The Trouble with Endless Aisles, Rogue Sellers, and Losing Control Over the Customer Experience

“Curating” an endless aisle in e-commerce doesn’t change the 80-20 rule for sales distribution.

Best Buy Canada expanded into the long tail with 4.9 million SKUs but bad actor sellers have damaged their brand image and the customer experience.

By expanding excessive product assortments, businesses are chasing an impossible dream of being all things to all people.

Retailers that have carefully cultivated their reputations should consider a highly-curated dropship program to build the “best aisle” for the customer.

This article was originally published on LinkedIn.

In the age-old tug-of-war between industry and academia, inconvenient truths often get swept aside in favor of popular theories that promise wealth and riches for those who are bold enough to seize the day. Left unchecked, these claims can cause irreparable damage, leaving financial losses, unsuccessful businesses, and battered reputations in their wake.

For example, building a third-party (3P) marketplace that allows third-party sellers to sell an “endless aisle” of products is commonly viewed as a profitable way for online retailers to “capture the long tail”. However, for many companies that buy into the hype, the promises of untapped profits rarely appear.

In fact, not only are the economics of the business model challenging, but the failure to recognize the dangers can seriously damage a company’s brand image. Furthermore, losing control of the customer experience can attract bad actor sellers and expose businesses to financial, legal, and operational risks.

[toc-embed headline=”Why “Curating” an Endless Aisle Doesn’t Work”]

Why “Curating” an Endless Aisle Doesn’t Work

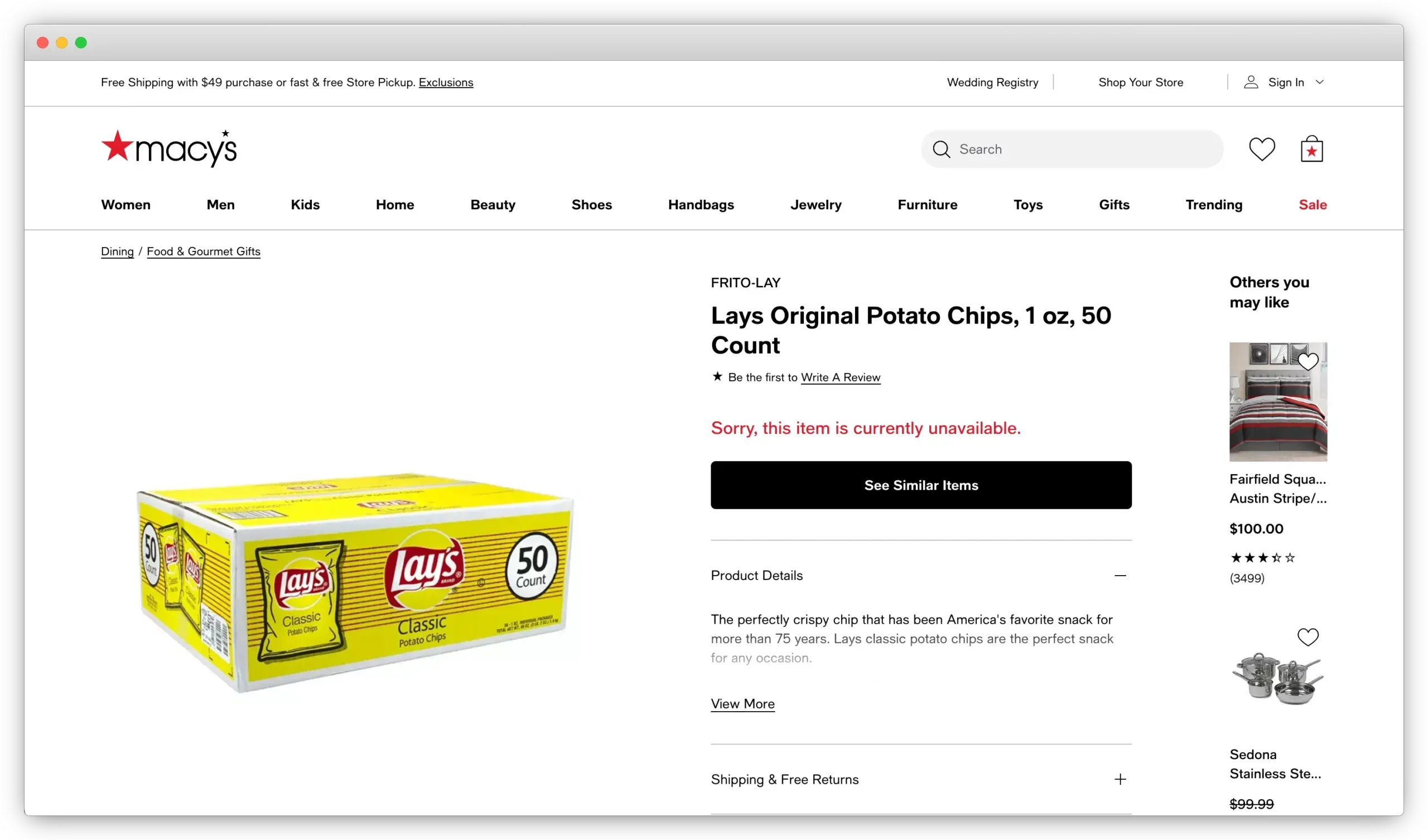

Macy’s allows third-party sellers to sell Lay’s potato chips through their 3P marketplace. This is an example of poor curation and the fallacy of the long tail impacting their brand.

