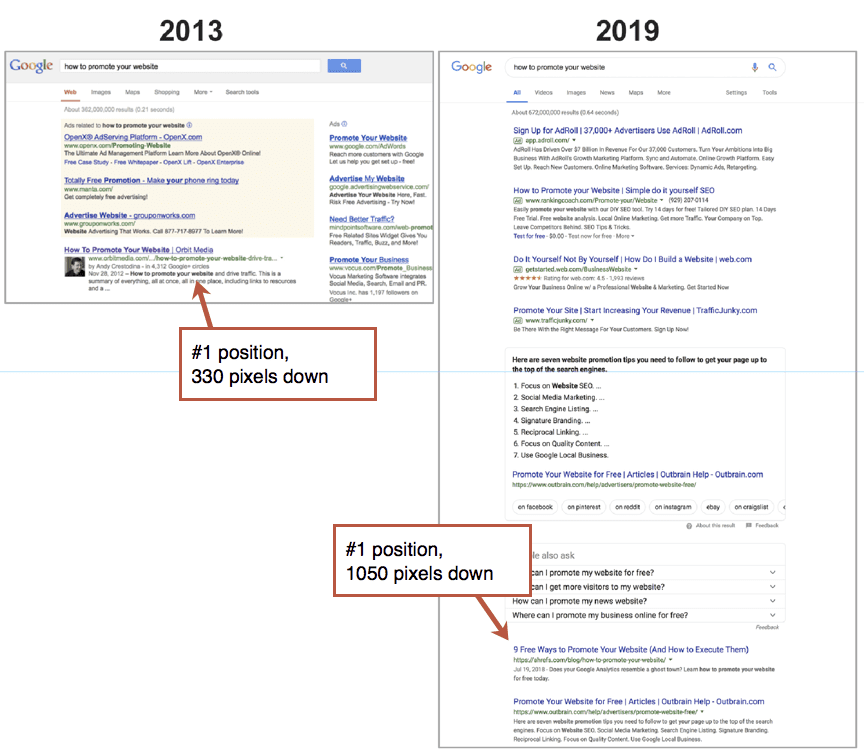

To illustrate, Orbit Media Studios created a sample comparison between Google SERPs in 2013 and 2019:

As you can see, in just six years, the user experience became riddled with ads, and organic search results were pushed well below the fold. Nevertheless, Google continued to thrive because it was still the top game in town. Companies couldn’t afford to not advertise on Google because, for every $1 spent on Google Ads, they would receive about $8 in profit. The returns on advertising spend (ROAS) were phenomenal.

Amazon’s battle for commercial intent

A commercial intent keyword like “buy North Face jacket near Seattle” is redundant on Amazon. The word “buy” isn’t necessary, and the location doesn’t matter because Amazon Prime will deliver the product anywhere in the country with 1-day or same-day shipping.

