fabric Launches Industry-First Commerce Platform With Native OMS, Supercharging Retailer Conversions And Outcomes

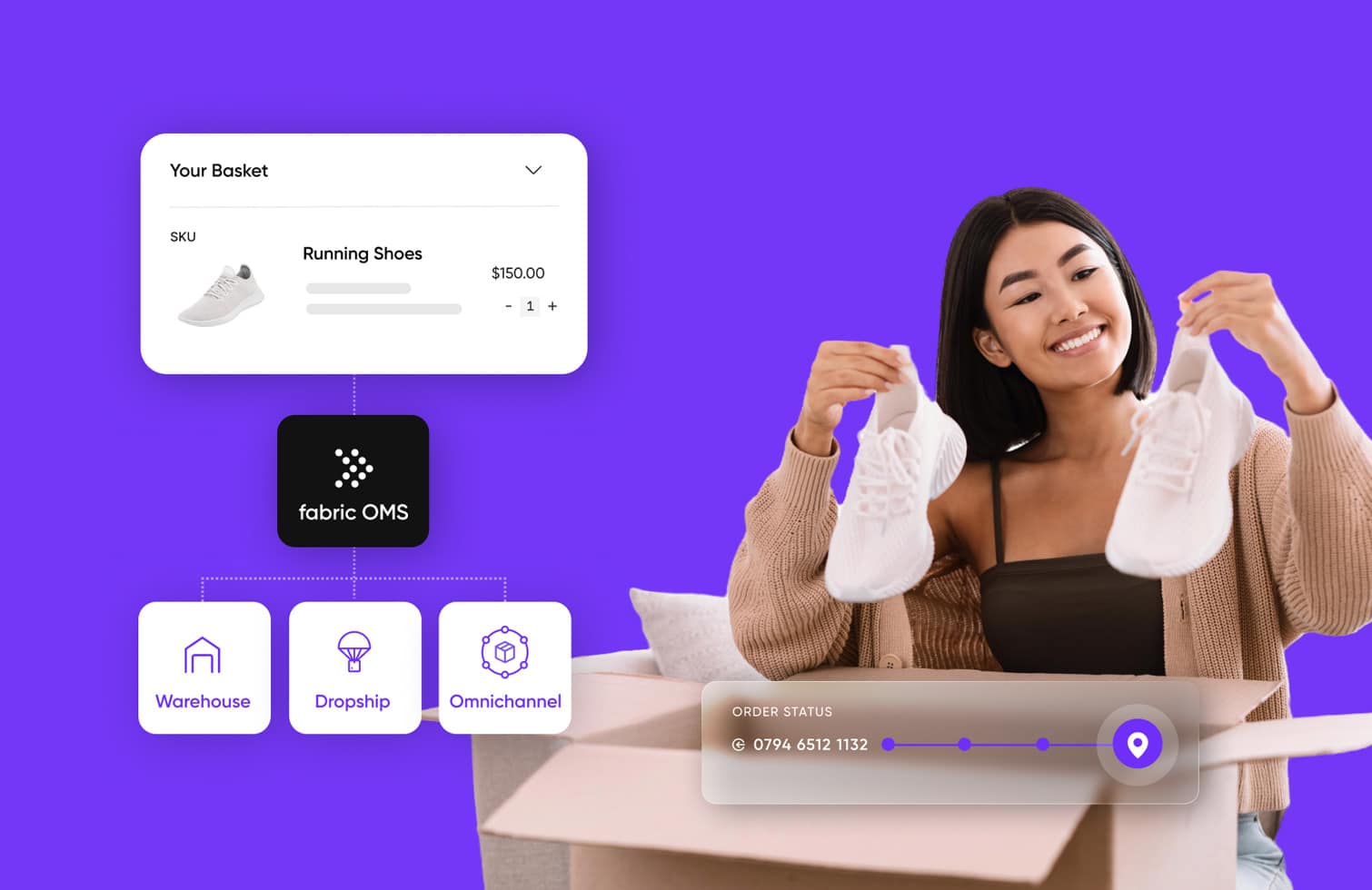

NEW YORK – NRF 2024 – Jan. 16, 2024 – fabric, the creators of the next-generation commerce platform, today announced the availability of fabric Order Management System (OMS). Native to the fabric commerce platform, fabric OMS unlocks commerce services like dropship, to streamline real-time inventory and order management. This combination reimagines the commerce platform, enabling retailers to reduce stockouts and increase turnover and customer satisfaction by empowering customers, service agents, and store associates with a single source of truth for all orders and inventory, eliminating poor customer experience.