Today, “endless aisles” and “long tails” are being grouped together with “curation” and “curation at scale” as if these trendy buzzwords don’t contradict. But what’s even more troubling are the calls for retailers to push through conservatism because “more sellers equals more GMV”.

To be clear, the hype surrounding curated endless aisles isn’t “onto something” if the 80-20 rule doesn’t change. It’s basically hype.

Blockbusters, hits, and bestsellers at the head of the distribution curve continue to gain in popularity and account for the overwhelming majority of revenue and profits across a wide range of industries.

To claim that higher GMV is proof that the long-tail economics of marketplaces are successful—without showing a shift towards a 60-40 or even a 70-30 sales distribution—is misleading at worst and confusing at best.

One also can’t help but question the wisdom of “infinite long tails” offering glimmers of hope to products that have outlived their natural lifecycles and have no business staying alive.

In a well-functioning free market economy, creative destruction would allow new innovations to efficiently replace existing ones that are rendered obsolete.

Yet infinite long tails can potentially give rise to infinite “zombie products” and “zombie brands” that consume valuable resources and misallocate capital. Extrapolated out, the impact of “endless aisles” of products that never sell would likely result in a net negative for society.

[toc-embed headline=”A Case Study on Best Buy Canada”]

A Case Study on Best Buy Canada

In my time at Best Buy Canada, I was in charge of seller success for their 3P marketplace and witnessed the addition of millions of SKUs to their product assortment. By most accounts, their “gated” marketplace functions as a marketplace should:

- The business development team vets its sellers

- Sellers are carefully selected to fit Best Buy Canada’s brand ethos

- Safeguards are put up to deter bad actors

- Customers get the same shopping experience as they do from their own sales channels

With first-mover advantage and limited competition in the Canadian market, the company was able to rapidly expand into the “endless aisle” with 4.9 million SKUs. Its marketplace now generates 1 in 4 sales by third-party sellers, and its GMV is expected to represent 20% of total Best Buy Canada sales by 2024.

Yet they’ve also faced tough challenges. Their marketplace has attracted bad actor sellers and their carefully-planned expansion into the long tail has eroded the customer experience and negatively impacted the brand.

In fact, Best Buy Canada’s own employees have previously warned customers not to shop for third-party marketplace products online.

[toc-embed headline=”The Dangers of “Endless Aisles” and the 3P Marketplace Model”]

The Dangers of “Endless Aisles” and the 3P Marketplace Model

Zombie SKUs

Building an “endless aisle” results in rapid SKU proliferation of millions of products deep into the long tail. However, these products often have zero engagement, don’t generate revenue, cost time and resources to maintain, and also negatively impact website speed, user experience, and cart abandonment rates.

While it’s true that retailers don’t invest money into holding or managing third-party inventory, listing “zombie products” on a website are not free:

“Despite marginal costs being lower in the distribution tail, they’re still present and include the macro costs of supplier on-boarding and data exchange as well as specific costs for item setup, cataloging, and digital asset creation.”

“Vetted” sellers can go rogue

3P marketplaces have teams that guard against unscrupulous third-party sellers with vetting and approval processes. Vendors are required to follow strict guidelines and retailers may also employ a compliance team to monitor customer experience metrics.

Yet industry-leading safeguards and best practices don’t prevent bad actors from circumventing the rules. Beyond deceptive pricing and fictitious savings claims (which risk breaking advertising laws), there’s always the risk of restricted products and price gouging by third-party sellers.