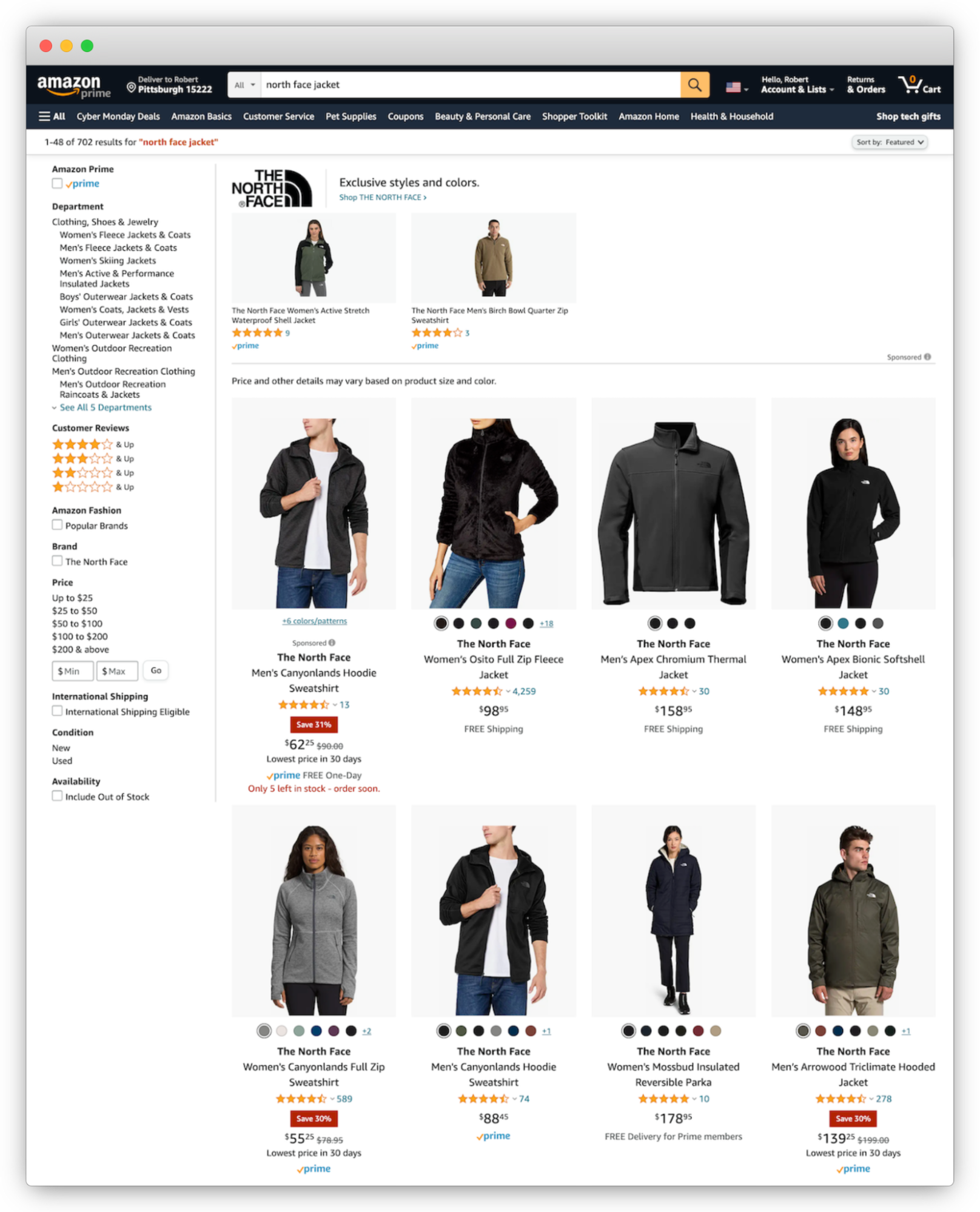

In addition, Amazon’s SERP showcases popular and best-selling products with positive customer reviews, offers competitive pricing, provides the widest selection of SKUs (over 1 billion), makes transactions as simple as possible (1-click ordering), answers customer questions with standardized product detail pages (PDPs), and automatically includes a best-in-class returns policy.

In contrast, Google Shopping only optimizes for price and location. Furthermore, although Google went to great lengths to mimic the look and feel of Amazon’s SERPs, you can’t purchase items from preferred locations directly on the Google Shopping app. A user still needs to leave the site to complete a transaction, which is why it remains a bad shopping experience compared with Amazon, Walmart, and Target. This is a great example of Google not building a good product into a viable business model.

To compare, here is a search result for a buying query on Amazon:

And here is a search result for a buying query on Google:

The economics have changed

For the reasons mentioned above, Amazon SERPs produce far more relevant results for product searches due to customer intent. It’s also why the ROAS for ads on Amazon have completely eclipsed Google.

A 2020 report from Feedvisor of more than 1,000 U.S. brands found that a majority of respondents (59%) said that Amazon’s platform generated their highest ROAS, followed by Google (22%) and paid social (17%). Furthermore, 40% of respondents reported that ads on Amazon generated ROAS of 7x to 10x their investment, while another 7% of respondents reported ROAS of over 10x their investment.