Today’s retail landscape demands a delicate balance between innovation in customer engagement and operational efficiency. According to a recent PwC survey, nearly 80 percent of American consumers prioritize speed, convenience, knowledgeable assistance, and friendly service as crucial elements of a positive customer experience. Until now, OMS has been a separate system. fabric has weaved OMS into the heart of commerce and tied it together with foundational commerce services that bring shopping and fulfillment together to fuel those experiences.

“fabric is dedicated to empowering retailers with the tools they need to not only survive but also thrive in the highly competitive retail landscape. By enabling world-class shopping experiences for customers, anywhere, anytime, our industry-first features, such as native OMS and now integrated dropshipping, are designed to give retailers a strategic advantage during crucial holiday sales periods and beyond,” said Mike Micucci, CEO of fabric.

Introducing fabric OMS: Transforming Retail Operations on a Modern Platform

fabric OMS is designed for omnichannel retailers to meet the needs of consumers today. Together on one integrated platform, fabric commerce and OMS give customers the ability to mitigate timely out-of-stock risks, offload slow-moving inventory with promotions and markdowns, reduce returns through improved catalog enrichment, merchandise mixed collections of owned and dropship SKUs, and more.

“Our partnership with fabric has been instrumental in achieving transformational outcomes for our customers. During the critical holiday season, joint customers achieved around 20 percent year-over-year increase in conversion rates during Black Friday and Cyber Monday. Our deep partnership has also allowed us to quickly bring new commerce innovations to market. fabric’s new OMS, a foundational component of their modern commerce platform, helps our joint customers win by enhancing operational and customer experience use cases. We look forward to the ongoing relationship with fabric as they continue to revolutionize commerce for everyone,” said Keith Schwartz, CEO, Bounteous.

Customers that migrated from legacy technologies to fabric experienced a 20 percent uptick in conversion rates. Similarly, customers that opened up inventory through fabric’s dropship service saw a 7 percent increase in average order values (AOV).

OMS Unlocks Dropshipping

fabric is turning speed into a competitive advantage for enterprise retailers by integrating OMS with dropshipping to streamline inventory and order management across the network. fabric’s platform with native OMS, and now integrated dropshipping, offers key benefits that include:

- Diversified Product Selection: Dropshipping allows retailers to expand product assortment and sell on any channel through retailer-owned and vendor inventory, without the cost and risk of purchasing inventory. Managing fulfillment routing and inventory can now be done in one place.

- Increased Speed: Suppliers can now onboard and approve inventory with clicks, not code. With real-time inventory visibility and updates across owned and dropshipped products, customers can get accurate product availability. This in turn prevents retailers from overselling, builds loyalty, and fuels repeat purchases.

- Faster Scale: Retailers can modernize individual commerce, order management, and dropship components in increments, achieving the shortest time to value without the usual risks, costs, or disruptions of a replatform.

An enterprise retailer using fabric’s dropshipping services saw a 13 percent increase in orders year-over-year, and 20 percent increase in GMV during peak holiday season.

For a personalized demonstration, request a demo or stop by fabric’s NRF 2024 booth at Level 3, #6539 to see the future of digital commerce in action.

About fabric

fabric is the next-generation commerce platform that is designed to provide the commerce services customers expect so they can build world-class experiences, anywhere. fabric is on a mission to revolutionize commerce for everyone, and we empower businesses who are striving to deliver commerce that drives conversion and customer outcomes. Leading retailers, including Chico’s, Brooklinen, and Ashley’s Furniture, trust fabric to run their modern commerce business. Headquartered in San Francisco, fabric was founded in 2017 by a group of industry veterans determined to bring the same technical principles found at Amazon to retail.

Press Contact:

Cathy Wright

Offleash PR for fabric

[email protected]