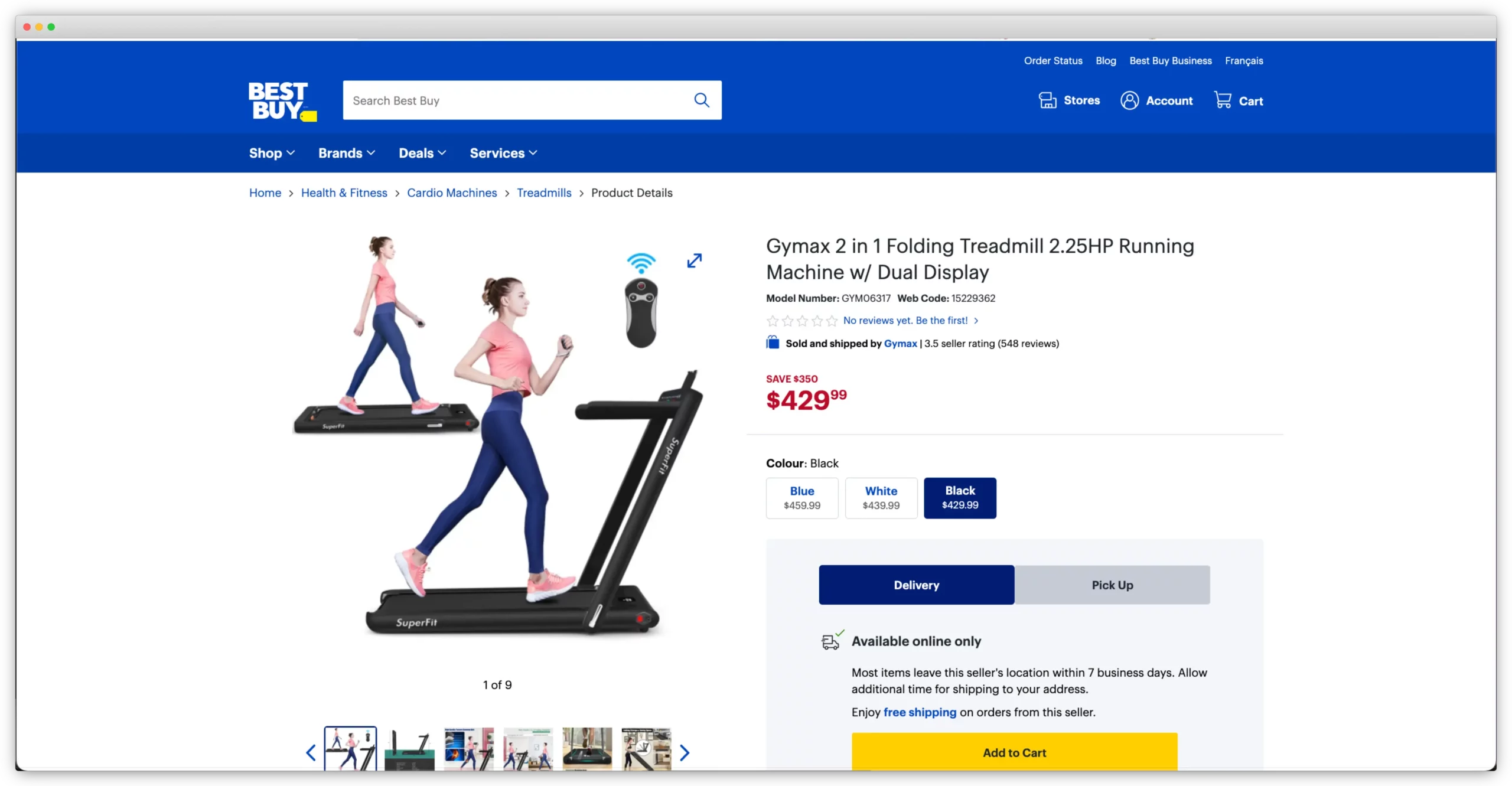

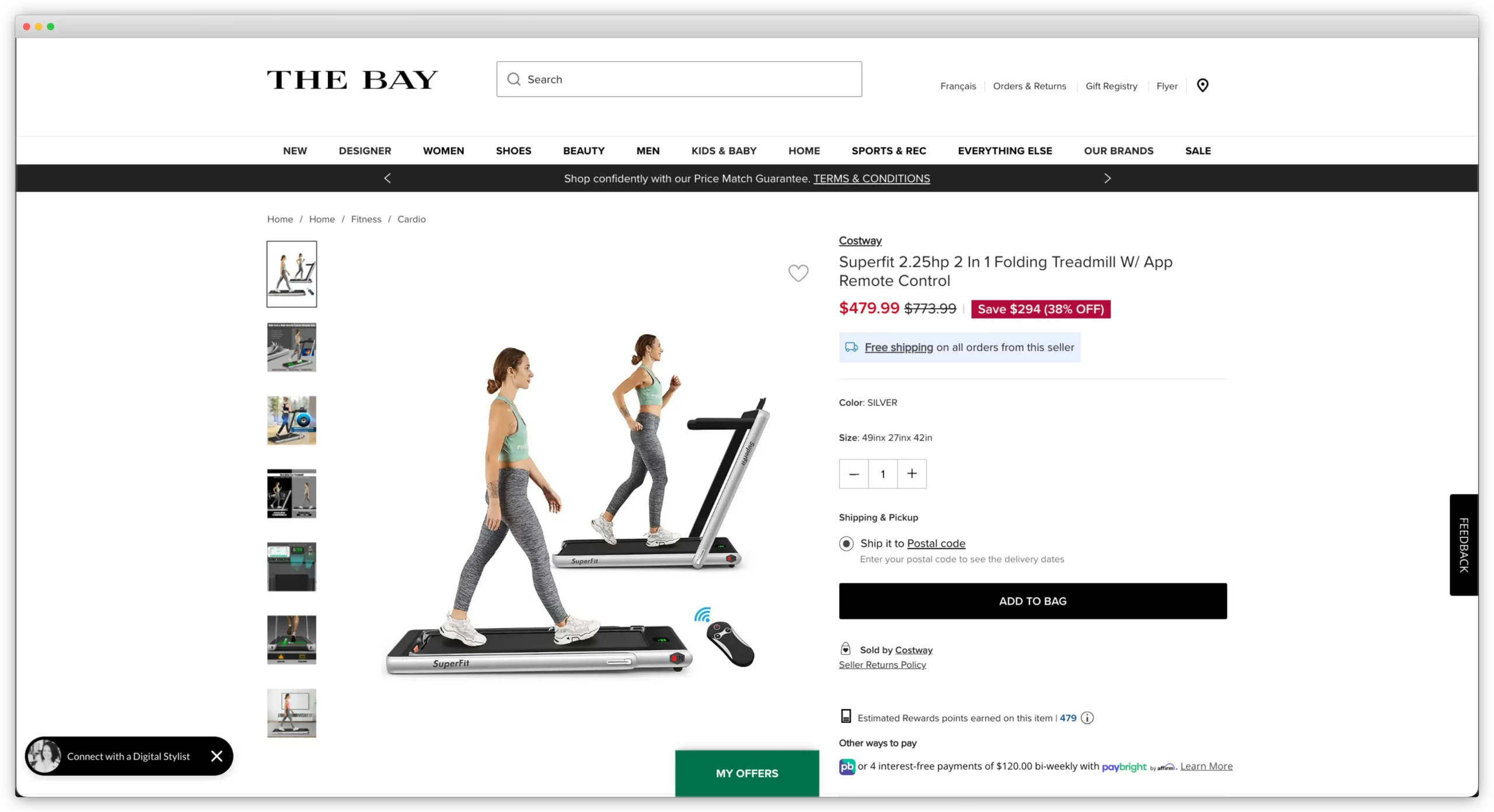

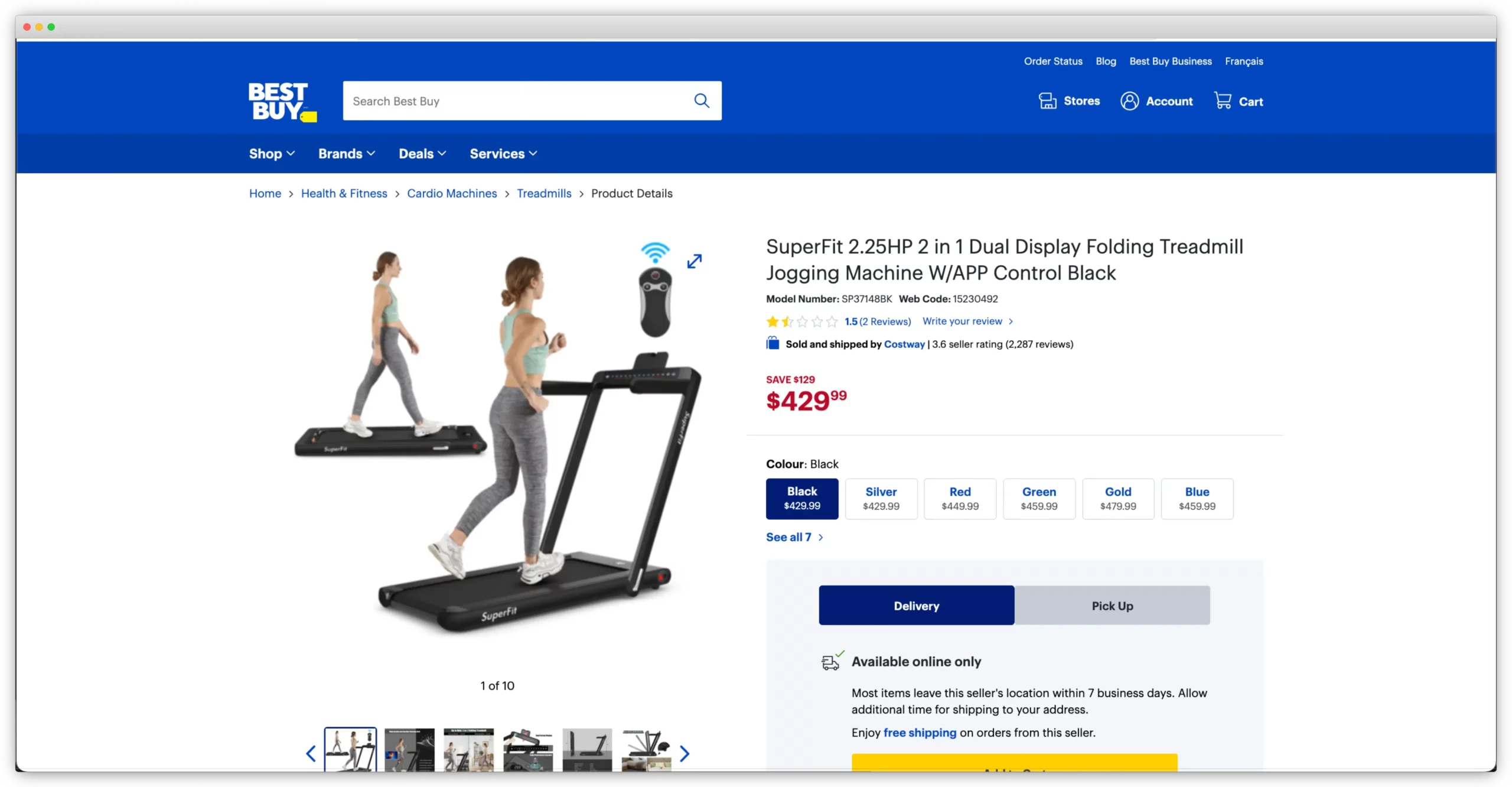

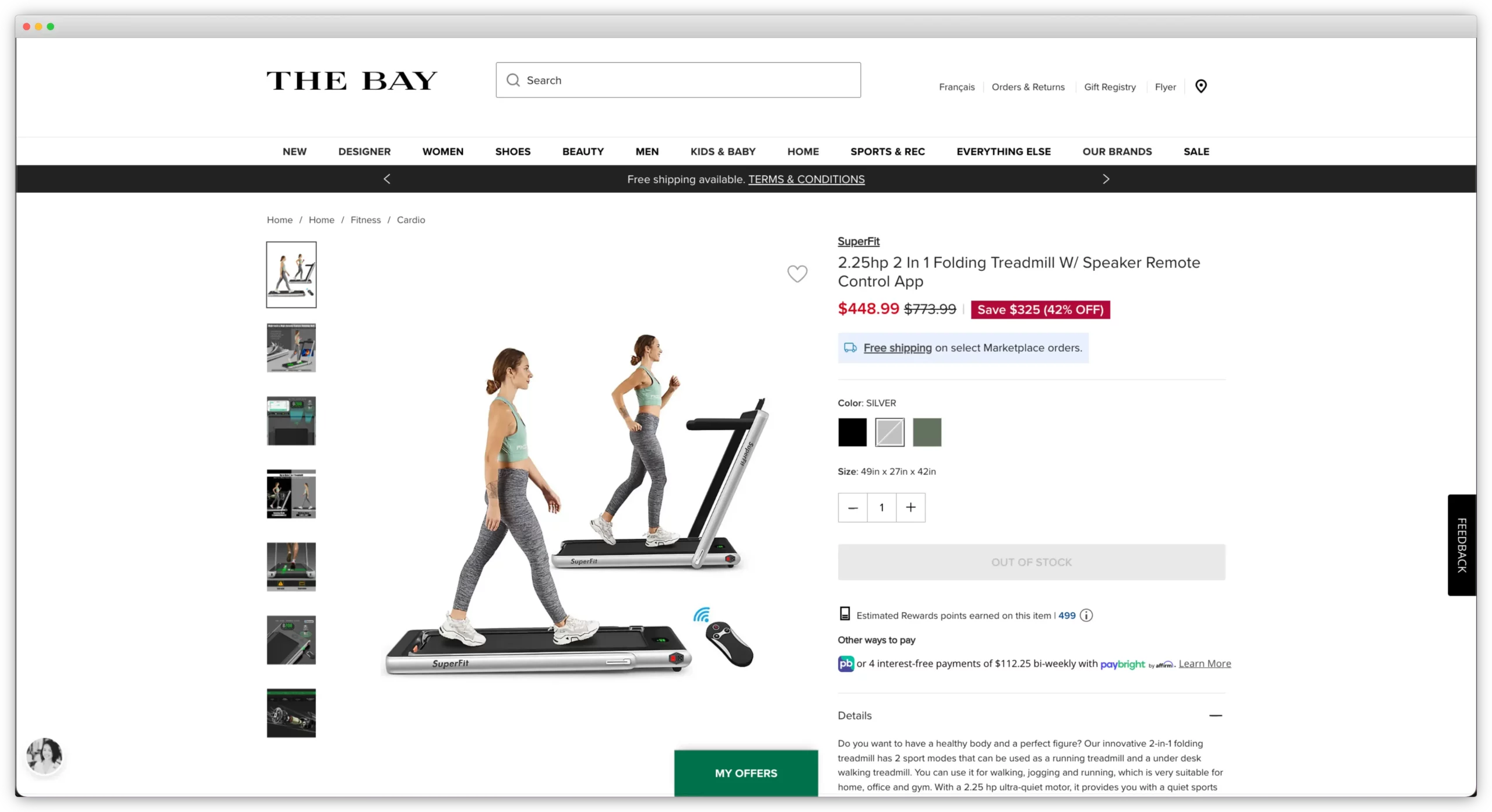

Below is an example of a third-party seller that has targeted Best Buy Canada and The Bay:

This third-party seller has duplicate listings of the same treadmill on different marketplaces but under different brand names. With Best Buy Canada, product detail pages (PDP) have different model numbers, universal product codes (UPCs), and savings claims.

With The Bay, the product detail pages (PDPs) for the same treadmill have different brand names and different prices.

Whack-a-mole policing

With an “endless aisle”, the sheer size of the long tail makes it extremely difficult to eliminate bad actors. Retailers require additional manpower to constantly police a website, but many issues slip through the cracks.

Amazon has some of the strongest protections in e-commerce, spending over $900 million and employing over 12,000 people in 2021 to combat counterfeit products, fraud, and other forms of abuse. Yet its vast resources and industry-leading policing do little to deter shady third-party sellers from infesting its marketplace. Efforts to permanently delist sellers don’t stop them from popping up again, or switching to other platforms.

Cannibalization of owned products

On Best Buy Canada’s marketplace, third-party sellers have the ability to place bids on other marketplace products but are not allowed to bid on Best Buy Canada’s owned SKUs.