These outstanding results were not achieved overnight. Jeff Bezos was long worried about Amazon’s reliance on Google for traffic, which forced Amazon to aggressively pursue Google’s business and invest billions in improving the relevancy of its search results. Combined with its vast stores of consumer purchase history to help marketers target ads at specific audiences, Amazon was able to make many of Google’s lucrative search terms irrelevant over time.

Amazon should tread lightly

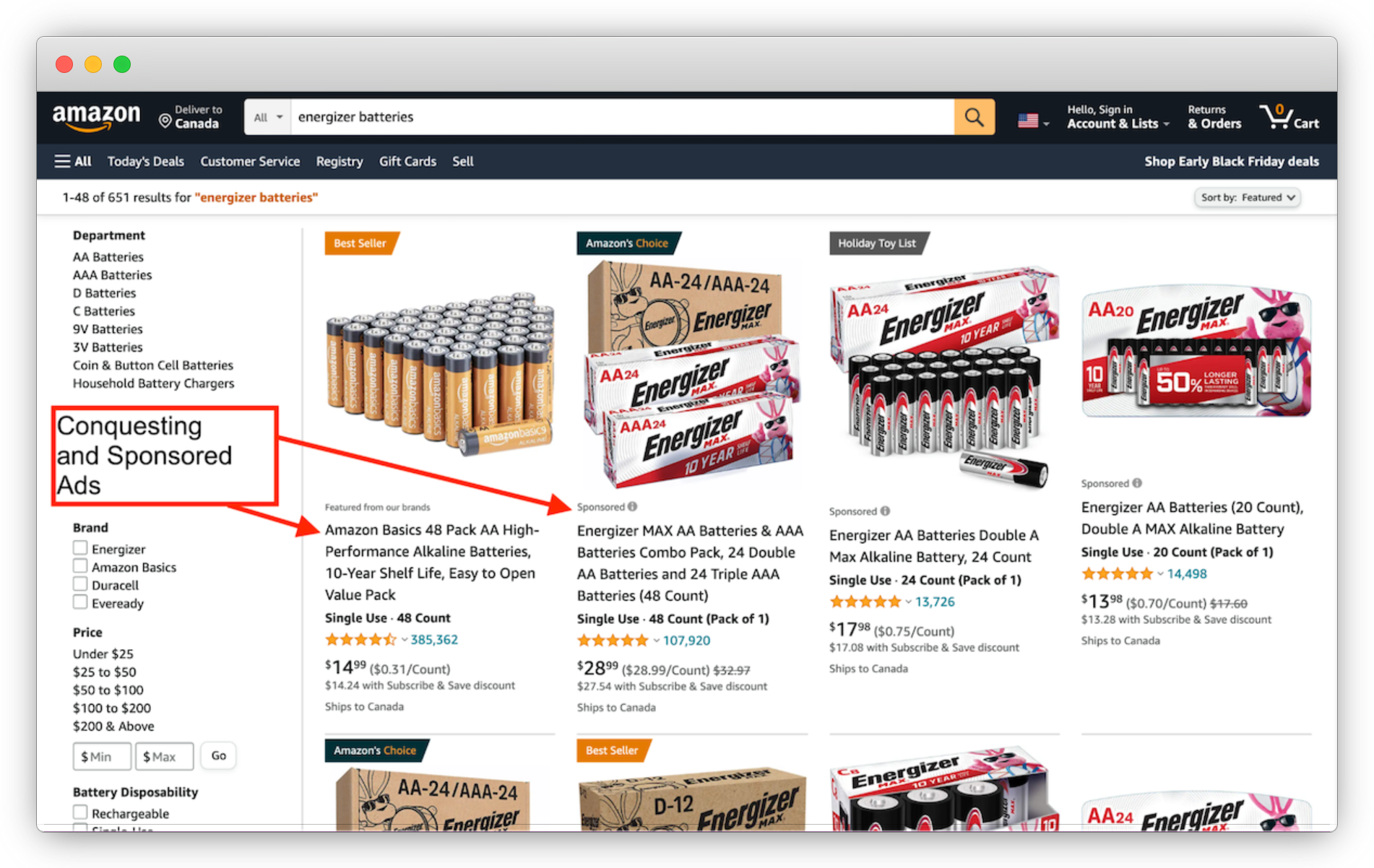

Having said that, Amazon needs to be careful if it wants to continue gaining market share in product search advertising. A damning report by Reuters found that Amazon’s A9/A10 Search Engine does not always produce the most relevant results because the company manipulates SERPs in favor of its own products, thereby hurting rival merchants’ sales on the platform.

Furthermore, with its SERPs now covered with ads and sacrificing relevancy in favor of blatant “conquesting” ad campaigns like this, the e-commerce giant is running dangerously close to alienating customers and making the same mistakes as Google.

My team was responsible for launching AmazonBasics back in 2009-10, and it comes as no surprise that Amazon is seeding house brands (Basics) next to branded products. This is what all retailers do, such as Costco with its Kirkland house brand and Home Depot with its Husky house brand. However, I’m not sure if conquesting in branded SERPs is the right move here.

To be fair, Google was recently fined €2.42 billion by the European Commission for manipulating Google Shopping results as well. Nevertheless, Amazon’s domination in commercial intent keywords has fundamentally altered the economics of the search advertising model. As a result, Google is not the best place for customers to find what they want anymore.

[toc-embed headline=”A Cautionary Tale for the E-Commerce World”]

A Cautionary Tale for the E-Commerce World

Google was gifted with an incredible opportunity to innovate and change the paradigm for commerce. But its inability to rise to the occasion is perhaps the biggest lesson to take away from this cautionary tale.

To elaborate, Google built an amazing search product that changed the world and launched the company to dizzying heights. Yet, the core ad business’ extraordinary success was also the anchor preventing the company from building anything meaningful outside of search.

From the early days of Froogle (2002-2007) to the more recent Google Express (~2014-2019), the company wasted numerous chances to build a viable logistics network, create an end-to-end customer purchase journey, and capitalize customers at the source. The search giant squandered two decades trying halfway measures to respond to the growing threat from Amazon while the e-commerce giant methodically chipped away at Google’s dominance.

The right way to execute

This is in stark contrast to companies that faced similar dilemmas but chose to risk cannibalizing their core businesses to capitalize on disruptive new opportunities instead. For example, Shopify seized the opportunity in the payments space to launch Shopify Payments in 2013. Now called Shop Pay, the one-click checkout engine has conveniently capitalized on a need for a payments aggregator, facilitating more than $24 billion in orders since its launch.

Another great example is Amazon Web Services (AWS), which allowed Amazon to capitalize on the burgeoning opportunity in cloud services. Since its launch, AWS has become a big part of Amazon’s business, generating $16.11 billion in the third quarter this year.

From a cultural standpoint, spotting, developing, and launching new businesses has never been a problem for Google. It’s been the unwillingness to cannibalize its own search and advertising business that has always held the company back. After twenty years of botched opportunities, the once-unstoppable search engine is now paying the price—especially with product search.

[toc-embed headline=”Will Google Ever Beat Amazon?”]

Will Google Ever Beat Amazon?

The battle for e-commerce dominance is far from over. “Day 2” is dawning at Amazon, and the e-commerce giant is at risk of repeating some of Google’s same mistakes as it duels with Target, Walmart, and new initiatives from Google.

However, for Google to have a shot of success in this arena, it needs to address deficiencies in its culture, embrace the notoriously difficult retail business model (including logistics), execute flawlessly on its future operations, and be willing to sacrifice some of its high margins and massive market segment share in search. In other words, Google has to stop being “Googly.”

Unfortunately, I believe the chances of this happening are slim to none. Unless the company finally addresses the underlying issues and gets serious about its e-commerce ambitions, I don’t see a path where Google can beat Amazon in any area of e-commerce.

Board of Directors @ fabric. Previously @ Google, Amazon, Staples, eBay, and Groupon.