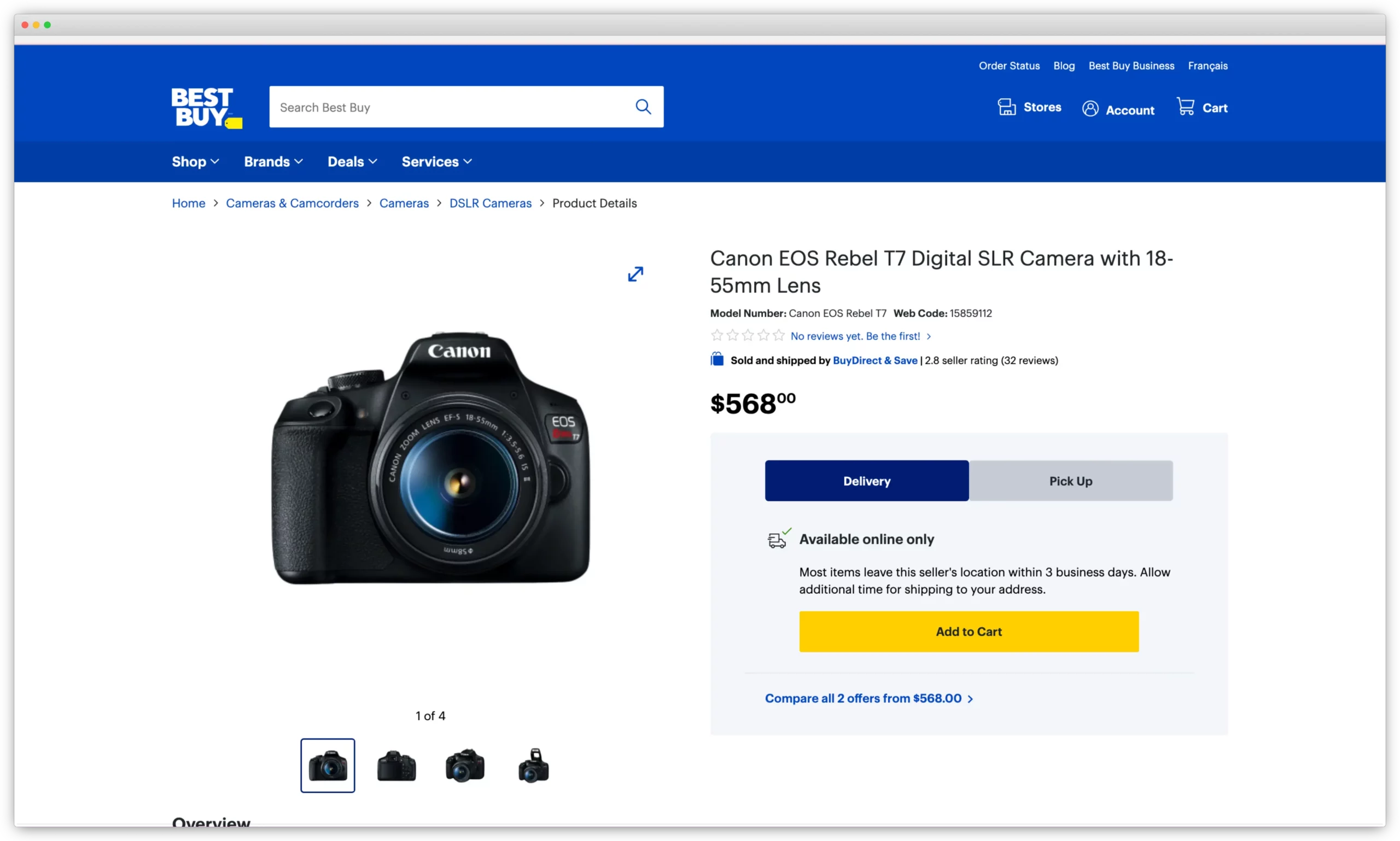

Yet despite its efforts, bad actors still evade safeguards and actively work to cannibalize Best Buy Canada’s owned inventory:

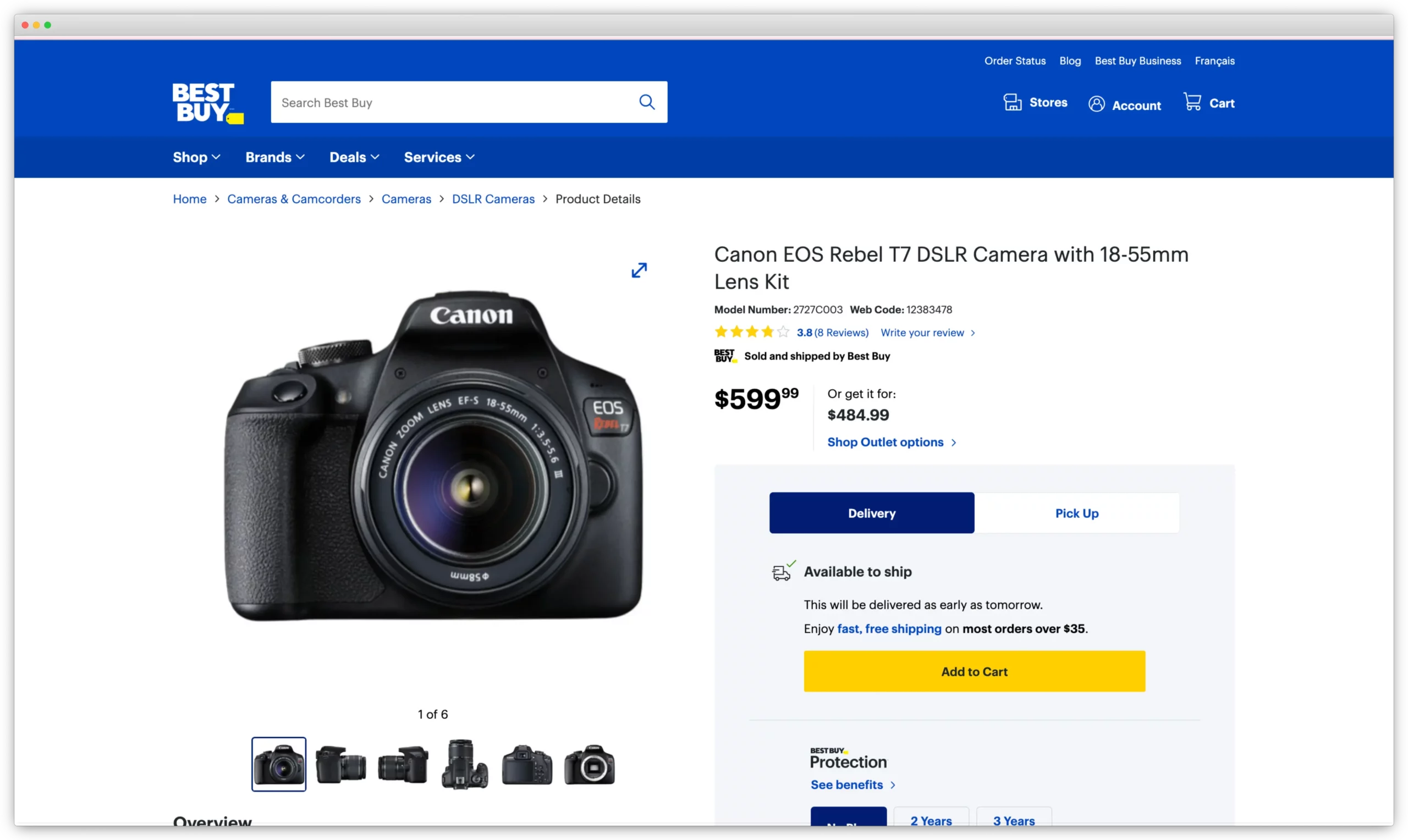

The first camera is a restricted product that is sold by Best Buy Canada. The second camera is an identical product sold by a third-party seller that has a different model number and web code.

Customer experience

In a 3P marketplace, third-party sellers are responsible for the transactional and customer experience. In some instances, it may be better to give up control to third-parties—especially if the retailer provides a subpar online shopping experience.

However, most companies are fiercely protective of their brands. When consumer protections differ for marketplace products, or when warranties, refunds, and returns are offloaded to third parties, shoppers can quickly lose trust in an organization and be left feeling disappointed, frustrated, and confused.

One such example is the 2021 refurbished electronics investigation into Best Buy Canada’s marketplace. After receiving numerous complaints of faulty devices, a news network purchased refurbished devices and found that many were damaged and unusable. Furthermore, refurbished products that failed after their 90-day warranties would not be eligible for returns. The investigation triggered “another round of scrutiny” into Best Buy Canada’s marketplace and its third-party sellers.

[toc-embed headline=”Retailers Can Only Do So Much”]

Retailers Can Only Do So Much

A reputation can take a lifetime to build and an instant to destroy.

But because bad actors change tactics by the minute, following best practices and implementing safeguards like vetting, policing, and compliance procedures are not enough for retailers to eliminate the marketplace model’s third-party risks, including:

- Financial/reputational risks: where a third party could damage your revenue or reputation.

- Legal and regulatory risks: where a third party could impact your compliance with legislation or regulation.

- Operational risks: where a third party could disrupt your operations.

So far, some legacy retailers with durable competitive advantages have been able to overcome challenges and keep their reputations intact. However, companies facing similar issues in the future might not be so lucky—especially if they have limited resources or if they operate in more competitive markets.

[toc-embed headline=”SKU Rationalization Across Retail”]

SKU Rationalization Across Retail

“It’s okay and, in fact, probably very beneficial to you to reduce your product line and to go all in on what you think are the most likely winners. And that is, in fact, what you see that the leading companies are doing across a number of different domains.”

- Anita Elberse, Professor of Business Administration at Harvard Business School

SKU proliferation into the long tail bears real costs and risks. Even “vetted” third-party sellers can go rogue and damage a company’s brand and reputation.

By expanding excessive product assortments, businesses are chasing an impossible dream of being all things to all people. It also adds suffocating layers of technology and accompanying processes, and introduces far greater business complexity and risk—with very little reward.

That’s why brands are now using SKU rationalization to mercilessly slash product lines after decades of excess.

Pandemic-fueled supply chain disruptions, shifting consumer demands, and rising inflation have been a huge wake-up call, forcing many companies to focus on the “head” of the distribution curve by prioritizing fewer bestsellers that have higher velocity:

- Hershey has increased shelf space by prioritizing their top velocity SKUs. They’ve rationalized select items to free up capacity and reduce complexity.

- Coca-Cola “ruthlessly” prioritized their core SKUs—cutting hundreds of zombie brands with “little to no scale” that made up just 2% of the company’s revenue.

- Mondelez cut its SKU count by 25% to reduce cost, complexity, and inventories. The SKUs represented just 2% of the company’s total sales.

- HanesBrands trimmed its SKUs by 30% in the past 2 years and believes it can go further to focus on its highest volume, fastest growing, and most profitable products.

- Urban Outfitters put SKU rationalizations in place to boost margins and get rid of higher cost, less reliable, and less profitable SKUs.

- Stanley Black & Decker cut nearly 50,000 SKUs, which is expected to generate $500 million in savings by YE 2023 and $1.5 billion in cost savings over three years.

- Amazon is slashing its private-label selection due to low sales. Executives discussed reducing its private-label assortment in the U.S. by well over half and only investing in bestsellers instead.

Clearly, SKU proliferation and the misallocation of capital into the long tail have done little to improve demand. Even if inventory risks were offloaded to third-party sellers, “endless aisles” would still create unnecessary additional costs.

[toc-embed headline=”Building the “Best Aisle” for Customers”]

Building the “Best Aisle” for Customers

For today’s modern retailers, the path is clear. Building a highly-differentiated product assortment that focuses on curating hits, bestsellers, and blockbusters will satisfy more customers in the head of the distribution curve and maximize sales and profits.

Now, can a 3P marketplace succeed by investing in curation instead of offering an “infinite aisle” of products?

Absolutely.

But many of the benefits of 3P marketplaces can be achieved by building a dropshipping program, which also allows retailers to sell products without keeping inventory in stock. The key differences are that retailers can minimize complexity and accompanying processes while also avoiding the risks posed by third-party sellers.

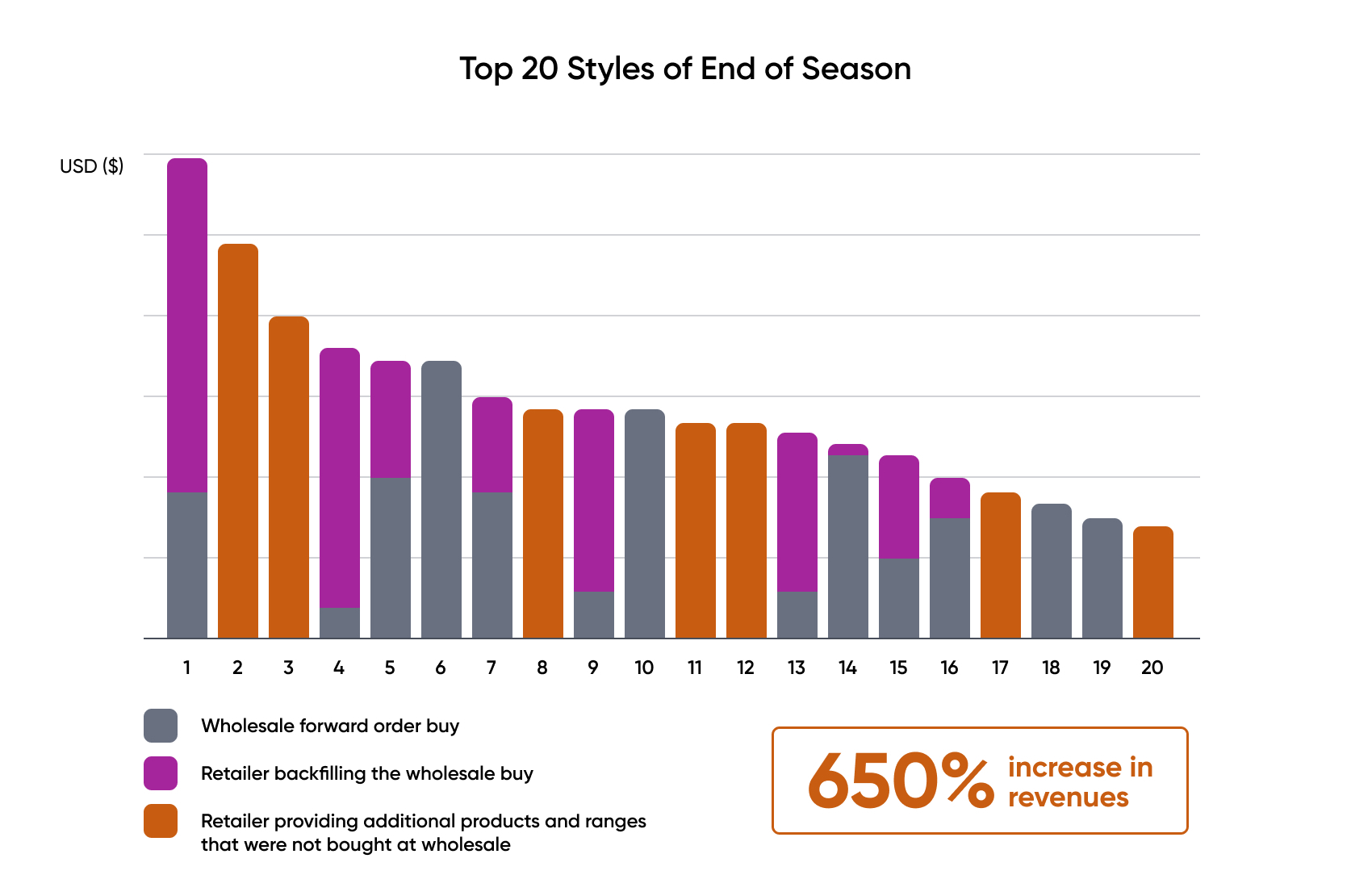

Instead of trying to build the “endless aisle”, this retailer turned its attention to building the “best aisle”, with laser focus on curating products with high sales velocity. Its dropshipping program not only boosted revenues by 650%, but it also accounted for 70% of all sales during the season.

More importantly, the company was able to strengthen its brand by retaining full control over the transactional and customer experience.

With dropshipping, the goal of creating a great marketplace can be achieved. If a company truly cares about its brand ethos and reputation, then expanding product assortment with a first-party dropshipping program is the better solution for building the “best aisle” for the retail customer.

Digital content editorial team @ fabric